“Zknow” announced that it has completed a new round of financing of several tens of millions of RMB, co-invested by a group of renowned entrepreneurs. The funding will be used for product R&D and market expansion.

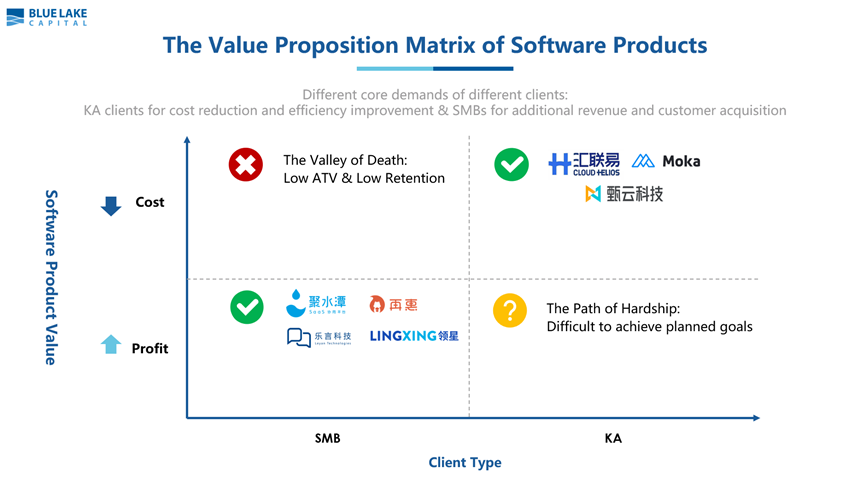

Founded in May 2021, “Zknow” was spun off from HAND Enterprise Solutions, providing medium and large enterprises with an “intelligent service management platform” that helps them transform into service-oriented organizations. The product is based on shared business components and a low-code platform that can be swiftly configured for application scenarios to meet the individual needs of clients. The Company focuses on public SaaS and continuously invests in the development of new modules and capabilities, alongside its AI capabilities that continues to empower multiple scenarios.

With yqcloud as its core product and Zknow Platform driving the development of business module application, ZKNOW is deeply engaged in domestic ITSM, assisting enterprises in integrating IT and business capabilities as well as establishing a new IT service management model that is service-value oriented, highly collaborative, pre-emptive, automated (reducing manual operation) and intelligent.

The intelligent service management platform of yqcloud provides proactive and efficient closed-loop services through technologies such as tickets, call centre, intelligent assistant and integration engine, achieving organic linkage between various departments. Its main advantages are: the linkage of online customer service/ call centre/ intelligent assistant/ knowledge base with ITSM; port automation capability (IM); linking and embedding capability to third parties; precipitation, reuse and recommendation of knowledge; analysis and aggregation capabilities of recurrent problems.

As a corporate digital intelligence development management platform of Zknow, Choerodon provides tools for collaboration, testing, DevOps and containers to facilitate the full process of software development and project management. In June 2023, Choerodon released version 2.0 of its open source software, which has upgraded its DevOps capabilities and significantly improved its R&D effectiveness.

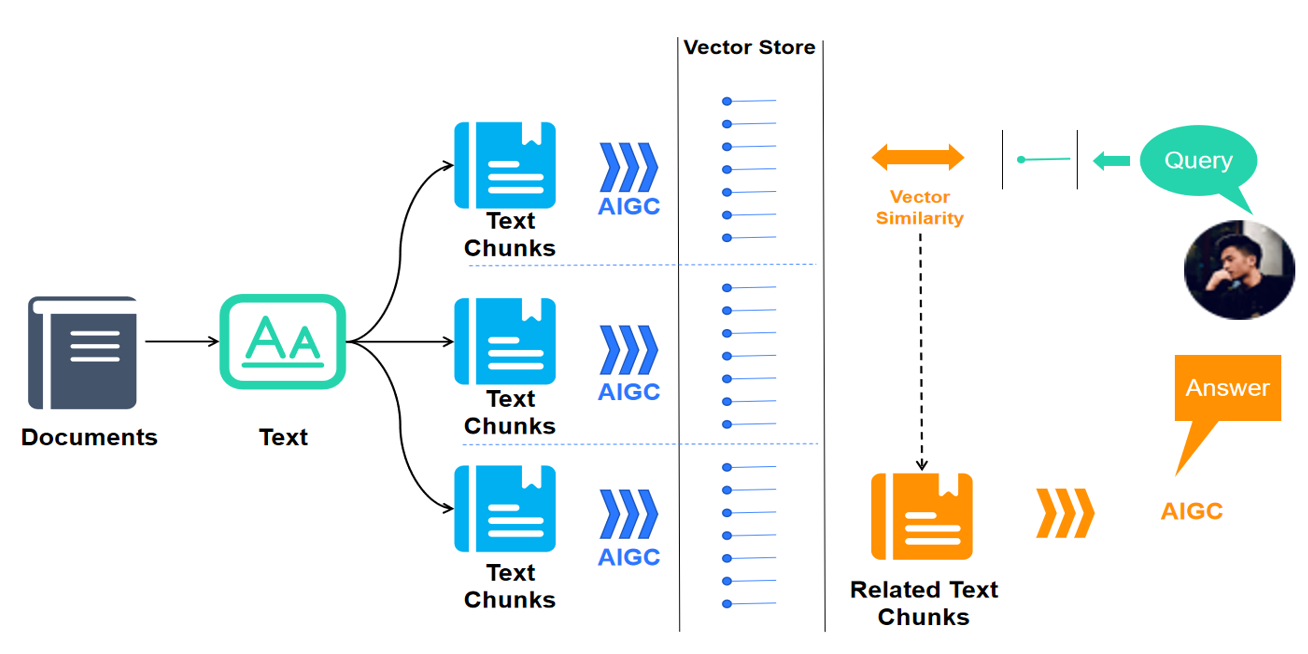

At the same time, Zknow released a new version of Yan Xiaoqian Intelligent Assistant, which digs into treasures of enterprise knowledge with AIGC. Its core is to integrate the knowledge of internal private domain of the enterprise with the large model of AIGC language so as to provide users with one stop Q&A services.

At present, more than one-fifth of China’s top 500 companies and half of the top 500 private enterprises have become users of Zknow.

Looking ahead, Zknow has devised plans to gradually expand its business from IT service management to enterprise service management and customer service management, eventually covering the entire internal and external service management of enterprises. It will also promote the development of the platform with its AI capabilities as well as building an intelligent and high-level enterprise service management platform AITSM, becoming the ServiceNow of China.

After this round of financing, the company will continue to invest in R&D, enhancing the core competency of its products. The average annual business growth rate is expected to exceed 70% and the number of clients will reach 1,000 in 2027, with cumulative ARR contract value and revenues of over hundreds of millions and profits above tens of millions.

Yifan Zhang, Investment Director of Blue Lake Capital said, “In the past, innovation in the IT operations and maintenance field has focused on monitoring tools and data analysis, while the ITSM application field has rarely been explored. We believe the reason is that good ITSM requires a team with rich IT operations and maintenance business experience, strong development capabilities of management software and product innovation. The Zknow team possesses all the above capabilities that lead to success. In an era where the number of enterprise applications is proliferating and the complexity of IT operations and maintenance is rising at a rapid pace, Zknow has continued to launch new products. We look forward to Zknow becoming the ServiceNow of China in the near future.

On 20 May, Cyzone released its “New Youth Venture Capitalists 2023″ list, in which Haitao Wei, partner of Blue Lake Capital, was honorably named as one of the ” 2023 Cyzone Top 40 Investors under 40 years old” for his in-depth planning and outstanding performance in investing in the intelligent manufacturing field.

Cyzone has published the “Top 40 Investors under 40 years old” list for 11 consecutive years since 2013, with the aim of finding top capitalists who are active at the forefront of venture capital. Over the past 10 years, a total of 246 outstanding young investors have been named (excluding those who are repeatedly named), who are knowledgeable, diligent and insightful, capturing opportunities in their own investment fields and are pillars of strength in the venture capital field.

Mr. Haitao Wei is a partner of Blue Lake Capital. He holds a Bachelor’s Degree in Electronic Engineering from Shanghai Jiao Tong University and a Master’s Degree in Business Administration from Antai College of Economics and Management, Shanghai Jiao Tong University. Having over 10 years of experience in the venture capital industry, he has been practicing the investment philosophies of “industry and research driven”, “deeply explore the market” and “finding and continuously creating value”, and has long been focusing on the investments in the fields of intelligent manufacturing and corporate software.

During his time at Blue Lake Capital, Mr. Haitao Wei, with his forward-looking perspective and deep understanding of the industry, extensive and close entrepreneurial connections, excellent negotiation and execution skills, as well as his determination to work alongside entrepreneurs, has led his team to identify numerous high-quality projects and achieved lucrative exit returns. Representative examples include Chaozhuo Aviation Technology (688237), Zelos, P&R Measurement, Zhenyun Technology, Cloud Helios, Yiheda (301029), Raise3D and more.

The ” 2023 Cyzone Top 40 Investors under 40 years old” were selected through a two-month call for applications and interview surveys, which was based on a comprehensive assessment of four dimensions: investment experience, investment performance, exit performance and industry influence.

The 2022 CVAwards was announced on 19 May 2023, in which Blue Lake Capital was named as one of the “Top 50 Best Foreign Venture Capital Firms in China 2022”, for its outstanding performance in the full process of capital raising, investment, management and exit in 2022.

CVInfo has published the “CVAwards”, a series of lists of Chinese venture capital firms and private equity investments, as an independent third party organization for 17 consecutive years. Based on data from CVSource standardized by the China Venture Capital Research Institute, recipients of the Awards were selected from more than 1,000 active investment institutions in the private equity sector according to the rankings of overall points. Divided into several categories by strict criteria, the event is known for its professionalism, authority and rigour. It is therefore also known as the wind vane of the domestic equity investment industry and is currently an important funding basis for many large institutional LPs.

The Awards announced included the “Best Foreign Venture Capital Firms in China 2022”, “Best Venture Capital Firms 2022”, “Best Private Equity Firms 2022”, “Best Early Stage Venture Capital Firm 2022”, “Best Limited Partners 2022” and “Best Sectoral Investment Firms 2022”.

Since its inception in 2014, Blue Lake Capital has been focusing on China’s digital transformation and upgrading from a multifaceted perspective of “research + industry”. It has captured industry changes as well as identified and assisted insightful entrepreneurs in the fields of intelligent manufacturing and corporate software, promoting the industry development as an investor, entrepreneur and operator. To date, Blue Lake Capital has been named as one of the “TOP 50 Best Foreign Venture Capital Firms in China” of CVAwards for a total of eight times.

Recently, Blue Lake Capital has completed a Series C round of investment of nearly 100 million in Trensor Co., Ltd (hereinafter referred to as “Trensor”), a leading automotive pressure sensor manufacturer. The funds raised in this round will be mainly used for capacity building for Trensor’s new factory and continuous expansion into domestic and overseas markets.

Established in 2009 with its headquarters and manufacturing base in Wuxi, Jiangsu Province, Trensor is principally engaged in the design and manufacture of pressure sensors and pressure temperature combination sensors. It is one of the very few manufacturers in the pressure sensor industry that specialises in technologies across the pressure scale from micro-pressure to ultra-high pressure (thick film, MEMS, thin film, SOI micro-melting) and develops proprietary ASIC chips. It also holds dozens of domestic and international invention patents.

As one of the very few Chinese sensor suppliers to enter the global mainstream automotive OEM sector and the first-tier supply chain of factory-installed products, Trensor has earned itself a place at the forefront of the industry in terms of production scale, degree of automation and process chain integrity. With over 80% of its products exported to Europe and North America, it has become an important or strategic supplier for global mainstream automotive OEMs and system integrators such as Cummins, Ford, Hanon Systems, and Valeo.

Pressure sensors are widely used in automotive, home appliances, aerospace and industrial fields, with a market size of tens of billions. Among others, the automotive sector is the single largest market for pressure sensors with an average of 15 installed on each passenger/commercial vehicle. Trensor’s pressure sensors and pressure temperature combination sensors have covered almost all systems of traditional and new energy vehicles.

Pressure sensors involve multiple disciplines including mechanics, electronics and materials, and demand high requirements for production and testing equipment as well as manufacturing processes which results in high technological barriers. Trensor is an industry leader in areas including signal conditioning chip design, production automation, production precision and reliability. In 2017, the US authoritative automotive magazine “MotorTrend” listed Trensor’s SensorCap™ technology as one of the twelve future car technologies worth talking about for the year.

The global market for automotive pressure sensors is currently dominated by international corporations like Sensata from the United States and Bosch from Germany. Chinese pressure sensors manufacturers are still catching up and only a few possess the ability to conduct product research and development and mass production. Trensor is undeniably one of the strongest performers.

It is worth mentioning that Trensor completed the R&D and production line construction of pressure temperature combination sensors suitable for the thermal management system of new energy vehicles two years ago in anticipation of the development trend of the automotive market. It has successively won orders of designated procurement by a number of international and domestic top suppliers of thermal management system of new energy vehicles since last year, and some projects have achieved mass production, becoming the latest highlight of Trensor’s new energy vehicle business growth.

“With the rapid development of the domestic automotive industry, we firmly believe in and support outstanding Chinese automotive suppliers,” Ray Hu, founder and managing partner of Blue Lake Capital, said. “Pressure sensors have an important value both in the era of fuel cars and new energy vehicles, and given that Trensor is one of the few names in China with mass production experience in the passenger vehicle industry, we have great anticipation for the company to become a top-tier in-vehicle parts manufacturer in the next few years.”

Hubei Chaozhuo Aviation Technology Co., Ltd. (“Chaozhuo Aviation Technology”, hereafter referred to as Chaozhuo) invested by Blue Lake Capital begins trading under the stock code “688237” on the STAR Market on July 1.

Founded in 2006, Chaozhuo has since been engaged in the aviation industry for more than a decade, dedicated to customizing additive manufacturing and repairing airborne equipment with military and civil aircraft maintenance as its major business. It is among the few enterprises in China that master the technique of cold spray additive manufacturing (CSAM) and apply the technique to aircraft maintenance and remanufacturing.

Chaozhuo has been committed to providing repairing services of airborne equipment, with years of technological accumulation and innovation in techniques. Its business now covers military and civil aircraft pneumatic accessories, hydraulic accessories, fuel accessories and electrical accessories.

In 2015, Chaozhuo made it a key objective to develop the CSAM technique before expanding its business to the remanufacturing of airframe structures and the production of aircraft parts, as it anticipated the technique would hold out great promise and recognized the limited role played by conventional maintenance techniques in the repair of aircraft parts made of materials like magnesium alloy.

In 2017, Chaozhuo participated in an aircraft renewal project in China as the major stakeholder providing technical support for repairing longeron cracks of landing gear of fighter aircrafts. It has developed the capability of using the CSAM technique to repair fatigue cracks in longerons of fighter aircrafts by giving its first try in the project. Later, it started repairing fatigue cracks in longerons of fighter aircrafts and remanufacturing the needed parts for repairing purposes in batch.

Chaozhuo is the only supplier of the A and B base overhaul plant under the Equipment Department of China PLA Air Force when it comes to the repair and remanufacturing of fatigue cracks in longerons of multi-type military aircrafts.

As a pioneer in remanufacturing with CSAM in the aviation industry, Chaozhuo will rely on its first-mover advantage in its core technology to continuously expand its businesses. It will proactively adopt additive manufacturing technologies in various scenarios as enablers to advance domestic industries for a rapid development.

The prospectus shows that Chaozhuo generated a revenue of CNY 140 million in 2021, and reported a CAGR of 66% during 2019-2021, with CNY 70.7311 million in net income attributable to stockholders of the parent company in 2021.

Chaozhuo’s business continued to grow rapidly in the first quarter of 2022, with its revenue reporting CNY 42.42 million, rising 63.87% YoY, and net profits reaching CNY 25.77 million, up 67.43% YoY.

Today, Chaozhuo Aviation Technology started trading, with its opening price up 42.86%. Its stock traded at CNY 74.37 per share by the time of publication, 80.2% above its listing price of CNY 41.27, giving it a market capitalization of about CNY 6.66 billion.

To be in line with China’s national strategy of transforming and upgrading the domestic manufacturing industry, Blue Lake Capital has been deeply involved in the field of smart manufacturing in recent years, and invested in Chaozhuo Aviation Technology in 2020. Its investment portfolio in smart manufacturing involves other industry leaders, including Avove Electronic, Cospower, PR Measurement, Raise3D, YHDA(SHE: 301029) and EMPOWER.

Although the past two years have witnessed great changes in the world, the digitization trend remains unchanged. Of all the uncertainties facing us, digitization is still the surest opportunity nowadays.

Editor’s note: China’s venture capital and private equity industry have undergone huge shifts over the past few years, thanks to a sea change in the global and domestic socio-economic climate.

As Chinese businesses struggle to adapt to the new normal, marked by more stringent regulatory oversight against overseas listings, a Covid-battered economy, dwindling household consumption, and stronger headwinds as startups move up the value chain, so will their financial patrons.

How are VC/PE investors faring in these turbulent times? What are the challenges they deem the most intractable and what are their solutions? Conversely, which are the emerging areas of opportunities that can be turned into the next money-spinner with their Midas touch? More generally, how do they expect China’s entrepreneurial scene to evolve in the next couple of years? And most importantly, after having their finger on the pulse of the country’s innovations, are they still China bulls or have turned perhaps into China bears?

These are defining questions to which no one has the exact answer. But we at EqualOcean believe that one can at least get a glimpse into the future of the Chinese economy by looking at how VC/PE investors are planning and making their moves.

With this in mind, we start a new series called “China VC Interview,” in which our analysts will sit down with frontline industry practitioners to hear their opinions about China’s VC/PE industry.

The following is the second in this series, conducted after interviewing Ray Hu, founder and managing partner at Blue Lake Capital(Chinese:蓝湖资本).

About 「Blue Lake Capital」 and Ray Hu

Blue Lake Capital is a next-generation, research-driven venture capital firm, founded by Mr. Ray Hu in 2014, which focuses on big market opportunities primarily on cloud software with a strong portfolio of investments including Meicai, Momenta, JST, Leyan Technologies, Zhenyun Technology, Cloud Helios, Moka, Thinking Data, Zaihui, Asinking, etc.

Ray Hu has 15 years of experience in venture capital investing. Before founding Blue Lake Capital, Ray worked at GGV Capital and the Boston Consulting Group. Ray holds a bachelor’s and master’s degree in economics from Fudan University and an MBA Degree from the Kellogg School of Management of Northwestern University.

Part Ⅰ Retrospect| Locating relevant variables and knowable questions

EqualOcean:What are the different types of venture capital firms?

Ray Hu:Relatively speaking, some firms tend to source their deals extensively while Blue Lake Capital focuses on two lanes: intelligent manufacture and SaaS. Of course, extensive sourcing is a precondition for finding quality deals. The purpose of doing research is to raise the efficiency and accuracy of investment decision-making after quality deals were found through early-stage sourcing and to be more targeted when sourcing deals.

My team was able to build a set of methodologies through research that promises lesser time and lesser decision-making in the future. After all, our investments — the startup companies — are high-risk assets. Oftentimes, their products are yet to be formed, the competition landscape unclear, and many variables awaiting in line. We research so we can locate the relevant variables to investment ROI and rule out the irrelevant ones. After that, we still need to distinguish between the knowable and the unknowable within the relevant range. Focusing on the relevant and knowable parts could bring about a small lift in investment success rate in one deal. That way, our fund as a whole could embrace a giant leap in return over time.

EqualOcean:Are you satisfied with the work of these eight years since Blue Lake Capital was founded in 2014?

Ray Hu:I’d give it a pass, but not without regrets. We’re not depressed for missing deals worth hundreds of billions of dollars, but we feel sorry for locking down on some deals in later rounds rather than earlier when their valuations were lower, which means more return for us. For example, we had a chance in a SaaS startup during their angel plus fundraising. But we ‘thought’ that the founding team had no sales team management experience which could leave them vulnerable. At the round following angel plus, when the team had proved their ability to manage the sales team, we then worried that their future expansion might hit a rock. This has given our team a lesson: base our decisions on the knowable and not waste time on the unknowable.

The success probability and achievement ceiling of a startup lie heavily on its founding team. But as investors, we can hardly reach a reliable judgment of the founder’s capacity based solely on several hours of communication and that would be meddling with the unknowable. Since then, we’ve made a turn towards objective and knowable questions, such as business progress, client contracts, price level, client conversion rate, and efficiency per capita. Venture capital firms need to look for universal patterns that could quantify a startup’s levels and risks.

EqualOcean:In the two sectors you’re experienced, intelligent manufacturing and SaaS, are founders’ backgrounds relevant to what they later do?

Ray Hu:Not so much as for academic degrees. But of course, more founders of intelligent manufacturing startups are of science and engineering background and have experience in relevant industries. It would be rare for a total stranger to come into this industry. Most SaaS founders also come from within the industry. For example, the CEO of JST was once CTO of a shoe company with the experience of ERP development and the founder of Thinking Data worked previously as a developer at Tencent Interactive Entertainment Group. They were aware of certain needs underlying the industry, and how to design products accordingly, hence successful companies.

EqualOcean:In hindsight, are there commonalities among successful founders?

Ray Hu:Of course. First, successful founders are good learners. They will find themselves in an emerging industry in China with a perplexing marketplace and few predecessors to learn from. Besides, SaaS founders mainly worked as PMs or programmers before and lacked experience in managing a functional organization. Things such as managing a sales team, issuing performance indexes, remaining independent, recruiting partners, and constantly adjusting to the external environment could be challenging.

Another important quality would be to get ahold of the Pareto Principle — the law of the vital few. It’s both tricky and essential for founders to recognize with accuracy the fundamental issues of the given moment right in the given business line. The first half-year after getting financing would be a dangerous period for many startups when they tend to proceed too aggressively. The familiar financial condition for most SaaS startups in China would be in deficit. To ration limited resources while losing money and expanding quickly could be complicated. Different companies face different situations such as whether to expand territories or to expand product lines and how. In the meantime, a lot of opinions coming from investors and from within the team are interfering with the founder constantly.

Part Ⅱ Status quo| Discerning certainties among uncertainties

EqualOcean: Is the plummet of major SaaS indexes in the US stock market a hit on your confidence?

Ray Hu: I wouldn’t worry about the stock market too much because I am optimistic about the fundamentals of the SaaS industry on solid grounds. When we look into some holistic indicators, we would see a fast growing market. The companies in our portfolio have acquired a lot more business leads this year than those of two to three years ago with more and more potential clients showing up with a clear budget and project. Based on companies’ communication with clients, we have the confidence to say that the market maturity has lifted prominently. Two to three years ago, clients would raise concerns about data security which hardly anyone would mention nowadays. What the buyers frequently bring about is whether the software could meet their operation standards and allow for flexible deployment suiting their organizational features. No longer is SaaS deemed mere “paperless tools”, but also a booster of elevated core competitiveness. Lots of industries do appear to move forward towards what the Chinese government calls for — digital transformation.

Here let’s raise an example of a contract management SaaS company we’ve invested in. In the past, we assumed contract management as helping companies to draft, approve and ratify contracts. Much more than that, lots of companies have procured the system to improve operational efficiency. Salespersons used to bring back a contract from clients to their direct leaders and district managers along with financial and legal departments within. Several weeks have passed before a contract could be finalized. Not to mention there might be hundreds of clients for a company and thousands of contracts involved. Now, using SaaS, the average contract signing period could be reduced to two to three days. That’s a huge lift of efficiency and motivation for salespersons to lock clients. We now see more SaaS applications have been approved by clients as of their value to businesses and have become a must to companies. That’s why I wouldn’t be too worried about stock performances since the SaaS business models are getting more recognition.

EqualOcean: How does the market view SaaS nowadays?

Ray Hu: When I started to talk about SaaS when raising funds in 2016, 90% of limited partners were not optimistic on it. Now, most of them do. With some SaaS companies going publicly listed and the frenzies about consumer internet cooling down, most importantly all general partners believing in the future of SaaS, limited partners are more open to this business model.

The same situation has befallen publicly listed SaaS companies over the past few years. Stock prices went high at first, then dropped. This implied that the market held expectations toward SaaS companies. Investors voted with money when companies with quality benchmarks went public, then vetoed when they were disappointed by bad performances. The currently listed SaaS companies derive their revenues mainly from customization, but the majority of their incomes go to building SaaS businesses. So they’re in transition. We do need eight to ten IPOs of high-quality and fast-growing SaaS companies to boost market confidence. Based on my evaluation, there are currently over 20 SaaS companies with Annual Recurring Revenue or ARR over CNY 100 million. It takes them two to three years to grow to the size qualified for IPO — which is USD 100 million of ARR at least.

EqualOcean: What would be your suggestion for fundraising SaaS companies?

Ray Hu: The financing environment may not be very friendly to SaaS companies this year. At the end of the last year, the valuation of SaaS companies in the US stock market was at its peak, most of which reached a dozen to twenty times Price-to-sales(PS). Now that number has dropped more than half. SaaS companies with a growth rate over 50% are valued eight to ten times PS, yet those with less than 50% are valued only six to seven times PS. This means for SaaS companies seeking financing this year that revenues need to be doubled than that of the previous year only to get a valuation equal to the previous year’s. For many entrepreneurs and former investors, mentality needs to be modified and the market status quo needs to be recognized. For worse, the fund is not guaranteed even if revenues double and valuation is equalized. Many VC investors are so overwhelmed by the turbulence in the stock market that they haven’t had the time to rebuild a sound evaluation pattern. We’re all in the process of adjustment.

I would recommend SaaS startups to hold a steady expanding pace, be prudent on cash flow planning, and resume financing the next year unless they were willing to bear the extended fundraising duration and harsher valuation and terms. We are hoping that long-term economic policies could be more explicit after the 20th CPC National Congress. We’ll see if it would be possible for some companies to seek IPO in the US stock markets. The HKSE is at a relatively low spirit for an IPO now. We’ll wait and see what happens next. We expect some good news to boost the market.

Part Ⅲ Prospect| Reacting promptly with prudent optimism

EqualOcean: Do you believe that Chinese SaaS companies could win global markets?

Ray Hu: Mostly I do. Firstly, there are a bunch of Indian companies with ARR of USD 30 to 50 million that live in Western markets. So SaaS companies from non-Western countries can open Western markets. Chinese SaaS companies usually start in domestic markets. The adaptability to global markets varies with product types. But it is reassuring that one SaaS startup in our portfolio that develops reimbursement systems has successfully won several Japanese key accounts despite all the obstacles, such as gaps in finance and taxation administration, approval procedures, FMIS, and HRMIS — that would be Financial Management Information System and Human Resources Management Information System.

Since startups themselves are in the process of probing, it would be hard for me to make assertions. But we can deduce from experiences that expansion would not be too quick for SaaS companies serving key accounts since they need time to adapt to the complicated operation procedures of global markets. While things could be different for SaaS companies who provide tools for small and medium-size companies in emerging industries, such as e-commerce and games, tools are often more applicable in a universal sense and they could bring about quantitative outcomes which help speed up clients’ decision-making process.

EqualOcean: What would be the challenges and opportunities of business service SaaS companies when going global?

Ray Hu: Building local teams would be the most challenging part, much more than mere recruitment. For example, SaaS companies targeting key accounts need at least pre-sales, delivery, and customer success departments to work together. In China, companies may win over a client with a broad tender and make modifications throughout the delivery process. But in Japan, they may need to submit a 300-page pre-sales proposal that wholly displays every interface of the software to the client. Once the proposal is agreed upon, there will be no modification commands from the clients. The whole team needs to cooperate functionally, including the local teams abroad and domestic supports. Besides, conditions in every market vary from each other. It may take six to nine months on average to recruit one employee in Japan!

There are not as many challenges at the technical level as in the product sense. Again take Japan as an example. Japanese companies hold zero tolerance for interface and language imperfections. They emphasize data security and compliance. The clouding environment is different there. So we’re talking about a lot of localization to be done.

Challenges aside, Chinese companies still stand a chance with better services. The western SaaS giants are somewhat slow speaking of their response time to Japanese clients’ needs. After all, it’s just a regional need of a regional market to them. But Chinese companies can be quick to respond when it comes to meeting clients’ demands. Besides, just like to China, Japan is also a foreign market to the west. So we’re equal in terms of localization.

EqualOcean: Do you think that this round of the Covid-19 epidemic would hurt entrepreneurs’ morale? How about the influence on your following investment allocations?

Ray Hu: Their morale appears to be higher than I thought. Since June 1(the day the city-wide quarantine was called off), I had been going around about the companies in our portfolio. Founders are generally in positive spirits based on the fact that over 90% of sales leads acquired before quarantine are still in pipeline. Market needs are not erased, maybe a little postponed. There would not be many changes to my investment allocations. CNY funds would be divided pretty much evenly between intelligent manufacturing and SaaS. USD funds would flow mainly to SaaS. In all, the SaaS industry would take up around 60% of the fund and intelligent manufacturing about 30%. The remaining 10% is for consumer Internet.

EqualOcean: While the economic growth has slowed down, what new Chinese narrative would you bring about to global investors?

Ray Hu: I would speak frankly to investors. The current environment may seem discouraging, but the future is bright. Economic policies could be more explicit after the 20th National Congress and the customs administration could be more liberal at the end of this year. In terms of asset allocations, it would be impossible for global investors to ignore an economy with such size and growth rate as China. Their perception of China needs adaptation: it is no longer the wasteland as ten to fifteen years before. The environment for investment has changed. Every VC firms, and every investor, need to have this question constantly in mind: how to better design their investment portfolios.

The science and technology innovation system(STAR) is still full of fast-growing opportunities. Big firms like Sequoia Capital, Hillhouse Capital, and GGV Capital tend to source from broader ranges and distribute their resources in sectors from consumer technology, and industrial technology, to even more advanced ones. For more compact organizations like ours, we focus on two fields so that the personnel and funds assigned to each field still have an edge in competition with big firms.

All in all, we hold a prudently optimistic attitude toward the economic trend. But this is not drawn from anything. We would keep a close eye on the companies in our portfolio as of their performance in the following two quarters. Being a venture capital investor is just like being an entrepreneur, “you gotta stay alert and react promptly to the outside world, and all the time.”

Source: https://equalocean.com/

Author: Lina Peng Editor: Yiran Xing

In a recent online talk organized by Blue Lake Capital, SaaS operators of the Blue Lake portfolio had a discussion on topics of common concern to SaaS entrepreneurs, such as the investment and financing environment under the new cycle, improving company management and HR efficiency during the pandemic, and post-pandemic era business layout and sales management.

Ray Hu, Founder & Managing Partner of Blue Lake Capital, shared his views on the SaaS Valuation Environment in 2022 and the Pace of Investment and Financing in VC Circles:

- SaaS remains the most popular business model today;

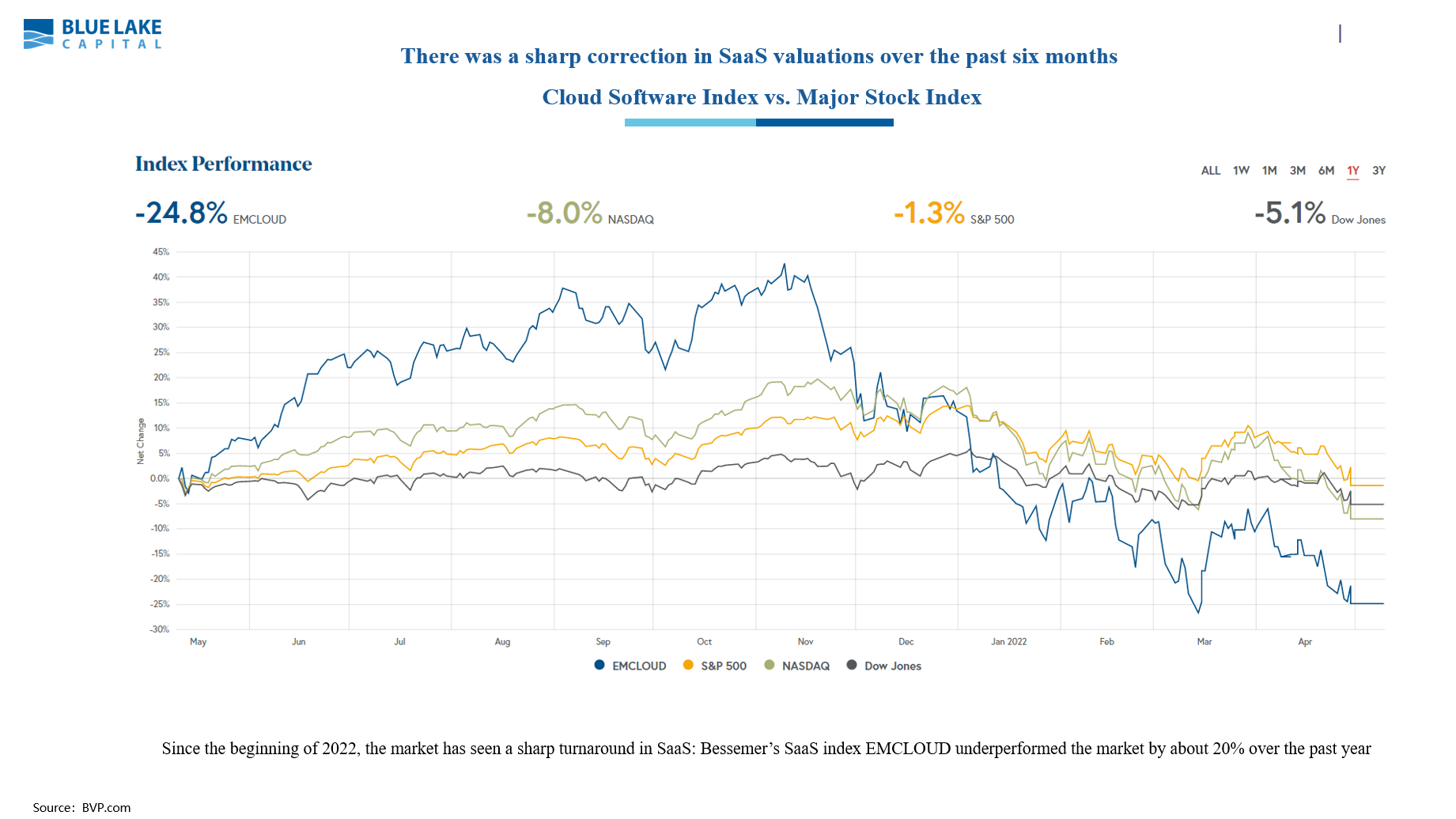

- Revenue growth remains robust in high-quality companies despite a sharp correction in SaaS valuations over the past six months;

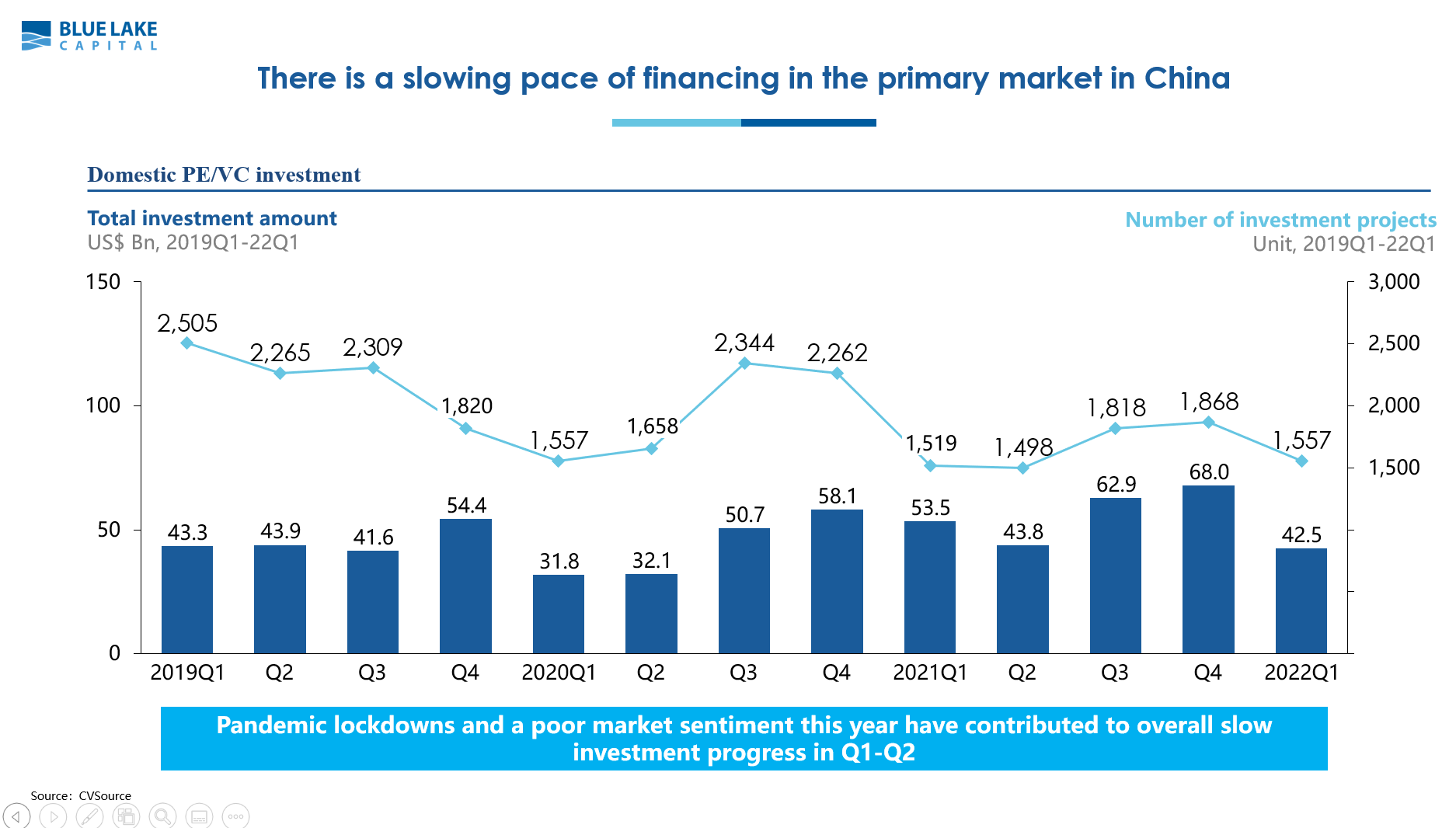

- There has been a slowdown in the pace of investment and financing in the primary market at home;

- After corrections, the valuation system may achieve a new equilibrium. Meanwhile, it is necessary to make realistic, prolonged efforts to maintain self-sustaining profitability.

Below are condensed and edited shareable highlights:

The changing market environment instigated this valuation correction.

Bessemer’s SaaS index in the US outperformed the stock market by a wide margin until November 2021 because of two substantial reasons. First, unlike traditional businesses hit by the pandemic, the software sector had been buoyed by the storm to a certain extent. Some SaaS enterprises reported positive changes in their fundamental secondary markets. Second, amid the high-risk environment, investors preferred assets with high certainty, such as SaaS products featuring recurring revenue and visibly compelling business. As a result, tech growth stocks, especially SaaS stocks, had attracted considerable attention since 2020.

However, the market turned around considerably after November 2021.

As the pandemic alleviates, traditional businesses become less uncertain and show high PS, thus regaining distribution from growth stocks. Therefore, without much correction in the general index, SaaS companies ’stocks have retreated.

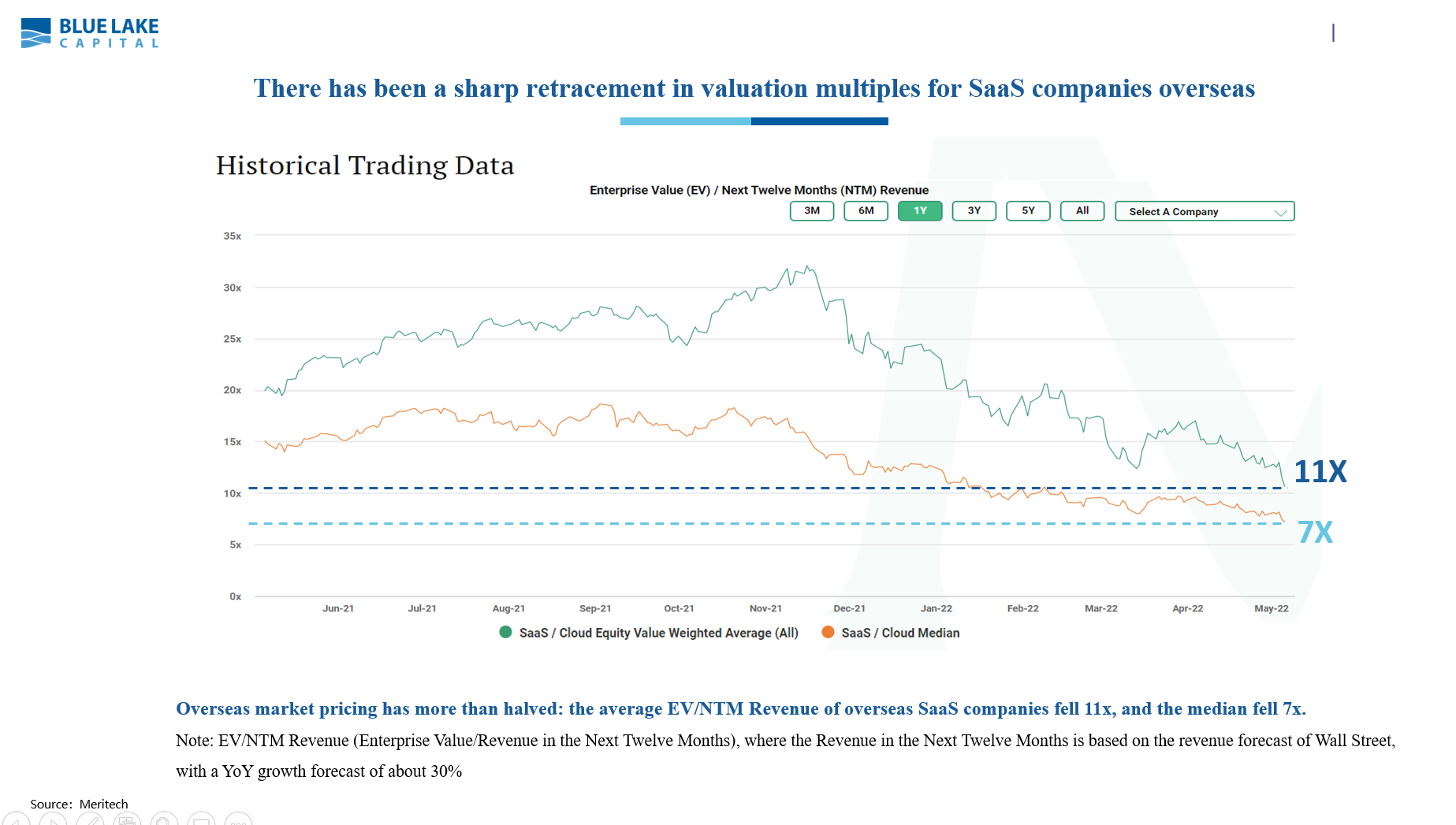

A further driver is the correction in valuation multiples for these SaaS companies. SaaS entrepreneurs seeking funding this year are more likely to suffer from the effects of the secondary market. There has recently been a sharp retracement in valuation multiples for SaaS companies overseas. According to Meritech, the average EV/NTM Revenue has fallen from over 30x to 11x, and the median has fallen from nearly 20x to 7x.

If there is no major rebound by the end of this year, mid- to late-stage investors will generally anchor SaaS companies at around 10x PS. Of course, higher valuation multiples are available if the company grows at a rate of 70-80%, and even higher if over 100%. Take the US market as an example. US-listed SaaS companies generate a median revenue of $500 million. Under such a scale, these companies maintain a YoY growth of nearly 30% on average, and those with faster revenue growth have naturally obtained a higher PS premium (about 20x).

I believe that halving valuation multiples from last year will become the market norm. If a company has closed a round of funding in 2021 at a valuation of 25-30x PS, during its next round this year, the valuation amount will not differ greatly from last year, even if revenues have increased by 80-100%.

At this point, management needs to timely adjust their mindset. In the case of relatively abundant funds, the financing window can be adjusted for the first half of next year with a more optimistic macro environment. The process is certainly subject to uncertainty. Or, with expected valuation cuts this year, we raise money at the expense of diluting more shares.

Liquidity in the primary market has tightened

The liquidity of the primary market faces an even more severe situation than the valuation. There was a significant QoQ decline in both the number of investment projects and the funding amount over the first quarter of 2022. When communicating with some of our peers, we noticed that this year, institutions focusing on early-stage and growth projects invested in less than 1/3 of the number of projects in the same period in the previous year, and the investment pace of the whole market is going to be very slow. This is partly due to the macro environment (like the pandemic) and partly because some software companies with mediocre performance, or that were packaged as SaaS companies, also got financed last year. And when their performance this year falls short of expectations, investors will react against the attitude of the whole industry.

In addition, the delisting risk of Chinese concept stocks from the US stock market also has a negative impact on the macro environment of the primary market. Especially for mid- to late-stage investors, a potential for delisting was not previously taken as the main risk—the business itself was. When this factor became a risk item, as it is today, institutional investors’ willingness to invest was further affected. This should be defused by valuation reduction.

Therefore, we do not have an optimistic financing environment this year. From a quantitative perspective, the valuation multiple is estimated to be only half of last year, and the number of projects expected to be closed in the market is 1/3 to 1/4 of last year.

Be realistic and return to focus on long-term profitability.

Earlier, I shared that the US market has also seen a drop in SaaS valuations and a slowdown in the pace of investment, which is being hotly discussed in Silicon Valley. Here are the tweeted opinions of Bill Gurley, the managing partner of Benchmark and a well-known American investor, who has been involved in venture capital for nearly 25 years and who has gone through several cycles. His advice is objective and to the point:

Opinion 1: Forget last year’s market madness.

The market price throughout last year was very unreasonable, and we must learn to forget the institutional offers of last year.

Opinion 2: Lower expectations for valuations.

If you stick to a measure of company valuation, 10x PS is ideal.

Opinion 3: Focus on cash flow and profitability.

Tech companies will ultimately return to focus on cash flow and profitability. Facebook has a YoY rise of 23% in revenue but only 14x PE.

Opinion 4: Ultimately, return to revenue and profitability.

Always keep in mind that the revenue and long-term profitability of the company remain the priority in the end.

Despite the recent gloom in capital markets, we are fortunate to be in a very appealing industry today. SaaS business is attractive to investors for its distinctive highlights, such as sustainable revenue, high gross margin, high growth, etc. Once the competitive landscape of the software market is established, there are usually only 2-3 top companies left in the end. If one becomes the market leader, they will enjoy a higher dominance and market share. SaaS businesses can generate strong operating cash flow after growth stabilizes.

From an investment perspective, SaaS business has a big competitive edge and high entry threshold and deserves long-term bullishness.

Amidst the overall market slowdown in investment pace this year, investors are expected to continue focusing on software projects in the technology sector, and in frontier technology, such as semiconductor and unmanned technology. The company’s management simply needs to adjust valuation expectations.

Despite the wave of dramatic changes the world has undergone in the past two years, the digitalization trend has not changed. Whereas digitalization was previously just a way to improve the business of some enterprises, today it is necessary for survival.

It was supposed to take 30 to 50 years to go digital, but now the process has been greatly accelerated as a result of the pandemic. Amid all the uncertainties ahead of us, digitalization remains the most certain and the biggest opportunity.

On June 15th, Shanghai Zhenling Technology Co., Ltd., a SaaS solution provider of CVLM (Contract Value Lifecycle Management), announced the completion of a Series A financing round of 53 million RMB, the second financing within six months. The financing round was led by Yunqi Partners and followed by the old shareholder Blue Lake Capital. Yiren Capital was the exclusive financial advisor. And all funding of this round will be used mainly for product development to deepen the value management of the performance phase of the contract.

As a leading contract management solution provider in China founded in 2021, Zhenling Technolgy’s core team was developed from HAND, a well-known enterprise digitalization service provider, having been equipped with digital service capability. “One Contract Cloud”, a self-developed product by Zhenling Technology, through controlling major nodes of CVLM—before signing, during signing, during performance, and after performance— organically integrates the three major processes of enterprise operation: business operation, financial accounting, and contract management. One Contract Cloud can better verify enterprises’ real business and financial data, implement upgrades from business finance to business finance law, help enterprises control operational risks, and improve their management systems.

Xie Weihu, CEO of Zhenling Technology, said, “Contracts are the carriers of economic activity and naturally carry all aspects of an enterprise’s economic activity, especially the liquidity management of funds. From time to time, enterprises will have various troubles in the actual performance process, which greatly impacts funds. Coping with these situations faster and more efficiently is a lesson (and a headache) for every business owner. Therefore, contract management is not the goal, but rather the solution.”

Considering that, Zhenling Technology has positioned its product as a “Contract Value Lifecycle Management.” While other vendors focus on contract signing and provide solutions to improve the efficiency of signing contracts from offline to online, One Contract Cloud extends its service focus to contract performance. By linking enterprise business and financial systems, One Contract Cloud sees each node of contract performance as a key, drives the execution of these key nodes, provides real-time feedback on the current situation, and exerts positive and timely influence.” Business owners may not have time to find out every detail, but now they can find the key points and deal with the difficulties in advance by watching the overall situation through the dynamic feedback of the contract,” Xie Weihu explained.

“This is a hungry market,” Xie Weihu added. “After beginning to operate independently, business opportunities have increased 2.5-3 times on average, with the number of customers signed in the first half of this year approaching the whole of last year.”

Since its establishment, Zhenling Technology has cooperated with nearly 130 large enterprises, including LVMH, Siemens, BECKMAN COULTER, Hello Inc., 360, Moka, and China Resources Capital. It has accumulated considerable experience in several industries and has been implementing productized solutions to certain professional cases, which can be rapidly promoted and applied to more enterprises in the future.

Zhang Yifan, Investment Director of Blue Lake Capital, said: “After our first round of investment, Zhenling Technology has exceeded expectations in team-building and market expansion, winning contracts from many major clients. The product has also been quite ahead of the game. We are very optimistic about the future of contract management and One Contract Cloud.”

This article is reproduced with permission from 36 Kr, written by Wu Sijin and edited by Wang Yutong.

The SCC (Supply Chain Collaboration) platform ZONE (Shanghai Zhenyi Technology Co., Ltd.) announced the completion of Series A financing of 70 million RMB, led by Blue Lake Capital, followed by Redpoint, INFAITH GROUP, and YI Capital, with Yiren Capital as the exclusive financial advisor.

“Complete supply chain digitization should internally improve the efficiency of departmental collaboration while supporting multi-party collaboration with the external supply chain. Disappointingly, the fact that enterprises prefer to apply IIS (Inside Information Systems) + SRM (Supplier Relationship Management) while in the integration of internal and external SCM (Supply Chain Management) means they still need to arrange people to be stationed at the production sites of offline suppliers and OEMs to monitor real-time progress, inspect quality, manage costs, support business upgrades, establish traceability systems for multi-party collaboration plans, and regularly dispense feedback to concerned departments using relevant business systems (or by sending word or excel documents via email or WeChat). All of this not only takes time and effort, but requires plenty of manpower,” explained Zheng Xiangtian, CEO of ZONE.

Considering that, ZONE—incubated in China’s well-known IT consulting service provider, HAND—started using SCC to further its SCM in 2020. Its core product, Zone Cloud, an SCC SaaS platform, connects the demand side (large manufacturing enterprises or brands) with the supply side (suppliers and OEMs). Besides the application, customers can connect to the business systems of suppliers through the Octopus connector—a real-time production schedule tracker developed by ZONE to reduce internal waste, minimize conflict between supply and demand sides, and achieve common goals through early warnings (and timely control) of problems with delivery time, quality, and cost.

Specifically, ZONE proposes solutions for various cases, including master data collaboration, multiple suppliers, OEM manufacturing process, inventory management, change management and statistical analysis, quality forwarding and traceability, supply chain planning, supplier logistics, checking, supply chain exception sensing, analysis, and other cases that require supply- and demand-side collaboration.

Within two years of independent operation, ZONE has over 50 cooperative customers in various fields, including equipment manufacturing, lithium support, 3C, footwear, central kitchen pre-prepared dishes, and other fields, and over 1,000 linked supply-side enterprises.

Revenue mainly comes from two areas: SaaS subscription fees, including the basic and deep collaboration versions, with an average unit price ranging from 100,000 to 300,000, and an SaaS service fee, which is calculated separately, according to demand.

There are nearly 200 members of ZONE, of which 60% are product researchers. It’s reported that this round of financing was mainly used for product development and marketing.

Ray Hu, the founder and managing partner of Blue Lake Capital, had this to say:

“Enterprises have a higher demand for monitoring OEMs and suppliers with the digitization of the supply chain. However, a complete solution that satisfies enterprises well does not exist in this field.

ZONE aims to meet these needs by building a software platform that involves understanding production processes, adapting multiple business systems, and polishing out-of-the-box tools. It seems to be simple but requires continuously integrating diverse customer scenarios into a standardized SaaS product.

ZONE has accumulated over ten years of relevant experience. We are optimistic that ZONE will help Chinese companies build a tighter supply chain network to improve efficiency.”

On June 6, Blue Lake Capital received the certificate of the “TOP 20 Investment Firms in Enterprise Services that are Most Focused by LPs in 2021.” made by FOFWEEKLY on the first day of returning to office work after the Shanghai lockdown.

After exploring the ways of building a core driving force for the GPs that are surviving and thriving in the new cycle of global economic development environment and local market development stage, FOFWEEKLY has put forward a relevant evaluation system and found many active firms including LP and LP-recognized GP.

Based on the above principles, FOFWEEKLY compiled a FOFWEEKLY “2021 Annual Investment Firm Ranking List” through its research on China’s equity investment industry. This listfocuses on leading firms with the most sustainable development in the new ecological environment. Important indicators include length and prosperity of Firm, continuous return on investment, and social responsibility. In addition, it publicly recognizes the leading investment Firms that play an exemplary role in advancing social development.

As a new generation of research-driven venture capital funds, Blue Lake Capital has been closely following tech innovators in China’s digital transformation. Upgrades and enterprise services have been the key areas that Blue Lake Capital has focused on. With years of extensive and in-depth communication and engagement with entrepreneurs, the Blue Lake team has accumulated a broad base of know-how in the field of enterprise services. A multi-dimensional analysis mechanism has been established from products, implementation, sales, competitors, and cash flow, as well as administering a post-investment service system with unique Blue Lake characteristics. This was accomplished by creating a Blue Lake enterprise service ecosystem and integrating post-investment resources. In recent years, Blue Lake has invested in many industry-leading projects including JST, Zaihui, HELIOS, Momenta, and Moka.

Moving forward, Blue Lake Capital will continue to seek investment opportunities in the field of enterprise services and cooperate with outstanding entrepreneurs to create value for Chinese enterprises.

As a new generation research-driven venture capital fund, Blue Lake Capital focuses on technology innovators in China’s digital transformation, with enterprise software as one of our key investment areas.

Blue Lake’s portfolio companies, including Jushuitan SaaS ERP, Leyan Technology, Moka, Momenta, Going Link, Helios, Shopastro, and Thinking Data, provide more efficient solutions for a wide range of industries through innovation in information science and technology.

Launched the First Online Audit Solution in the Industry

With new fiscal and tax policies, such as the 14th Five-year Tax Reform Plan and all-electronic invoices, the fiscal and tax environment for enterprises has changed drastically over the last two years. With unprecedented digital capability, the Taxation Department can supervise enterprises more strictly and more frequently. In addition, to deal with internal and external audit sampling, walk-through tests, and periodic industrial and commercial legal inspections, enterprises have had to spend many workdays sorting and searching files of different legal persons across various departments and even for different periods.

Facing these challenges, Helios came up with the first online audit solution in the industry to help enterprises meet the regulatory requirements of internal and external auditing in a more efficient and compliant manner. This solution can significantly enhance file utilization efficiency, reduce manual file searching and sorting, and address the problem of low audit efficiency.

Using an E-archive query-tracing feature, Helios establishes relationships among various unstructured documents by relying on a flexible configuration of a chain of evidence. According to external auditing and supervision requirements, standard templates are created for corresponding investigations of the Taxation Department and compliance checks, audit sampling, and walk-through tests. It can perform an intelligent search and provide complete sets of archives useful for internal and external audits with a click. It also supports tracing and file searches for different legal persons across various departments, warehouses, and accounting periods. No longer using an offline paper accounting approach, it dramatically improves the efficiency of internal/external audits.

Helios’ E-archives system is helpful for archival storage for enterprises; it also leverages its advantages to make better use of data. It helps enterprises build a more compliant, efficient, intelligent, and shared archive management system for paperless accounting and effectively meets compliance requirements for accounting documents, including electronic invoices. Moreover, it launched two innovative schemes: intelligent matching with categorized storage and online auditing, which significantly reduces time sorting and binding vouchers by more than 90%, and reduces time spent on compliance with internal and external audit requirements by more than 80%. Using comprehensive electronic image borrowing increases the efficiency of archive retrieval by more than 90%.

Awarded the title of “Excellent Service Provider” on Jingdong’s Service Market

On March 31, Jingdong released its annual winners’ list of excellent service providers for 2021, with Jushuitan as a winner for its software services.

Covering 17 categories and involving both upstream and downstream portions of the e-commerce industry chain, this reward is considered the highest honor JD’s service market awarded to its service providers. It reflects an affirmation of the comprehensive capabilities of awarded service providers, including their transaction amount, service quality, contract performance ability, merchant satisfaction, and degree of cooperation, and constitutes an important reference point for JD merchants to select service providers.

As a leading SaaS software service provider in China and a quality partner of JD e-commerce merchants, Jushuitan stands out from many other enterprises by virtue of its excellent technologies and services to secure this annual award, which shows the affirmation and recognition of the JD platform and its merchants for their quality service.

Jushuitan’s SaaS ERP system has been provided to more than 300 e-commerce platforms to deliver comprehensive information and digital solutions for businesses. Up to now, Jushuitan has more than 4,000 employees and has set up more than 100 offline service outlets nationwide, covering more than 400 cities and towns. Over 70 million orders are sent through the SaaS ERP system every day, and one out of every 5 or 6 packages in China is sent through Jushuitan.

Listed in the 2022 Panoramic Report of AI Manufacturers by Ai Analytics, This AI Tech Firm Helps Brands Continue to Grow

Ai Analytics, well-known digital market research and consulting agency in China, recently released the 2022 Panoramic Report of AI Manufacturers. With outstanding products, quality service, and a good reputation, Leyan Technology was selected as a representative manufacturer of intelligent customer service and marketing. Previously, Leyan Technology was also listed in the 2021 Panoramic Report of AI Manufacturers as a representative for intelligent robotics and intelligent quality inspections. As can be seen, Leyan Technology has been recognized many times for its comprehensive strength.

As an important driver of the digital economy, artificial intelligence improves production efficiency and serves as a catalyst for new products and models, which in turn promotes the reconstruction of the entire industrial chain. It has become an essential engine for social progress and sustained economic prosperity.

Now, facing rapid growth of online business demand and consumers’ demand for high-quality service, brands must combine their products and services with better intelligent marketing operations to stand out from the competition.

By using AI tools, such as intelligent customer service, marketing, and advertising, Leyan Technology provides consumers with complete, high-quality, around-the-clock online services, thereby helping them refine their store operations and decision-making tools to help develop their marketing strategies.

Leyan Technology is a high-tech firm focusing on the industrial application of AI technology. Led by its CEO, Dr. Shen Libin, and other outstanding experts in natural language processing and knowledge graphs, it is an outstanding provider of overall AI solutions in China.

With the mission of “pioneering AI technology to create value for customers,” the company is committed to enabling e-commerce customer service, intelligent education, government and medical consultation, and other public service verticals with advanced cognitive computing technology to improve efficiency, reduce labor costs, and create more customer value. After many years of involvement in e-commerce, Leyan Technology has built a complete set of AI solutions for e-commerce businesses that cover all links from marketing to services.

The New TA System Version 3.6 is Released

Thinking Data recently released TA system 3.6, upgrading three aspects of its core functions, adding 10+ functions and 20+ optimized items, and improving its overall analysis capacity, efficiency, and intelligence. The new version supports complex data types and can create SQL statement labels, add field-level permissions, extend time ranges, and upgrade functions for behavior sequences, including more forms of data visualization, better alerts, and daily pushes.

Since its launch in 2018, Thinking Analytics (TA System), an extensive data analysis platform developed by Thinking Data for games, has won unanimous recognition within the industry with its capabilities in data collection, flexible and robust data analysis, and safe, rapid deployment.

As a professional platform for data analysis, the TA system continuously delivers pioneering data awareness and experience and constantly upgrades and iterates products according to customer needs.

Thinking Data always adheres to its “customer first” corporate value and implements it throughout its product development and innovation, always believing that connecting functionality to customers’ needs is the lifeblood of products.

In the future, Thinking Data will continue to focus on the gaming industry and adhere to its corporate mission of “making the value of data accessible at the touch of a finger.” It will continue to improve the depth and ease of TA analysis to create the most professional data analysis products and build a new data infrastructure for global gaming.

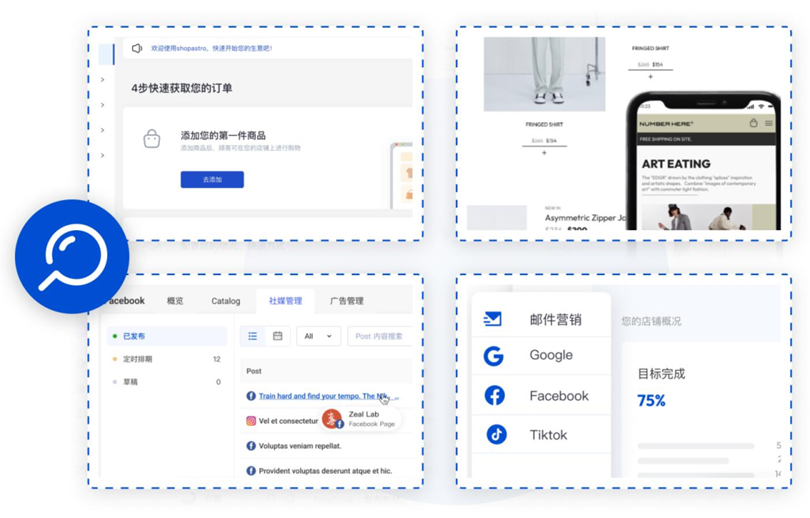

The Zhejiang Double Hundred Project for Public E-Commerce Services Recommends Shopastro Services for Brands Going Overseas

According to the Notice of the Zhejiang Department of Commerce on Organizing Public E-Commerce Services (2021, No. 62), which includes important instructions for department leaders, it is necessary to combine online and offline businesses under the new normal of COVID-19. The Zhejiang Provincial E-Commerce Promotion Center has explored more options for e-commerce service providers. It has integrated and sorted many high-quality ones within and outside the province. Offering preferential prices for the Double Hundred Project, the Center has launched a series of activities to help enterprises with public e-commerce services.

“Shopastro Going Overseas” has always responded actively to a new mode of government-enterprise cooperation by helping achieve win-win development of cross-border industries and enabling more high-quality domestic brands to go overseas quickly. Honored to be recommended in the Double Hundred Project, Shopastro will provide better commercial services for Chinese brands and sellers.

To couple with the Double Hundred Project, Shopastro launched the Starry Sea Plan for government-enterprise cooperation and offered a 50% discount for one-stop services for 1,000 high-quality brands to go overseas. The benefits include independent website building, year-round website operation, and overseas advertising. From building the website to marketing transformation and repurchasing, Shopastro can walk brands through its development cycle by meeting their needs at every step.

Shopastro is a one-stop and full-link service provider helping Chinese brands go overseas. Focusing on “building and operating websites, marketing transformation, and repurchasing,” it is dedicated to serving B2B foreign trade factories, domestic brands, cross-border brand sales, and existing DTC brands. Shopastro is committed to solving the pain points of Chinese brand sellers aspiring to go overseas, including independent website building, efficient advertising, accurate customer acquisition, and all-around marketing, and to realize brand value and cash in on internet traffic through focused operation driven by big data and AI technology.

Ray Hu, founder and managing partner at Blue Lake Capital, was recently invited to the “Dark Horse SRDI Industry Convention” hosted by Dark Horse and delivered a speech titled, “Consensus and Anti-consensus for SaaS Entrepreneurship .”

In the speech, Hu gave his thoughts on the outlook of the Chinese SaaS industry and suggested innovations for SaaS products and its entrepreneurial process.

- SaaS, based on the industry’s growth rate and market potential, is likely to become the next big thing in the coming years.

- With the maturity of public cloud infrastructure and the upgrade of demands for software in Chinese enterprises, applicationized, product-centric, and intelligent SaaS products are likely to overtake global competitors.

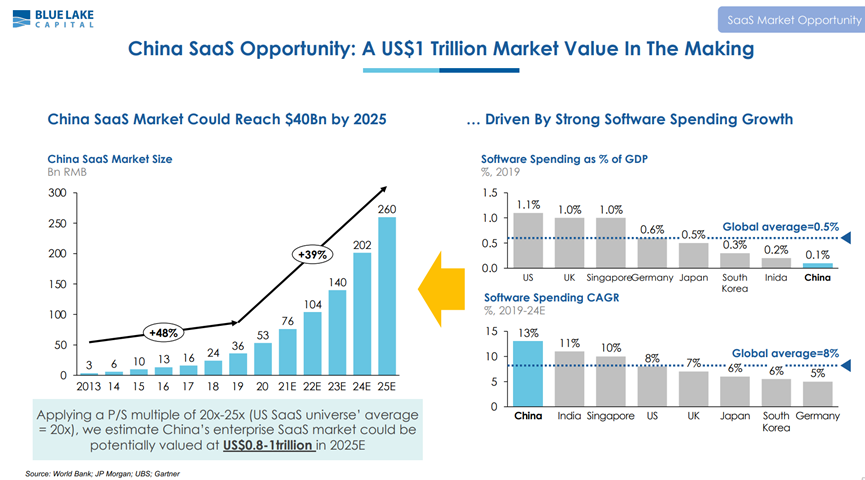

- Product value should match its customer positioning. Products for KA clients are positioned for cost reduction and efficiency improvement, while products for SMB clients are positioned for additional revenue and improvement in client acquisition efficiency.

The following are excerpts from the speech:

We at Blue Lake Capital manage both CNY and USD funds, and we pay great attention to the digital transformation of the Chinese economy. The core part of our business is enterprise software. Over the past three or four years, we have heavily deployed our investments in the enterprise software sector, covering nearly 40 companies.

During the process, we as investors feel lucky to learn while making investments and growing together with many outstanding SaaS companies as China’s digitalization continuously deepens.

Under certain circumstances, when we look at the growth of these companies as a board of directors, we consider different perspectives as we notice the development of these emerging firms.

Today, I’d like to share what we have seen and experienced during this process.

When we talk about SaaS, we are first challenged with the market scalability of SaaS start-ups, which is the concern of most entrepreneurs in the initial stages. When people compare SaaS with the thriving consumer internet industry of the past ten years, they often worry that either the market isn’t big enough, the growth of companies isn’t easy enough, or action isn’t fast enough. Entrepreneurs to investors, including even our LPs, are concerned that SaaS start-ups may not reach an impressive size even with a long time to develop.

From a macroscopic perspective, we’re not too worried because China is among the top countries in the world in terms of GDP growth rate. If we break down the figure to look at the growth rate of each industry, we’ll see that digitalization, information technology, and software-related sectors are all growing at 2-digit speeds. Such high growth speeds are very rare, even compared with global rates.

For anyone who’d like to start a business, finding a rapidly growing environment is essential. Only high growth leads to significant opportunities and only when there are enough opportunities can start-ups seize upon one and enter the market. Information technology and software industries are undoubtedly rapidly growing environments that provide great market opportunities.

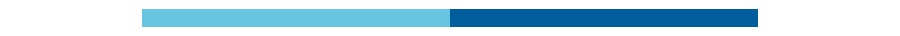

We are often asked that if a Chinese software company succeeds, what kind of scale can be achieved? And how much can its market value be on the secondary market? To answer these questions, we have consulted a large amount of data from third-party research institutions. According to a research report from JP Morgan, the market scale of the SaaS industry is forecasted to exceed ¥260 billion by 2025, and that of the software industry will be even larger.

Suppose the P/S ratio of a software-related company is 20-25x, which is equivalent to a market value of $1 trillion on the secondary market. It means that if an average company has a ¥100-billion market value, at least 50 companies of a similar size will emerge. Suppose the average market value of a company is only ¥50 billion. In that case, over 100 companies will arise in the next few years with the boom of the Chinese software market, each with the opportunity of becoming relatively large companies in capital markets (in Mainland China, Hong Kong, and the US). We are very optimistic about both the size and the growth rate of this industry.

Lately, we’ve heard a lot of feedback saying that a significant drop came in the secondary market, making investors worried about the software industry not receiving enough attention and potentially leading to a bleak prospect for starting a software business.

We’ve given this a lot of thought. First of all, the question is a little weird because, in essence, the drop reflects short-term fluctuations in the secondary market but not the fundamentals of the software market. To a degree, the instability of the secondary market provides an excellent opportunity to eliminate companies with relatively poor production capacity from the industry. Companies with unhealthy businesses will have difficulty in raising funds in the market. On the contrary, those with excellent products and high-quality businesses will be able to withstand the fluctuation.

The other side of the coin is that we’ve seen very positive signs in the Chinese software market even in the last two or three quarters. In Q1 of this year, the production capacities of China’s top integrators barely met the unprecedentedly high demands of middle-to-large enterprises for IT-supported and systematized solutions. This means the digitalization of the Chinese economy is prospering. Whether for entrepreneurs or investors, it is a good time to get involved.

Why do we say there are opportunities for the SaaS industry this year? And why are opportunities happening now?

One important reason is the maturity of public cloud infrastructure. The second reason is that Chinese enterprise software users use ERP on their computers at work but consumer applications on their phones, which offer hugely different experiences. Also, the upgrading and iterating of companies’ businesses are getting faster while traditional, locally-delivered, customized software is having difficulty catching up with the demands generated from the development of these businesses.

An increasing number of entrepreneurs are asking where the opportunities are. The demands of enterprises for IT products have been fundamentally changed. We’ve noticed some obvious trends: apart from application development and product-centric approaches, improving artificial intelligence is essential but difficult to achieve in traditional, locally-delivered software products. Even if you look from a global perspective, Chinese entrepreneurs today have the opportunity to overtake their competitors because in terms of AI algorithms or human resources, China is leading the world when you make horizontal comparisons.

The timing for our software products is perfect for integrating intelligence with information. The product power thus produced is highly likely to exceed that of European SaaS products of the previous generation. We’ve seen increasingly more cases of the practical application of this integration in software products.

Next up, let me share with you our thoughts on product value.

First, how do we weigh up the value of a software product? Which target is better, KA clients or SMBs? It’s not simply an either/or question. There have been cases of success for both KA and SMB clients. The type of clients you choose is not the key to success. But the product positioning and the value it creates for a client have to match the client’s positioning.

Usually, products for KA clients are positioned to reduce costs and increase efficiency. KA clients are usually more complicated in their organizational structures and attach more importance to the transparency of business operations, efficiency improvement, and controlling costs. Software products can generally meet clients’ management demands. However, it would be unprovable if we told a large enterprise that our software product could increase their revenue. Too many factors influence a large company’s sales, so it isn’t realistic to expect revenue to increase with a mere SaaS product.

Contrary to the above, the organizational structures of small to medium enterprises are relatively simple and owners of SMEs know how to save money. If we told them our software products could help them save money, they would probably be unwilling to spend an additional ¥100,000-200,000 per year to save a little money. They care more about generating extra income and how our software products can help them increase their revenue and improve the efficiency of client acquisition. For example, among our portfolio, JST specializes in order processing and inventory management. Zaihui focuses on precision marketing for catering businesses. Leyan Technologies deals with intelligent customer service. Lingxing is dedicated to PI analyses of the cross-border e-commerce industry. All of them base their businesses on their respective value propositions. When it comes to small to medium enterprises, your growth curve will be impressive if you can find the right target clients for your products and show the value created by the products.

At this moment, SaaS is a highly feasible field with a huge market for both investors and entrepreneurs. It provides an opportunity rarely seen in other verticals. From Blue Lake’s perspective, this is the best entrepreneurial opportunity in 15 or even 20 years.

From an entrepreneur’s perspective, running a business is a long-term game. It is necessary to consider whether a company can succeed and become an asset and whether the products can match client positioning, accumulate WoM, and gain higher customer satisfaction. If the answers are yes, success will naturally follow.

Ray Hu,Founder & Managing Partner of Blue Lake Capital,remarked:“ZKNOW’s Yanqianyun has become our new player in the SaaS industry. IT innovation has stayed focused on monitoring tools and data analysis, but few have set foot in IT service management (ITSM). It sets a higher standard for the team to have rich experience in operation and maintenance and competence in developing management software, especially PaaS solutions. The team behind Yanqianyun happens to have it all. As the enterprise applications increase and IT operation and maintenance are complicated, we believe Yanqianyun will become the ServiceNow of China.”

ZKNOW has completed raising 70 million yuan in its debut round. Matrix Partners China and Blue Lake Capital have co-led the investment, followed by Baidu Venture and An’s Information. Yiren Capital was the exclusive financial advisor. The funding is for product R&D and market expansion.

Founded in May 2021, ZKNOW was spined off from HAND Enterprise Solutions, which was established in 2002, and listed on the ChiNext board in 2011. With 20 years of experience in development, HAND now provides IT applications for product R&D, consulting, and technical support. The company started with ERP implementation and has become a solution provider. It has grown to be a comprehensive digital service provider. Their rich experience has enabled HAND to satisfy customer needs and offer excellent solutions in particular sectors by incubating several SaaS companies. ZKNOW is one of them.

Huang Jianhua, Chairman of ZKNOW and CTO of HAND Enterprise Solutions, attributed the birth of ZKNOW to two opportunities. First, HAND has served over 6,000 customers and completed more than 20,000 projects in its two decades of engagement with enterprise IT service. Such accumulated experience had come together to meet the needs of IT operation and maintenance during the digital transformation, including software not implemented by HAND. Second, enterprise software and hardware needed more diversity in type and quantity as user applications and system maintenance became increasingly complex. The software helped enterprise management liaison with customers and suppliers but presented challenges to digital transformation. The upgraded digital operation also required enterprise management and service solutions. This is where ZKNOW came in.

Yanqianyun, ZKNOW’s flagship product, works as a leading service platform for enterprise digital transformation. Specifically, it supports three areas with operational AI solutions: IT service management (ITSM), enterprise service management (ESM), and customer service management (CSM).

Since 2019, based on its 16-year experience in service management in HAND, Yanqianyun has transformed itself into providing platform-level service in operations and maintenance. It provides enterprises with IT lifecycle management and internal knowledgebase integration, improving IT service and efficiency.

With the outbreak of COVID-19 in 2020, the demands for remote service, self-service, and other enterprise services have soared. To provide more digitally intelligent services, Yanqianyun launched Yanxiaoqian, a virtual assistant available 24-7 for online service, which has helped solve recurring problems and reduce labor costs.

With the normalization of the pandemic in 2021, enterprises became more motivated to accelerate digital transformation and attach more value to a high-quality experience for both employees and customers. Therefore, Yanqianyun gradually expanded its services by including back-office ITSM, such as human resources, legal affairs, administration, customer success, etc. This provided employees and customers with a unified one-stop service portal, achieving more efficient inter-department collaboration through automated and intelligent processes. Meanwhile, it also links with instant messaging applications like DingTalk, Feishu, WeChat Work, and others to make daily communication and collaboration easier and improve employee and customer experience.

In 2022, Yanqianyun further perfected its multi-channel service, including online customer service, call center, email, instant messaging, etc., and launched customer success solutions for SaaS enterprises.

As Huang Jianhua introduced, when customers use the enterprise application, it involves coordinating various internal systems and departments. So, across different scenarios, it all comes down to digital services management, whether ITSM, CSM, or ESM. The design of Yanqianyun, according to Huang Jianhua, is based on ITIL (Information Technology Infrastructure Library) industry’s best practices and concepts. It serves as an enterprise digital service center, bridging business service with IT solutions and employee and customer experience, and offers a comprehensive and professional out-of-the-box digital service package. Such achievement owes credit to the cooperation of innumerous HAND customers over many years, which has made it easier to understand the real needs and obstacles of enterprise digital transformation and how to meet the demands of management, technology, and product design. “We will pay attention to reporting, access control, workflow, multilingual functionality, and transnational collaboration,” said Huang Jianhua.

Yanqianyun’s platform relies on HAND’s business background in terms of product architecture. Such an advantage enables Yanqianyun to provide SaaS and PaaS services to customers. Plenty of SaaS companies build their own PaaS application at a certain point in their business development to avoid becoming an outsourced service provider. Still, ZKNOW can skip years of business development by relying on accumulated experience.

Another advantage is that ZKNOW is connected with many high-value customers through HAND, among which are ZKNOW’s hundreds of customers and various leading companies in multiple industries, such as Chang’an Ford, Siemens, AVIC Lithium Battery, Ganso, MINISO, etc.