Ray Hu : Stay calm and be patient as the SaaS segment is worth the wait

In October 2022, Ray Hu, Founder and Managing Partner of Blue Lake Capital, shared his view as a mentor on the development strategy, business management and product concept of Dark Horse Enterprise, a SaaS company, as well as the investment and financing environment for the SaaS segment and coping strategies.

01: SaaS is still the most attractive business model at present

Over the past year and a half, the financing environment for the SaaS segment has undergone unprecedented changes, and valuation fluctuations of the SaaS industry in the secondary market are the direct cause.

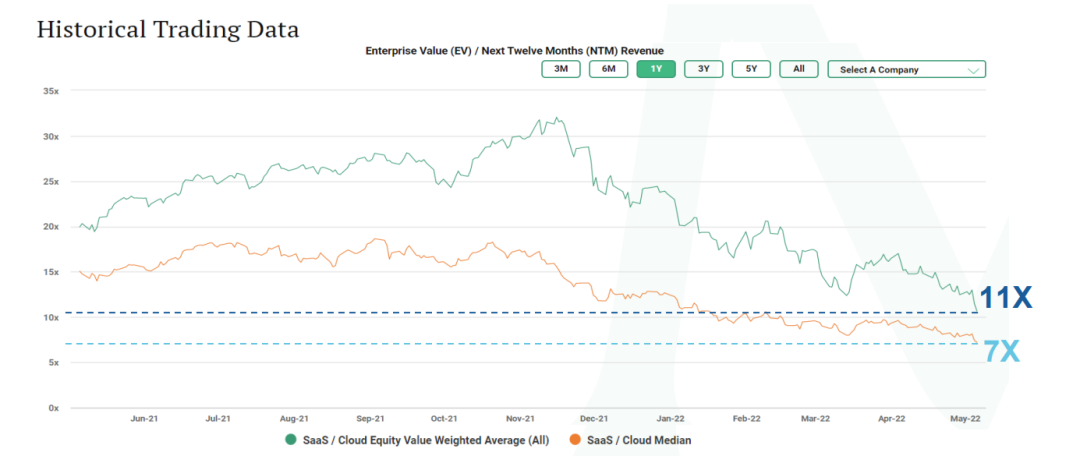

In the secondary market, price-to-sales ratios are usually used to calculate the median valuations for software companies. As shown in the figure below:

We can see that the valuation of the SaaS industry reached its peak at the end of 2021, with the average being close to 30 times the price-to-sales ratio and the median being close to 15 times the price-to-sales ratio. In 2022, the valuation of the SaaS industry in the secondary market returned to 8-10 times the price-to-sales ratio. This valuation is relatively reasonable in the long run, but such a change has caused confusion and given rise to a cautious sentiment in the primary market and severely undermined the confidence of many entrepreneurs.

In fact, from a long-term perspective, volatility in the capital market is almost inevitable. For a particular business type, short-term sentiment changes in the capital market are not at all representative of long-term market trends of such business. Actual market data show that whether in the United States (U.S.) or China, most listed software companies have been able to maintain a growth rate between 20-30%.

Therefore, the fact that the entire software segment is still growing at a high rate remains the same regardless of how we change the investment valuation mechanism for the primary market and secondary markets,

02: Facing up to the SaaS valuations, and focusing on the long-term business value

A managing partner from a leading U.S. fund has an interesting piece of advice for software entrepreneurs in the midst of valuation fluctuations in the SaaS capital market: forget the market valuations last year.

Software companies should prioritize long-term business growth and profitability at the development stage. In particular, many SaaS startups are still in the early stage of development. Founders should pay particular attention and think about how to lay a solid foundation for long-term revenue growth and profitability at this stage.

In terms of the business itself, SaaS software is still a very attractive business model in both the U.S. and the Chinese markets. Even during the stage of rapid growth, SaaS software remains a high-margin business. Business models with both high gross profit and fast expansion like this are still rather uncommon in the entire market.

Moreover, SaaS software revenue is an ongoing revenue, specifically the annual subscription fee that customers pay to use the auxiliary software. The implicit assumption behind this is that once user stickiness is developed, SaaS companies will have a high renewal rate. This is the indirect reason why quality SaaS software can easily build a strong market dominance.

Therefore, SaaS founders can still cultivate excellent investment targets by facing up to the constantly changing market valuation mechanism, refocusing on the business itself and patiently improving their products.

03: Product intelligence is a crucial consensus for SaaS startups in the face of fierce competition

There are some obvious distinctions between the U.S. and Chinese SaaS markets: the Chinese market is far more competitive than the U.S. market.

In China, a segment that is only partially validated can instantly swarm with dozens of companies competing in a homogeneous manner. As a direct result, the unhealthily low unit pricing is troubling the domestic SaaS market. However, there are workable solution to this issue. When the concentration of a certain market segment gradually increases, there will be more room for price rises. More importantly, China’s SaaS customer base is unmatched by the U.S. or any other market in the world.

The market itself is changing at the same time. According to our observation, customers are less concerned with the concept of SaaS products but concentrate on the functionality and security of SaaS products, as well as the importance of paying attention to local development. From the perspective of entrepreneurs, there is a very obvious trend that the software products are advancing in terms of intelligence and applicability, and more and more products are centered around the end user and become more segmented and more specialized. Product intelligence, in particular, is more fundamental, which directly affects the application applicability of products and the degree of specialization of a partial function. It is an important prerequisite for products to stand out in the future market.

Therefore, developing intelligence for SaaS products and patiently pursuing PMF (Product Market Fit) have come to be a consensus in the industry amid intense local competition.

Finally, let’s sum it up:

First, SaaS entrepreneurs should be customer-oriented and prioritize the needs of customer. Second, they should persevere and understand that building a software-based business is like a long-distance race. Third, they should be good at money management. What the founders have to do is to stay calm and concentrate on implementing the above ideas in the actual business operation.

Related Reading

Follow us on Wechat