From September 15th to 29th 2021, Moka’s signature event “Moka Talks 6 – Nothing But Innovation” was held in Shanghai, Shenzhen, Hangzhou, Beijing, Guangzhou, and Chengdu. Over the course of the event, almost a thousand top HR managers from across the country shared their views and insights.

Li Guoxin, CEO of Moka, addressed the audience and expressed his commitment to developing an application system that users are genuinely happy with. His statement explains why Moka’s NPS score (an index that measures the willingness of customers to recommend a company’s products or services to others) is 8, the highest among all players, compared to the industry’s average of -20. Ray Hu, founder and managing director of Blue Lake Capital, in his interview with Tencent News, said that Moka was “a company whose corporate culture is truly product-driven”.

As of to date, Moka has gained the biggest market share in China’s ATS market, with a product renewal rate constantly hovering above 115%. One out of 10 HR professionals in dotcom companies is using Moka’s products.

Below is the transcript of Moka CEO Li Guoxin’s speech.

Thank you very much for taking the time to be here.

Moka was founded in September 2015. Today, I would like to take this opportunity to walk you through Moka’s six-year journey and its path ahead.

Face Problems Head On and Figure Out Solutions

I came back to China in 2015. As I was browsing the official websites of internet companies, I couldn’t help but notice that the career pages were often shabby, with static information about job openings that required candidates to submit their CVs via email.

Such poor experience undermined a candidate’s impression of the company, as he/she could not receive timely feedback.

We realized that this was an issue, and I thought, if a candidate wasn’t happy about it, how about the HR person?

According to our surveys, many recruiters felt that a big part of their time was spent on trivial and repetitive tasks. They used tools that offered basic ATS functions, but they also expressed their dissatisfaction with those problematic systems. Indeed, as we found out later, in those systems, key insights that should’ve been highlighted were buried among other information and repeated actions were often required.

One common problem we identified was that existing products were designed just to meet the needs of decision makers. The needs of end users, who also happened to be heavy users, were neglected and their pain points remained unaddressed.

Starting from 2015, we decided to develop an ATS that users are genuinely happy with. We hoped to build a product that would help recruiters and deliver better work experience.

Meanwhile, we aimed to offer candidates a better experience as they applied for jobs in companies that used Moka products, and we hoped that all users along the hiring process, including the line manager and interviewer, could see the value our system had to offer.

What have we achieved in the past 6 years?

You might be wondering, what have we achieved in the past six years?

To begin with, our product has gone through over 3500 iterations. When we started out, we had just enough capacity to serve startups of a few dozen employees but later expanded to cover enterprises of different sizes and sectors. Use cases also expanded, from general recruiting to campus recruiting, employee referrals, and recruitment for physical stores.

In 2019, we have built an R&D team to develop a new product–Moka People, which underwent over two years of development and was launched at the end of 2020.

This marks an important step for Moka to shift from being a service provider of one single ATS product to being an integrated HR SaaS provider.

Over the past few years, we have served over 30 co-creative enterprises. Currently, Moka is providing services to over 1300 clients spanning 25 sectors, from small startups to global 500 companies. We don’t take these numbers lightly because they represent the trust our clients place in us.

Moka’s NPS (net promoter score) is 8, the highest among all players, compared to the industry’s average of -20. Customer endorsements have been a source of confidence and a foundation for solid and robust business growth. We achieved 100%+ growth compared to last year, which is rare in the SaaS sector given our scale.

In addition, our customers are also loyal and heavy users. That’s why our product renewal rate constantly hovers above 115%.

We have the highest market share in the domestic ATS market. For every 10 HR professionals in dotcom companies, there is one using Moka’s products. It wouldn’t have been possible without the 6 years of hard work, the support and trust our customers place on us, and an outstanding team behind Moka.

We started out as a team of two and grew to become a company of almost 600 employees with offices across 9 cities. We are headquartered in Beijing. In order to provide better products and services, we will soon establish a second headquarters in Chengdu, which will serve as an industry hub, a service hub, and a marketing hub.

What Will Moka Offer to the World?

Talent is a company’s greatest asset. A company will only grow by creating a nurturing workplace culture that meets the self-fulfillment needs of its employees. It is therefore essential to create an open, equitable and respectful work environment.

In this sense, Moka not only helps individuals at work but also gives companies a competitive edge in terms of attracting and managing talents. To help us better achieve those goals, we’ve recently updated Moka’s mission statement as “enabling a better workplace experience for everyone; driving greater individual growth in organizations.”

These two lines will serve as an important compass that guides Moka’s work in the future.

We hope to zoom in on every individual in the workplace in everything we do. We firmly believe that traditional software that centers on managers and decision makers will be obsolete. What enterprises need nowadays are products designed to help everyone do a better job.

We hope that our products and services can automate trivial and repetitive day-to-day tasks for HR professionals and other users. In the meantime, we hope that with our products, companies can put the right person in the right position and give him the support he needs to grow.

How Should Moka Go About It?

So, how should we go about it? Our principle in Moka, simply put, is “continuous innovation with a focus on pain points”.

We hope to focus on addressing the pain points of our customers and tackling their problems one at a time. In Moka, there is only one definition of a job well done – being well recognized by customers and able to bring continuous incremental innovations.

One of my favorite documentaries – Jiro Dreams of Sushi, is about Sushi master Jiro Ono, who, in his 80+ year career, keeps innovating and honed his craft to ultimate perfection.

In Moka, pursuing perfection is also part of our core values that guide our innovation endeavor.

Let me give you two examples. The first one is about the candidate satisfaction feature, which was made available as early as 2016 when we first launched the product.

Back in 2016, there were hiring platforms in the market that collected candidates’ post-interview reviews. But the feedback was often fraught with disinformation and personal emotions, making recruiters’ lives difficult.

As time goes by, it would also undermine the employer branding. Considering the situation, we developed a candidate satisfaction feature that collected feedback straight from candidates.

Now, right after an interview, Moka products automatically send a text and an email to the candidate and request feedback on the interview process. The survey is put together by the HR person, and the candidate can choose to either reveal his/her identity or remain anonymous. All feedback is captured in Moka’s system.

The HR person may view the information and, based on the analytics, pinpoint key and common issues that need to be addressed. This is a closed loop that covers the entire hiring process, from interview, feedback, to optimization. We’ve created a win-win situation where employers need not worry about the negative impact of the information and candidates also have improved experiences.

This module quickly became the most popular and widely used feature in the entire system.

In addition, we added the online appointment scheduling feature for campus recruitment, as we realized it could minimize repetitive and mundane tasks.

In the system, a recruiter may select a number of student candidates, who, after choosing the corresponding opening, may select the interviewer and time for the interview. When the interview is set up, the candidate receives an invitation link and goes to the interview at a time of his choosing.

Future Facing and Continuous Innovation

I would also like to share with you three innovative solutions that Moka will soon offer.

First off, the talent pool.

Our survey shows that companies are having a hard time trying to build up their talent pools. Building a well-structured, functional talent pool requires a lot of effort and human resources, and HR personnel have not yet developed the habit of using talent pools.

That’s why we launched an integrated talent pool solution, leveraging AI to address these two challenges. Talent profiles will be automatically added to the database and pushed to the HR person for screening. The system will then generate a text or a call to alert the candidate and find out whether they are interested. We call it “candidate activation”.

This is a closed-loop system that covers the talent sorting and activation processes. With analytics generated by the system, the user has visibility over the how the talent pool is operated and used and implements necessary improvements.

Here I would like to highlight one important new feature that is powered by AI. We call it automatic profile storage.

It is often difficult for companies with a big recruitment team to develop a consistent recruitment standard. To address this problem, Moka leverages NLP technologies to filter and automatically store candidate profiles. In the process, a standardized database of various talent categories is generated automatically.

This feature went live a few days ago. Beta tests are now open. If you are interested, please contact your CSM to participate.

Let’s now look at video interviewing, which gained traction during the pandemic. We were one of the first companies that introduced the concept of contactless hiring. Since then, we have been working to optimize the online interview experience.

Early this year, we established a strategic partnership with TencentMeeting. In the first half of this year, we launched Moka x TencentMeeting, a solution for video interviewing.

As of today, 211 enterprises have used our solution to complete 430,000 online interviews.

In order to provide a better experience, we recently worked with TencentMeeting to explore deeper integration. We are going to embed candidate and interview information in the TencentMeeting video interface. That means an interviewer can talk to a candidate, browse his/her CV, and input assessment all in one page. The updated version will go live in a few months.

Last but not least, I would like to touch on our new product – Moka People.

Moka People is a core HR product that hosts the lifecycle of an employee, from onboarding, to transfer and departure. By integrating Moka People and Moka ATS, we can finally offer the ultimate application and onboarding experience to all parties involved.

First, the HR person can create an offer and fill out the compensation information by pulling a standard compensation package from the company’s Moka People.

When the onboarding process is started, Moka People will automatically capture all information in the offer, including salary and compensation, job description and reporting line, etc. There’s no need for the HR person to input information in two separate systems – one for hiring, one for compensation. Work efficiency is boosted, and data errors are minimized.

Now, let’s look at the candidate. In this demo, we show you the complete hiring life cycle from receiving an offer to onboarding.

The new hire will have a seamless and streamlined onboarding experience. As a result, he or she will develop a strong sense of belonging and feel the company’s attentiveness for its new hires.

These three innovative solutions, launched or soon to be launched, are only the tip of the iceberg. Our innovation journey continues. Enabling a better workplace experience for everyone and driving greater individual growth in the organization is Moka’s mission, and it will always be our guide in everything we do.

Thank you very much for your attention.

Senser, an e-commerce app for fashion and luxury products, raised $40 million in a Series B round from Trustbridge Partners, with Lighthouse Capital as the sole financial advisor for the deal. Most of the funds raised in this round will be used for brand building, user expansion, and investment in technologies.

Senser was founded in 2017, with investment from Blue Lake Capital, Vision Plus Capital, Spade Capital, and Fosun RZ Capital (who participated in angel round and pre-A round).

In its first year, Senser started to build an integrated supply chain for fashion and luxury items across Europe, including sending a team of over 10 people to Italy for offline business development. It took Senser a year to build its initial network.

In the first three years, Senser focused on B2B market, sourcing luxury and fashion items for buyers and retailers. In early 2021, Senser made its foray into B2C market by launching the Senser mobile app. As of today, the app has registered a 60%+ compound MoM GMV growth rate and sold to over 400,000 users with an average transaction value of over 5000 RMB.

The Senser app is integrated with the inventory management system of shopping malls across Europe. New arrivals in those malls will be immediately available on the app as well. As the team told 36Kr, over 70% of the app offerings were new arrivals, sold for 30-40% less than those at a branded store in China. That’s because of the bargaining power Senser gains by sourcing in bulk from shopping malls. Sensor now offers over 600,000 products from more than 3,000 brands, sourced from nearly 1,000 shopping malls across 50 countries and regions including France, Italy and Germany.

Building a supply chain is Senser’s forte, but even so, it hasn’t been an easy feat to pull off. The founder Seamon Shi said, there were several challenges Senser had to tackle. For one thing, Senser was dealing with an enclosed sector. Putting together a supply chain that covers all European luxury shopping malls requires a deep understanding of the products and how they travel throughout the entire system.

There are many things in this business that are counterintuitive. For example, the most sought-after items are also the least available, and one needs a prior and extensive purchase history to get their hands on a much-coveted item. The team has to know the nuts and bolts of every collection of every brand.

Another challenge was the weak infrastructure. When Senser set out in 2017, Europe was twelve years behind China in terms of internet infrastructure. So the team had to build the entire supply chain almost from scratch, from the SaaS system to the non-standard item models,the digital linkages for electronic duty refund, and shipping routes where international cargo can be efficiently sent to Hong Kong and eventually mainland China. It took the team four years to build a complete infrastructure that was good enough for China’s e-commerce retailers.

Senser has hammered out a cost-effective and efficient logistics solution. First, to offer a 100% duty refund (versus 50% if a customer claims on their own), the company established digital linkages with European tax authorities, customs offices and international logistics providers. Senser also built small warehouses in Europe where individual orders from various malls can be stored, packed and shipped in bulk to Hong Kong. The China Certification and Inspection Group (CCIC), Senser’s strategic partner, inspect each item, and each qualified item is packed by Senser for customs clearance. On average it takes 10-14 days for a purchase to be delivered to a customer.

According to Mckinsey, China has a nearly 800-billion-Yuan luxury market, accounting for a third of the world’s total. Luxury retail platforms such as Farfetch and Net-A-Porter have also stepped up their investment in China in recent years. Senser’s statistics show that before COVID, 70% of China’s luxury spending happened offline outside of China, but over 20% of post-pandemic luxury spending happened online and the number keeps growing.

Senser’s founder Seamon Shi has over 20 years of experience in online and cross-border retail. He was President of Mei.com and previously held senior positions at LVMH and Nike. The team consists of members that previously worked in tech giants such as Alibaba, Tencent, Amazon, Meituan, and luxury groups such as Gucci and LVMH.

Within the same week, Momenta, a Blue Lake Capital portfolio company, has announced that it has received significant funding both from General Motors and SAIC Motor.

Momenta is dedicated to reshaping the future of mobility with best-in-class AI technologies. In order to offer solutions that are at least 10 times safer than human drivers, Momenta has pioneered the iterative “flywheel insights”, a three-pronged approach that combines large amount of data, data-driven algorithms and closed-looped automation. This shall accelerate the mass production of its autonomous driving solution Mpilot, and driverless solution MSD, thus enabling a more effective, rapid and massive deployment of driverless technologies.

On September 23rd, General Motors announced that it would invest $300 million in Momenta to accelerate the development of next-generation self-driving technologies for future GM vehicles in China. Julian Blissett, executive vice president of General Motors and president of GM China, said “Customers in China are embracing electrification and advanced self-driving technology faster than anywhere else in the world, and the agreement between GM and Momenta will accelerate our deployment of next-generation solutions tailor-made for our consumers in China.”.

On September 16th, Momenta further announced that it had received additional funding from SAIC Motor, which became Momenta’s biggest institutional investor in the March Series C round. Both parties will further deepen their strategic cooperation in core technologies of intelligent driving, jointly develop full-stack intelligent driving algorithms, accelerate the application L4 autonomous driving in China, and drive the worldwide commercialization of intelligent driving technologies.

Blue Lake Capital, since it became the lead investor of Momenta in the first financing round, has been stepping up its research and investment in autonomous driving. The Blue Lake Capital team aligns itself with Momenta’s mission “Better AI, Better Life”.

China’s new generation of enterprise service providers have entered a period of accelerated growth. Salespeople, as the bridge between value propositions and customer needs, have become increasingly sought-after by SaaS startups.

The growing SaaS market calls for salespeople that are capable of driving more sales, uncovering hidden opportunities, and thriving in an ever-changing market. They are expected to manage the presales and sales processes and work to the satisfaction of their customers. Companies are willing to pay a high premium for such top sales talent when they can find it.

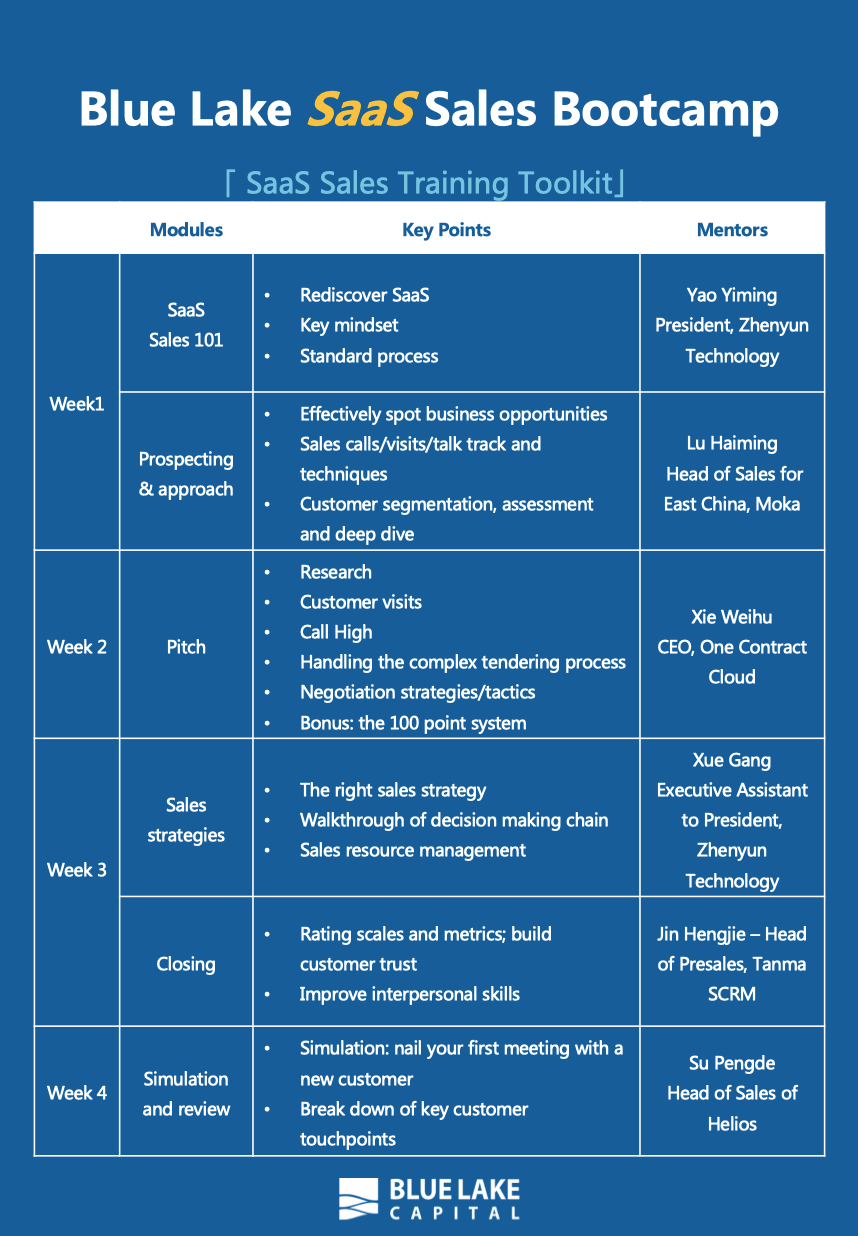

As a champion of enterprise digitization, Blue Lake Capital is committed to scouting and investing in promising SaaS companies and providing them with the support they need to grow. From 14th of August to 4th of September, Blue Lake Capital joined forces with six top-performing portfolio companies and offered the Blue Lake SaaS Sales Bootcamp. We sifted through over 200 applicants and handpicked about 30 HiPos for the four-week bootcamp which featured super salesmen from each of the companies who offered coaching and provided “brain training” each Saturday.

This was the first time Blue Lake Capital unveiled its Sales Enablement Module, whish is a part of its post-investment management program. With the existing resources and expertise of Blue Lake Capital and its portfolio companies, The goal of this bootcamp is to find a new path for talent development which can bring much-needed fresh blood to our portfolio companies and the wider SaaS community.

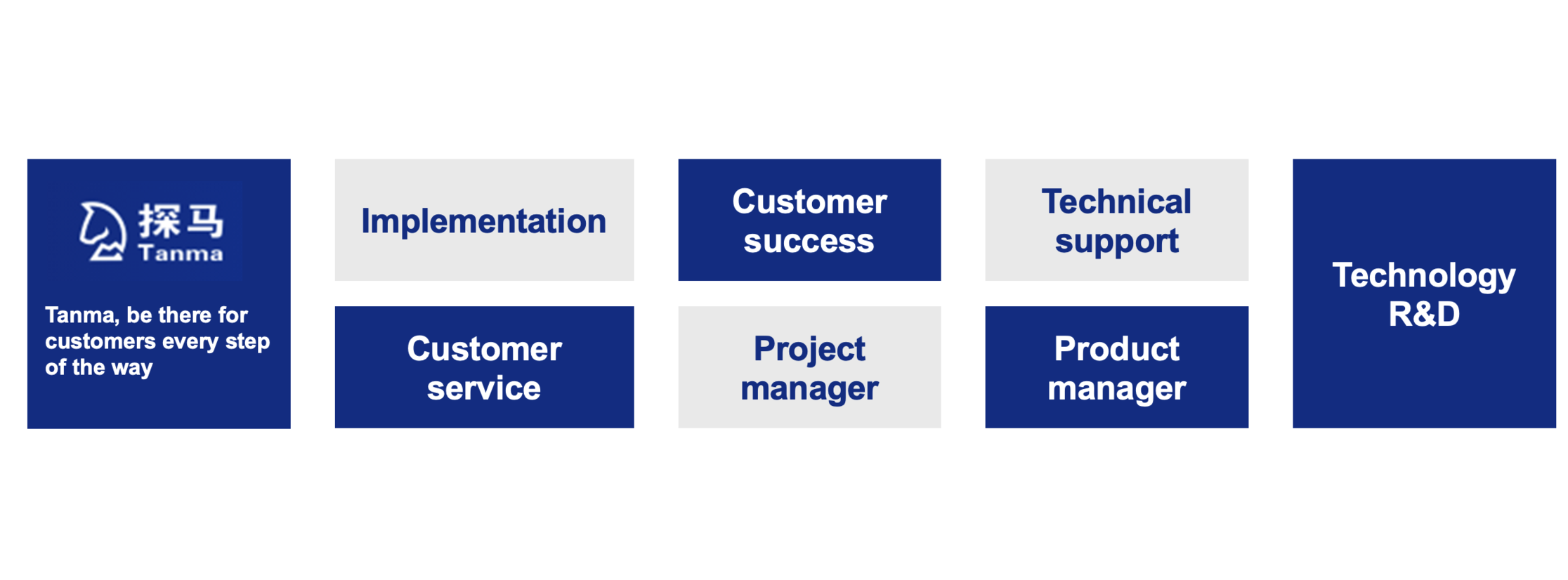

(Six Super Salesmen:Yao Yiming – President, Zhenyun Technology;Su Pengde – Head of Sales of Helios;Lu Haiming – Head of Sales for East China, Moka; Xue Gang – Executive Assistant to President, Zhenyun Technology; Xie Weihu – CEO, One Contract Cloud; Jin Hengjie – Head of Presales, Tanma SCRM)

Sales is an art about people. It is also a science and skill. Drawing on the vast real-world experience of the coaches, the bootcamp was a complete sales training framework we put together and repurposed specifically for the SaaS sector.

陈昊辉

蓝湖资本合伙人

非常高兴跟大家介绍蓝湖在清洁家电领域的投资。小米生态链企业「顺造科技」于近日完成5000万美元B轮融资,本轮投资由保碧产业链基金领投,蓝湖资本跟投,小米集团、顺为资本追加投资,云沐资本担任公司独家财务顾问。

家庭清洁设备正处于产品形态变革和渗透率提升的阶段。2020年,全球销售量1.4-1.5亿台,并以10%的年复合增长率加速渗透。在这一品类里,非常有望诞生百亿级销售额的品牌。我们非常看重核心团队十余年深耕产品研发、工业设计和供应链效率优化,顺造有望推动中国的产业从制造到智造,面向全球市场打响品牌。

顺造科技成立于2019年,目前打造了手持无线吸尘器、智能扫地机器人以及智能洗地机三大清洁家电品类,通过研发各类新型结构设计,持续开发前沿专利技术,来满足场景识别、物体识别以及语音交互等多种智能化需求。当前,顺造科技已经积累数百个自有专利技术。在终端的产品工业设计上,顺造科技也先后获得德国红点设计大奖、德国iF设计大奖、美国IDEA设计奖、日本G-MARK设计奖以及当代好设计奖等国际奖项。

顺造科技当前两大业务线包括米家产品线以及自有品牌产品线。目前米家产品线品类持续扩充,继车载便携吸尘器以及手持吸尘器K10 Pro后,顺造科技还成为了米家扫地机器人产品与洗地机产品的合作企业,其中首款旗舰产品K10 Pro在上市首月完成了3000多万销售额。自有品牌方面,顺造科技也在持续围绕不同价格区间,进行不同梯队的产品部署,同时基于家庭清洁场景、出行清洁场景以及户外清洁场景进行品类创新拓展。

在国内市场方面,顺造科技将进行线上线下全渠道覆盖与建设,深耕各类专业渠道,同时借助本轮地产股东资源,进入前装市场,将扫地机器人、拖地机打造成如洗衣机、空调的家庭标配产品。海外市场方面,顺造科技已经在德国、俄罗斯、日本、新加坡等多个国家和地区有所布局,并将搭建自有海外团队,进行全球市场本土化建设。

依托于完善的中国供应链体系,顺造科技在两年内打通了上游供应链体系,配合自有研发能力,核心零部件把控能力,在产品功效和成本之间达到平衡。本轮融资后,顺造科技将与产业方共同打造自有智能化工厂,满足海外市场对于家用清洁产品的巨大刚需。

顺造科技创始人唐成表示:“后疫情时代会是中国产品及品牌走向世界的最好时机。顺造聚拢了一批行业人才和跨界精英,打造同时拥有产业经验以及多维度创新能力的复合团队。公司从第一天起就关注用户诉求,针对不同国家及地区的清洁场景,真正从用户出发,打造最贴心的产品。顺造也将持续迭代,打造属于世界的中国品牌。”本轮融资将主要用于新技术开拓研发、核心产品迭代创新、全球渠道建设以及黑科技全自动化工厂打造等方面。

2021年9月6日,蓝湖资本投资企业中睿天下(全称“北京中睿天下信息技术有限公司”)宣布完成数亿元C轮融资。本轮融资由智慧互联产业基金、中金资本、国投创合、前海股权、中原前海以及老股东信雅达旗下网信基金联合投资,密码资本担任本轮融资独家财务顾问。继获得蓝湖资本、华创资本、元起资本、信雅达旗下网信基金投资后,中睿天下再获多家国资背景产业投资机构加持。

通过本轮融资引入多家国资背景产业投资方,中睿天下将加速自身业务的优化和创新,研发新技术、开发新产品、进入新市场,从网络安全产业发展新方向的引领者,进一步成长为网络安全行业的领军企业。

北京中睿天下信息技术有限公司成立于2014年,目前公司旗下包括行业级XDR“安全智能运营一体化解决方案”在内的全系列产品已广泛应用于政府、能源、金融、国防、运营商、教育、互联网等数百家关键基础设施行业客户,公司基于攻击者视角和“实战对抗”的军事思想理念打造的创新产品,有效助力关键信息基础设施运营单位构建新一代高级安全防护体系,高效率、智能化的解决网络安全日常运营过程中的实际问题。

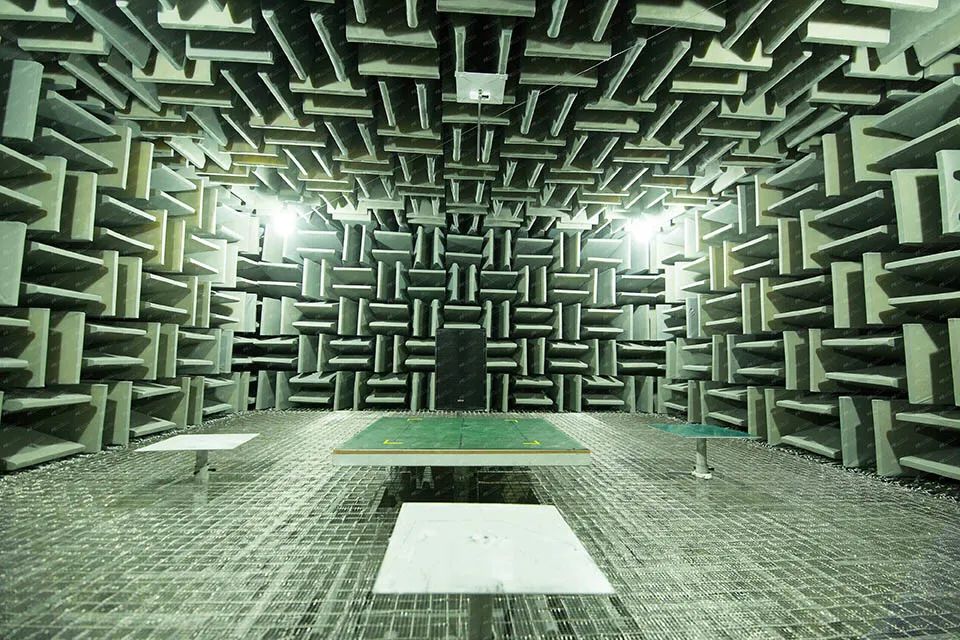

测控是研发、生产和品质管理的灵魂。在消费者重视品质的时代,越来越多的品牌厂商在过去几年里完成了产品质量从抽检到全检的转变,并开始逐年增加对自动化和测试设备的投入。

在精实测控公司创始人、董事长王磊看来,测控行业是一个不容小觑的蓝海市场,“整个生产自动化这块的设备供应商一年的全球产值大概在几千亿之间,检测装备这块的市场的想象空间就更大了。”头部消费电子品牌一年在测试仪器仪表装备的投资预算就超过了百亿规模。

精实测控成立于2011年,致力于测控技术研发与应用,以及先进测控装备的商业落地,对标美国国家仪器公司和丹麦B&K公司,主要聚焦于声学、力学、振动、电子测试技术以及自动化应用研发。

蓝湖资本合伙人魏海涛常年在在3C产业链上下游发掘投资机会。从初次结识到投资,再到几次加仓,在近4年的相处之中,魏海涛非常欣赏精实自始至终都在坚持做基础研发的投入,“兼具技术思维和商业嗅觉”。目前精实测控已拥有超过300项专利,其中50项为发明专利。其声学测试、电子测试、电机工艺自动化技术属于国内领先水平,力学与振动测试与控制技术则具备国际竞争力。

精实测控刚成立时先从白色家电领域入手,之后逐渐扩展到消费电子、新能源汽车电子等领域,目前服务的客户包括谷歌、亚马逊、格力、美的、北汽新能源等知名品牌。

工业领域的创业企业年收入从几千万增长到1个亿容易,但跨过1亿收入门槛,稳步向3亿、5亿、甚至10亿的目标迈进,则更考验团队的管理能力、战略格局和执行力。“绝大多数公司倒在了1亿收入的门槛前,而精实在短期业绩增长和长期研发投入之间做了很好的平衡,始终保持着清晰的产品思路,这是非常可贵的”,合伙人魏海涛说。

技术的先进性和过去多年与国内外顶尖客户合作形成的信任基础,让精实测控发展在2018年进入到了发展的快车道,开始参与到多家公司的Design In(嵌入式设计)环节,在客户新品研发的早期就进入,这意味着更多的订单和更深的绑定。

作为一家有着工程师文化的公司,精实测控如何找到用户需求,实现从技术到产品的过渡;在创业初期又是如何与大客户打交道;随着公司的发展,公司又是如何突破收入的瓶颈呢?围绕这些问题,近期蓝湖资本与精实测控董事长王磊进行了一次深度访谈。以下为访谈内容,有删减:

精实档案

- 成立于2011年

- 致力于测控技术研发与应用,以及先进测控装备的商业落地,包括装备的研发设计、生产、销售及服务

- 从10几人的团队到400余人的独角兽种子企业

创始团队

董事长 王磊

- 工程师出身,曾任美国国家仪器公司华南区销售经理

- 中国科学技术大学,通信工程本科与硕士

首席科学家 樊可清

- 35 年行业科研和工程经验

- 西安交通大学机械制造及自动化博士

测控是研发、生产和品质管理的灵魂

蓝湖资本:在整个工业领域的研发生产环节中,测控扮演着怎样的角色?

王磊:目前资本市场上对测控的了解更多是跟自动化绑在一起。我在美国国家仪器(National Instruments)工作的时候,我们将行业定位为测试、测量与控制,即Test、Measurement、Control。这三个词是技术词汇,而不是行业词汇。当提到测控的时候,我们往往脑海里想到的是仪器、测试设备、自动化装备,但实际上我们平时用的家用电器,它本身就是一个测控器。

所以测控的外延还是很广泛的,无论是研发过程中用到的各类集成设备,或者开发技术、验证和确认手段,亦或者是在生产环节提供测试制造装备,测控技术都发挥着重要作用。

我认为,测控是研发、生产和品质管理的灵魂。从定位角度来说,精实测控定位成测控技术研发公司,而不是一个简简单单的高端装备制造公司,反而是范围更广了。

蓝湖资本:测控作为一种技术手段,服务于各行各业,是一个很大的市场。精实在最开始是如何找到适合自身的行业切入点的?

王磊:我们是2011年成立的,当时汽车领域的测试基本上是欧美的设备供应商把持着,我们很难进入。而在消费电子领域,iPhone 4刚出来并未广泛普及。所以检测仍然是局限在很小的玩家里,并未形成一个产业。

但那时,白色家电正经历从定频转变成变频的时代,像振动、噪音和电子方面的检测技术需要全部更新,这是一个很大的机会。所以我们最终确定从白色家电领域进入,帮助格力、美的等进行振动、噪音、声学、力学的测试。

获得大客户信任,口碑收益比账面收益更重要

蓝湖资本:技术型公司常常会面临如何找到市场真正需求,跨过从技术到产品的鸿沟,在此方面,精实测控有哪些经验可以分享?

王磊:这其实是技术型公司的通病。一般来说借由技术转化产品的流程是,自身本身拥有技术,再去市场做用户调研,根据需求分析做产品的规划设计,并付诸实施交付与迭代。但如果只是表面的市场调研,估计得到的需求可能并不如你所愿。不同于消费领域的需求,工业领域的需求其实是藏在角落里的。

我们的策略是,从一开始就先在行业龙头客户中寻找可以技术落地的定制化项目,因为大客户的需求通常也代表着行业需求。在我们做项目的过程中,收敛客户需求,从中迭代出行业需求,这样规划出来的产品,在很大程度上能避免脱离市场、闭门造车。

无论做任何事情,需求分析是第一位的,其重要性甚至占到了一半,如果需求分析没有做好的话,后面很多付出都是没有结果的。

我们过去也吃过方面的亏。在16、17年跟某客户合作,我们前期投入了2、300万研发客户需要的传感器,当时客户承诺一年购买1万个左右,但最后只买了两个传感器,后来才知道他拿着我们生产的产品去压外国厂商的价格,帮他们砍下了40%的价格。过去像这样被当作实验品的事情时有发生。

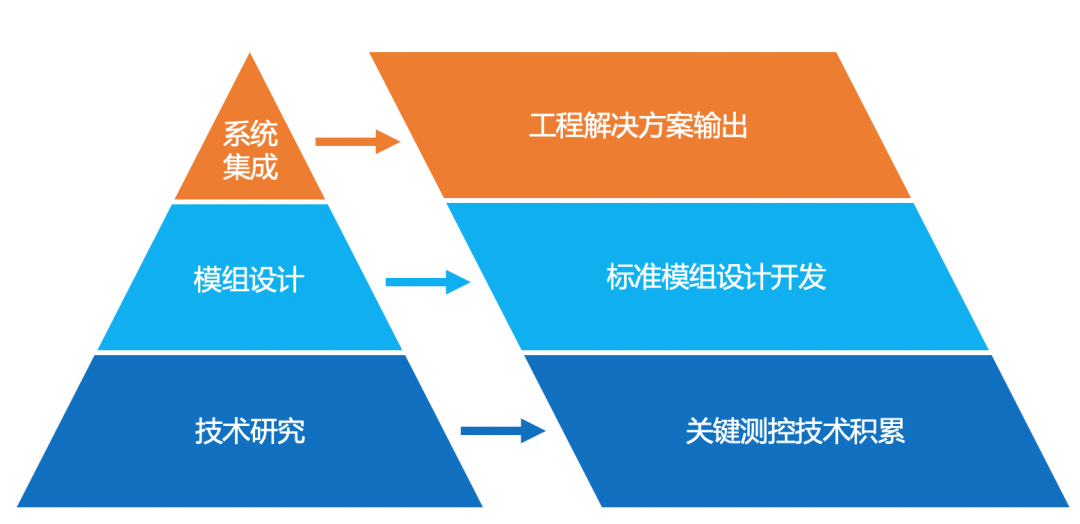

这也让我们反思,如果我们一直做Tier 2(二级供应商)的话,永远会被Tier 1(一级供应商)卡脖子。

Tier 1是做系统集成,负责生产管理项目管理的工作,Tier 2是做模组模块,但是如果不做Tier 1的话,连客户需要什么模块都不知道。

因此我们吸取教训,在2018年融完资以后,将资金投入到做Tier 1上,将系统集成做大。这不仅是为了赚取财务收益和利润,更重要的是获取真正的市场需求,为研发提供需求分析和指导。

蓝湖资本:公司从一开始就选择走大客户路线,服务的客户有亚马逊、格力、美的等,甚至会参与到国际一流公司的Design In(嵌入式设计)环节,在发展过程中精实测控是如何一步步取得这些知名厂商的信任,进而扩大公司订单规模?

王磊:和大客户做生意是个循序渐进的过程,如果没有耐心和坚持,你很难成为他们的中大型供应商。

和大客户初次合作要遵循“找小”的原则。

首先是要有辨识度。不能让业务的人先把单子拿过来之后再考虑其他,而是拿订单时一定要考虑匹配你所擅长的。

其次规模并不一定要大。一定要聚集所有的力量打在这个点上,哪怕就是一个几十万的小单。

在客户端内部人员的信息是互通的,一个给你30万项目的工程师,可能过两年会给你2000万的项目。要尊重每一个给你“小单”的大客户员工。

此外要集中所有的优势力量,把前面几个小单做好,要超过客户原本的要求。

如果走大客户路线的话,前期起步千万不能太在意账上收益,而是要更在乎口碑收益。

最后,在获取订单时,配合客户的战略规划,要自上而下看问题,而不是低价竞争。可能一个项目今年不赚钱,但可以让你赢得未来5年,那么这就是潜在的优质项目,就可以考虑。

突破的关键点在于坚持和高净值的大客户长期合作,通过合作积累口碑,获得未来更多做大项目的机会。

突破收入门槛的秘诀不在技术,而在组织管理

蓝湖资本:研发是一个非常重投入且持续的过程,对于技术类公司在早期如何平衡现金流和公司长期发展?

王磊:我们的路线是先做Tier 1,未来再做Tier 2。

做产品和Tier 2的话,它的增长曲线不是线性的,研发投入、迭代、市场培育用户需要一个过程,无法实现快速创新,所以一开始发展比较慢,但过了拐点后它会增长很快,但是到对于做Tier 2的创业公司而言,能不能在到达拐点之前还活着,这是一个问题。

另外也要考虑在到达拐点前需要花多长时间,会不会错过一些窗口红利期,因为如果错过窗口期,即使你表现再优秀也会打折。这其实还是非常复杂的一件事情。

对于大客户来说,他们都希望得到的服务是专属定制化的;同时对我们来说,刚开始未找到适合市场需求的产品,而做系统集成可以实现收入的快速增长,解决了我们当时生存的问题。

但是如果只是为了生存,那就会变成一家纯项目公司了。实际上我们在16 、17年逐渐发现一些测试测量项目,也逐步形成一系列的标准化和半标准化的产品系列。

做Tier 1 是一件重投入的事情,因为大客户对于你的机器的先进程度、品质控制体系、场地、服务能力都提出了非常高的要求。

所以到了2017年我觉得我们必须去融资,不然连客户审核都无法通过。如果没有资本的加持,可能我们就会错过绝佳的窗口期。

我们真正的Tier 1的拐点发生在2018年。经过了前期几次项目合作,我们在项目管理方面得到了认可,订单规模也接近上亿元。

我们现在正在把产品往系统服务上发展,过去积累多年的技术正慢慢地集中爆发。

蓝湖资本:工业领域的企业从几千万做到1亿元收入不难,但如何突破1亿元,实现更大的增长却不容易。精实测控在此过程中是如何突破发展瓶颈的?

王磊:我觉得最重要的是搭建适合的人才梯队。因为做Tier1的话,更多考验的是生产、供应链、项目管理和商务能力,并非单纯的技术能力。

创业初期,我们先是集中火力做大项目,在18年、19年引入资本后,我们做了大型自动化系统集成项目,当时人力资源扩张太快,管理的组织结构又过于扁平,来不及培养腰部中层力量,造成了管理层精力分散。

所以在18年年底时,我们暂停了大型国内自动化的项目业务,把团队组织架构改为模块化的服务方式。

但是随着后期业务扩张,我们发现每个中层和高层能力范围上1个人要管20~30个人,管理质量有所下降。

19年底我们又做了一次组织变革,把一些公共的项目合并同类项,以此降低管理难度,同时我们也充实了中层的腰部力量,从外面也引入了行业优秀人才加入。

我们之前一直秉持着前端思维,注重业务和技术工程,现在我发现后端思维对于企业发展也很关键,更加关注内控、仓储管理、生产管理、供应链管理。

在我看来,组织架构遵循着“分久必合,合久必分”的规律,对不断发展的公司来说2-3年就需要变革一次。

蓝湖资本:在你看来,精实测控公司的核心竞争力是什么?

王磊:我们的核心竞争力是我们有一群人,他们拥有用技术改造行业的愿景,历练多年,已经深刻理解了行业的需求。这些员工中有“高谈阔论”的,也有踏实干活的,这两类人在一起会产生很大的价值。

我们的使命和愿景是未来能成为一家世界级的工具设备供应商,但就我个人而言,我更加希望精实测控是一家不断能够吸收新技术、新理念,并且能够基于这些新技术、新理念创造出新的工具,从而改造整个行业的公司。

On August 10th, Forbes released its 2021 Cloud 100 List. This list, produced in collaboration with Bessemer Venture Partners and Salesforce Ventures, is the definitive ranking of the world’s top private cloud companies. JST, a Blue Lake Capital portfolio company, is one of three Chinese companies to make the list.

Forbes uses four factors to evaluate hundreds of private cloud companies and identify the standouts: market leadership (35%), estimated valuation (30%), operating metrics (20%), and people and culture (15%). Dozens of public cloud CEOs helped score and rank their private peers.

Founded in 2014, JST has been committed to developing cross-platform ERP systems for numerous enterprises. Tasked with addressing customer demands and pain points, JST leverages the synergistic nature of SaaS to connect the entire e-commerce value chain from upstream to downstream. Today, the company has grown to become a SaaS ERP platform that offers a diverse range of services to merchants. As of today, JST operates over 80 outlets across China, covering 350 cities, with a team of over 2000 people providing timely and quality services to its merchants.

During the past 7 years of serving e-commerce enterprises, JST has been digging deep to diagnose the pain points of the industry and its users. Efficiency and synergy are the two guiding principles of JST when it looks at building up a comprehensive product mix and optimizing its service system. As a result, JST’s products and technologies are leading the way. Its unique “tailor-made” service system has now become an industry standard. The integrated SaaS ERP solutions offered by JST has dramatically sped up the digitalization process of the entire e-commerce industry in China and contributed to the thriving SaaS sector in China.

As Luo Haidong, Founder and CEO of JST said: “ B2B business is a pit that’ll take a decade to fill up. As a B2B company, we have a long way to go before we become the world’s biggest SaaS Synergistic Platform that pivots on e-commerce ERP. This is our vision and something that we will work tirelessly to turn into a reality.” In the future, JST will continue to focus on technological innovation in order to keep upgrading its products and service capabilities. By doing so, JST can offer users ever-improving integrated solutions and service experience to lead the industry toward transformational upgrades. In the meantime, they keep optimizing their layout strategy around their core business. They will also work to build an integrated e-commerce innovation ecosystem via M&A and incubation. We believe all this will help increase their presence across the value chain and contribute to the digital and intelligent transformation of enterprises.

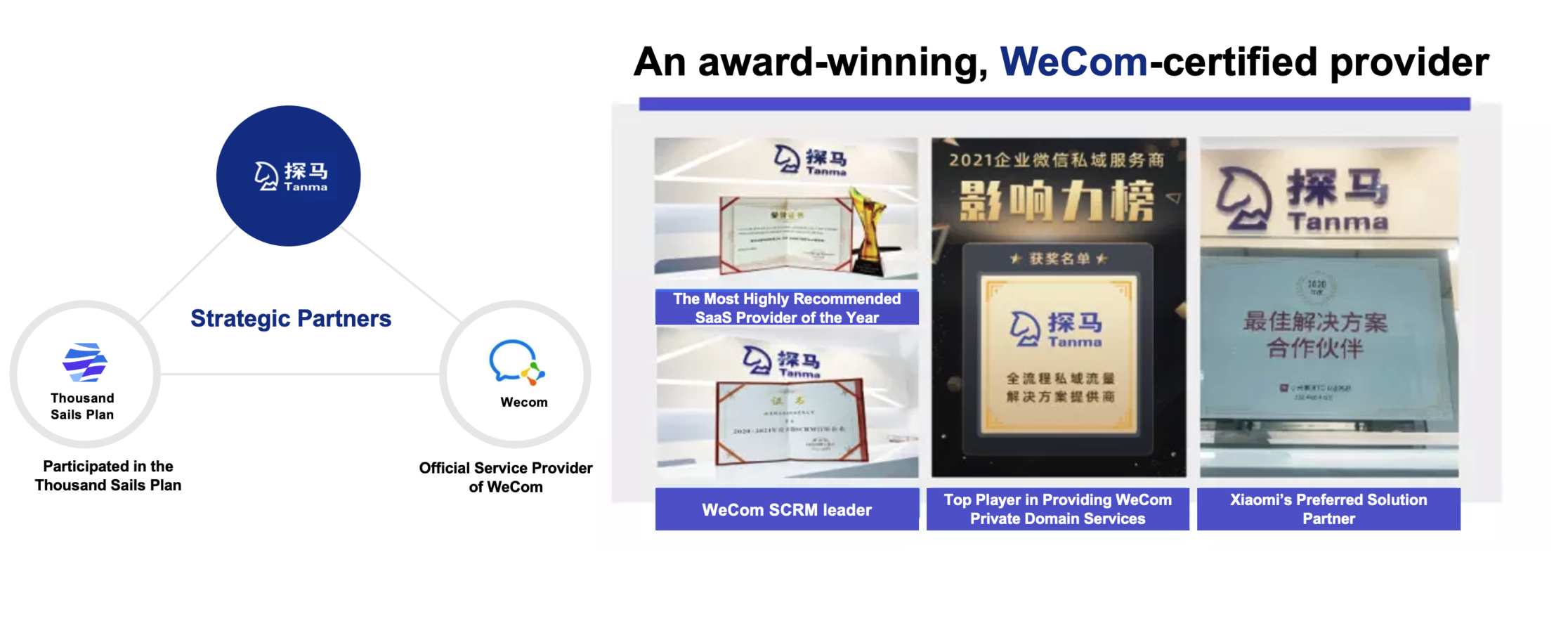

Tanma SCRM, a leading WeCom SCRM provider, announced on July 28th the completion of a 15 million USD Series B funding round led by SoftBank Ventures Asia and co-invested by Shunwei Capital. Tanma closed its Series A funding round just two months ago, raising 10 million USD from Blue Lake Capital, Legend Capital, and K2 Venture Capital.

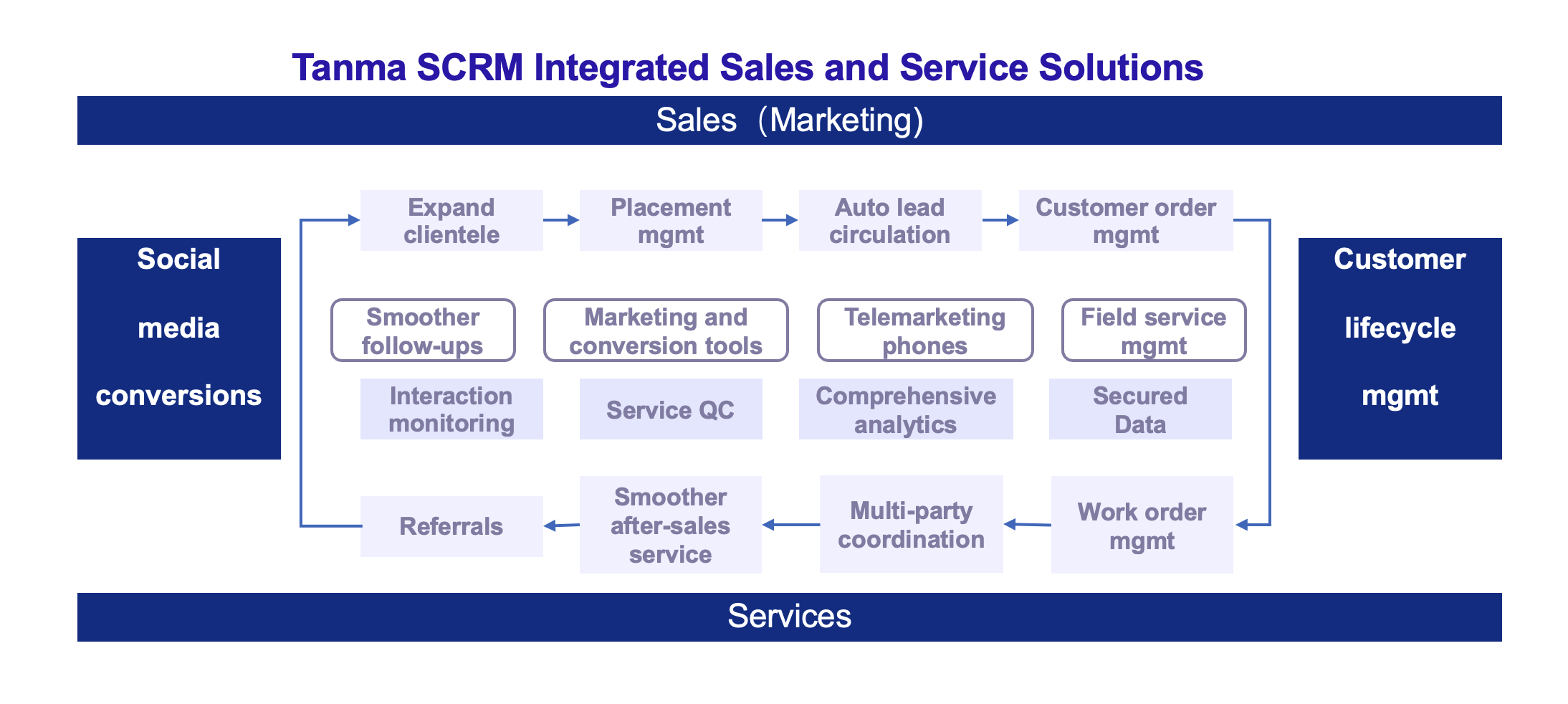

Tanma SCRM uses WeCom to serve sales-driven enterprises by offering total process solutions from customer acquisition, conversion, and services to management.

Tanma has all three customer-facing scenarios (online, offline, and by phone) covered through the use of multi-channel management, search/location-based customer expansion, and their marketing toolkit—which includes community operations, fission marketing, red packets, lottery, CRM, and telemarketing calls. These tools have effectively lowered customer acquisition cost, improved lead conversion, and increased transparency of social marketing—arguably the biggest pain points of SCRM.

In addition, the use of Tanma’s side bars, client SOP, and marketing tools make it possible for enterprises to have smoother after-sales communication and boost customer renewal rate. By supporting digital and granular sales process management and CRM processes, Tanma helps take its clients’ businesses to the next level.

Tanma SCRM has served thousands of corporate clients, including Gaotu Group, Taikang Life Insurance, and Zoomlion. Its marketing solutions have been implemented across various sectors such as education and training, finance and insurance services, real estate services, big-ticket purchases, aesthetic medicine and enterprise services.

Meanwhile, as part of Tencent Cloud’s Thousand Sails Plan, Tanma SCRM has received many awards such as the Most Highly Recommended SaaS Provider of the Year and 2020-2021 WeCom SCRM Leader award, making it one of the most well-recognized service providers among peers and customers.

Tanma SCRM has a team of over 270 people, over 50% of which are in R&D. Many of its core team members have come from big-name companies such as Google, Tencent, Baidu, Huawei, and top universities in China and abroad. Collectively they have innovative capabilities in cutting-edge technologies and vast experience in the field of enterprise services.

7月23日,蓝湖资本投资企业「怡合达」正式以“301029”为证券代码在深交所创业板挂牌上市。

成立于2010年的怡合达主要从事自动化零部件研发、生产和销售,提供 FA 工厂自动化零部件一站式供应;其深耕自动化设备行业,基于应用场景对自动化设备零部件进行标准化设计和分类选型,通过标准设定、产品开发、供应链管理、平台化运营,以信息和数字化为驱动,致力于为自动化设备行业提供高品质、低成本、短交期的自动化零部件产品。

截至2020年12月31日,怡合达已开发涵盖176个大类、1,404个小类、90余万个SKU的FA工厂自动化零部件产品体系,并汇编成产品目录手册;年订单处理量约55万单,年出货总量超过230万项次,90%标准件可实现3天内发货;累计成交客户数突破4万家,服务3C、汽车、新能源、光伏等行业。

今日,怡合达高开713%。截至10:45,怡合达报于每股113.36元,较每股14.14元的发行价上涨701.7%,市值约为452亿元

What are the hottest arenas for VC firms this year? Most investors would agree—it’s new consumption and enterprise service.

However, enterprise service is not nearly as accessible as internet products are for most people. You don’t often hear sexy, insane growth stories. However, as the internet traffic dividend dwindles to a trickle, business warfare starts to break out from behind the scenes — among companies that are quietly serving their big-name corporate clients.

In the enterprise service sector, SaaS attracts the largest amount of capital and is considered the most likely to disrupt the software market. It is estimated that China has about 20 SaaS companies with over 100 million RMB of ARR (annual recurring revenue, a key indicator that measures the size of a SaaS company). Blue Lake Capital is a champion of SaaS and has placed a substantial bet on the arena. According to the company, they have invested in 6 of the 20 biggest SaaS companies of the past 4 years.

In July 2021, I had the chance to meet up with Managing Partner Ray Hu, Chen Haohui and Wei Haitao, partners of Blue Lake, and hear what they had to say about SaaS. Blue Lake Capital was founded by Ray Hu in 2014. He is an investor of Momenta, Meicai, Qunar, and Grab. Starting from 2016, Blue Lake Capital gradually shifted its focus area to SaaS, with investment in Moka, Zhenyun Technology, JST(Jushuitan), among other SaaS companies. The insights into the SaaS business they gained over the past five years are more than hard-earned experience than investment methodologies.

Blue Lake Capital was founded at a time when the big VC firms got even bigger in China. That made it impossible to stay a competitive and comprehensive boutique fund. Placing big bets on highly selected companies and becoming part of a value chain has become a way forward for some small and medium-size funds.

Ray Hu characterized this domain-specific strategy as “standing on the other side of the table”.

01 “There’s a devil in every irregularity”

Tencent News: When did the idea of “standing on the other side of the table” come to you?

Ray Hu: When I made my worst misjudgment with Moka. The founder said in angel round that he wanted to do ATS (applicant tracking software). I told him: stay away from ATS. I’m telling you, I’ve looked into it and there’s simply no market for it in China. We talked again in Series A round, and I still decided it was a no-go for me because however, I looked at it, the ATS market was just not big enough to make sense. But then in Series B+, we just couldn’t let the Moka slip away again, so we jumped on the bandwagon.

Tencent News: What did you learn from this case?

Ray Hu: Don’t give too much thought about the ceiling. Knowing the unit price and scale of the customer base should suffice. If both are five-digit, we would take the plunge; if one is five-digit and another is 6-digit, chances are it’s quite a good project.

Basically, it’s about zooming in on matters most in any given stage: in Series A round, see whether the product is standardized; in Series B round, see whether the sales are scalable.

Tencent News: What methodologies have you accumulated for investing in Series A and B rounds of SaaS companies?

Ray Hu: What exactly is an investor looking for in a deal? One, real product with value. Two, margin of safety. Three, compound interest. In the SaaS business, these three things can be translated as: Is there customer value? It is complicated enough, with barriers to entry? Retention/renewal rate?

What’s really good about this arena is there are many success stories, especially in the US. You can look at the growth trajectories of these companies from year one to year ten. By year ten, a company would typically be listed already. The revenue they generate each year, the number of customers they have and the amount of money they burn – all these numbers are readily available. Our job is to identify metrics that are quantifiable so we don’t spend much time on those when doing due diligence, but instead focus on the outliers. Evaluating a deal is about sniffing out irregularities.

Tencent News: What do you mean by irregularities?

Ray Hu: For example, three salespeople generating 20 million RMB of sales.

Tencent News: Isn’t that great?

Ray Hu: It might be. It could also be a red flag for many of the problems you didn’t see. As the Chinese saying goes: there’s a devil in every irregularity.

What could the devil be? No competitors, robust customer demand, short sales conversion cycles, contract signed after one or two visits – all these are irregularities.

Tencent News: Isn’t that supposed to be great? What can be the problem?

Ray Hu: 3 salespeople for 20 million RMB. That’s 6+million RMB per person. That means these are big contracts. Chances are this company is not working on SaaS products but contract deliverables.

Tencent News: Such companies may have a hard time scaling up in the future.

Ray Hu: And the sales pipeline can be problematic. 3 big contracts worth of 20 million. Where can you get 3 more next year? You simply have no idea. I’d rather the 20 million come from 100 small contracts, and next year I can look at signing up 150 to 200 small customers and growing at a steady pace. That’s the certainty I’m looking for.

Tencent News: Any other irregularities?

Ray Hu: Along the lines of sales, say, if a company tells you the cost of sales is only 15%. That just can’t be for a startup in its first few years. We need to dig up as many reasons as possible when doing due diligence because the window is small.

Tencent News: How do we identify irregularities?

Ray Hu: You would have to go the opposite direction by knowing what’s normal or regular. If we have a feel for the business, we would know what’s normal and not get obsessed with it; we would also know what issues are problematic, but not too important. You have to take the bull by the horns and figure it out.

Tencent News: President of Zhenyun Technology Yao Yiming said that if a SaaS company (in China at least) has a high enough ARR rate and retention rate, you can invest with your eyes shut.

Ray Hu: Yes, you can invest blindfolded if those metrics look great. But most companies are not that good, especially in the early stage. They are not around long enough to have a track record, much less a renewal rate.

Tencent News: Two of the four partners of Blue Lake Capital are pure investors, and two are operator-investors. Do you pay attention to different things?

Ray Hu: A pure investor would usually look at the product interface and talk to a few customers, which might be a setup or a bait. You may go one step further and talk to experts and competitors. But even if you find inconsistencies you might not be able to interpret it. An operator investor, however, would hit the nail on the head.

The pure investor would have to know what your hammer looks like and try to find the right nails. Back in the day, there were many opportunities but not nearly enough money. If you showed up in the market with enough money and tried your luck here and there, you could always nail something. Now with fewer opportunities around, if you go hunt for nails with your hammer in your hand, you’re more likely to hit the nail on the head.

Tencent News: What is your hammer?

Ray Hu: That would be our knowledge of how SaaS software should be done.

A SaaS company is supported by three pillars – products, sales, and service. The last two are just as important.

02 “The first 12 months post fundraising are the most dangerous.”

Tencent News: What are the implications of SaaS companies’ rising popularity over the past two years?

Ray Hu: It’s a mixed picture. The good news is it’s easier to raise capital for your portfolio. The bad news is the post fundraising 12 months is the most dangerous period for any company as it tends to make lots of mistakes.

Second, there is a lot more competition – VC firms that used to steer clear of SaaS are coming in; Before you had a deal for 30 million dollars, but now you don’t even get a chance to talk to the founder without putting 50 million on the table; In the past, you had 3 weeks for due diligence, but now you have to whip out a term sheet in three days. The “involution” (cutthroat competition) is incredible. But this is expected – just a matter of sooner or later. You should be worried if you don’t see competition in the industry you want to invest in.

Tencent News: Why is that 12 months the most dangerous? Is it because of euphoria?

Ray Hu: You do get a boost but end up making more mistakes when it comes down to business.

Let’s see what could possibly happen. During the fundraising process, the founder tends to paint a nicer picture and tells investors that the company can bring in at least 30 million next year while it’s more like 20 million. Now, they have to make it happen, say, by having 50 salespeople after fundraising instead of working with just 15. That’s how SaaS companies dig themselves into a hole.

What happens then, with the 50 salespeople out there hunting for new orders? A salesperson may come to his boss and say, this product is usually sold for 200,000RMB, but this big client/sucker/friend I know would sign an 800,000RMB order. But he has a handful of other requests. Yes or no?

Tencent News: No.

Ray Hu: You wouldn’t say no. If you do, the order is gone, so is the salesperson. The order may go straight to your competitor.

You’d just have to sign it. And you’d soon realize that the salesperson has made a way bigger promise to the customer than he was telling you. You’d realize you can’t deliver, and you would have to get more R&D people on board to deliver. Say you have five orders like that and the entire R&D team is burying itself in work trying to deliver, the company would be ground to a halt. Scheduled upgrades are left behind.

Tencent News: What would be the right way to go?

Ray Hu: Do not rush to hire more salespeople.

You need to sign more orders but don’t rush to hire more salespeople. They are shortsighted. The right way to approach it is to follow the original trajectory and do not set a growth target too high. There’s a pattern in this business. A typical SaaS company can grow 50%-100% each year in the early years, but something is wrong if it suddenly hits 200%.

There’s no such thing as a free lunch. A company can grow crazy fast, but not without a hefty price.

03 “Do not put human nature to test.”

Tencent News: Moka CEO Li Guoxing said that organizational capability is more important to a SaaS company than having a heroic CEO.

Ray Hu: The SaaS business is one long value chain that requires the concerted effort of everyone. It is an arena without secrets. The trick is to be able to gather a group of people to do it out of pure faith while being paid a lowball salary.

Tencent News: From your vantage point, what are the typical traps for SaaS startups?

Ray Hu: Sales and delivery are always the two biggest traps out there.

You will not only need good salespeople to drive sales, but you also need willing customers. The salesperson may peddle really hard and rattle off a list of product features. But even if some of the features are unique, 1) it’s not a done deal because that feature might not be what the customer wants, and 2) even if it is, a competitor can catch up within 2 or 3 months.

Tencent News: What should you do then?

Ray Hu: There are many ways around it. For example, developing a new feature. It can be one that customers really need and see great value, or it can be one that looks fancy for driving sales, but that’s not necessarily useful for customers. We need to have both and use them alternately. Every responsible investor would keep revisiting these issues with the founder until they get it right.

Tencent News: What are the fail-safe tips you have?

Ray Hu: The founder of a company we invested used to be in the tech business. One of our partners with operational background asked him about the company’s revenue breakdown by region. He said 50% came from Northeast, 30% from Southeast and 20% from the East. Most investors would just let it lie, but our partner immediately knew the numbers were off – all management software companies get 50% of their sales from the East.

If you build a new sales team in the East region, but the salespeople keep picking the low-hanging fruits. Would you let them? You want to go beyond the tech industry, but how do you tackle the barriers down the road – brand new use cases you don’t have experience with? Greater investment into R&D? Longer conversion cycle for your salespeople? Lower ARPA in other sectors compared to the deep-pocket tech industry? Would you be willing to solve more complicated issues for less? It’d be even more agonizing for the salespeople. If I were the sales lead, I’d think – would this impact my performance and commission? Who should I send to fight the toughest battles? What’s in it for him? All these are typical managerial issues.

There’s a simple solution for this. Let’s say this company is trying to boost its sales in the East. Step 1, send your main sales force to the East to seize the tech industry. If you don’t get it in the bag, your competitors will.

Step 2, cast your net wider to cover more sectors, but not with the entire sales force. Send scouts instead. These are people that will take one for the team. But don’t send your top salespeople. You don’t want to lose them in the fight and impact the team. Send people with mediocre performance.

But then the scouts can’t explore at random, going for the medical industry today and FMCG tomorrow. For example, a salesperson in Guangzhou is assigned to cover FMCG companies. Beyond that the supervisor would have to grant him the approval and go with him. His commission can a bit higher just so his real income does not suffer. If he manages to sign on new customers, he may actually make as much as when he covers tech firms. That’s how a company gets people on board. Take it slow, see whether a certain sector generate more revenue than cost incurred. If the cost is greater, then move on to the next. That’s how you get a hang of the sales dynamic in each sector, at a small cost.

There are many detail issues it’s quite fun. Just tackle them one at a time.

Tencent News: How about delivery?

Ray Hu: A typical delivery issue is – should I say yes to customers’ weird demands? If so, for how much? How much is too low and not doable? Do I do it on my own or hire more people for it?

You may say yes because this feature may be useful to future customers. Then you’d need to involve R&D personnel in customization. Should these people follow the lead of the delivery team or R&D team?

Tencent News: The delivery team.

Ray Hu: Wrong. They should follow the R&D team. After all this customized product will be integrated to the product mix. There are many similar issues like this where choices would have to be made.

Tencent News: Of all customers with weird demands, what type of customer can I say yes to?

Ray Hu: It’s complicated. You’re asking because it’s a judgment call. That’s usually because you don’t have enough customers to tell whether it is a universal demand. Companies would say yes in most occasions because they want to get the order.

Firstly, You need to figure out how to lower the cost as much as can. Second, whether the customization team follows the R&D or delivery team. This is crucial.

Tencent News: Having homogeneous products would only set a company up for an endless price war. So how does one build a differentiated product?

Ray Hu: Moka is highly responsive to customer demands. It has a Net Promoter Score of 8 while the industry average is -20. How did Moka pull that off?

Moka runs a “group for grumbling users”. Everyone from CEO to frontline salespeople and customer service are there. Anyone who receives customer complaints shares a screenshot of the complaint for follow-ups and troubleshooting. If it’s a common issue, it will be put on the agenda for the next meeting, and addressed with a timetable and a lead person.

I don’t think other companies have a group chat like this.

Tencent News: Wouldn’t that make the CEO overwhelmed?

Ray Hu: All discussions would happen among a much smaller group of people. Say, if a salesperson shares a product complaint in the executive group chat, the product manager would go: why did you blast it to the group? You could’ve just sent it to me. Companies with that kind of corporate culture can’t possibly be product-driven. Every company can make the change their customers wish to see, but most would take longer.

Tencent News: They are trying to keep the CEO in the dark.

Ray Hu: We all try to look good and capable. Such is human nature. So don’t put human nature to test.

Tencent News: With all this insight into the business and what’s going on in their minds, how does that help with your investment decision?

Ray Hu: Operator investors tend to subscribe to the Eastern philosophy, which is more about human nature, while pure investors lean toward Western philosophy, which is more logical and categorical.

Investing is an art, not something that can be solved with just equations and numbers.

04 “Herd Behavior in Venture Capital”

Tencent News: Where does the SaaS market stands in terms of development stages? What is the macro-environment that sets the stage for SaaS explosive growth over the past 2 years?

Ray Hu: It is in the early stage of explosive growth. My understanding of the macro environment is different from that of operators. As a pure investor, I would say it happens against the backdrop of raising labor cost, widespread availability of IT equipment and mobile devices, and the readiness of cloud infrastructure. Operators would attribute the rapid growth to VC’s involvement. After all, building a software product can cost 300 ~ 500 million RMB. Apart from VCs, who else has the wherewithal to do it?

Tencent News: So why did VCs enter the fray?

Ray Hu: there is the herd mentality among VCs. They wouldn’t have joined the race without these few success stories.

Tencent News: Why can’t we see a salesforce of China? How do you look at future trends?

Ray Hu: We will, in the next 3-5 years.

Most SaaS companies in the US follow the same playbook. Value creation typically happens after IPO, and the market cap would at least double after IPO.

A growing market cap correlates with stronger performance, higher valuation, and M&A, which is an important factor. Being the first public company in a sector means it has money to acquire latecomers. Salesforce, Adobe and Workday all expanded via acquisition funded by the capital market. The salesforce is key to a SaaS company. That’s how you generate additional sales. SAP and Oracles have been known for their shopping sprees. In China, SaaS companies have not yet taken advantage of the capital market, but they will, sooner or later.

Tencent News: When do you think SaaS companies in China will be ready for the capital market?

Ray Hu: Within 2-3 years. A company can scale up very quickly if it has a solid main business and a smart acquisition approach.

Most B2B companies will live, but they may find it difficult to scale up. If a company grows to become huge, the capital market will give it a high premium. Why? Because we all know that it’s a highly unlikely event. We pay more for scarcity.

In China, I think 10 billion is just a starting point. It’s possible for a company to grow to a 30-50 billion enterprise.

Tencent News: What is the worse fear of a B2B company?

Ray Hu: B2B companies can’t grow fast, which is a good thing, because your competitors can’t either. So if you’re lagging behind, you can catch up real quick. You can afford to make mistakes.

Top B2B companies are investors’ darlings. They have money to burn. The flip side is the cash flow can easily go in the wrong direction. That’s why managing cash flow properly is important. It’s not unusual for a company to stay in the red for the first 3-5 years. But you’ll need enough money to keep up with the bleeding.

Tencent News: Tech giants such as Alibaba, Tencent, Baidu, Tictok have all burst onto the B2B scene. How does that impact startups?

Ray Hu: No impact at all. Granted, they have more traffic, but that has nothing to do with you. Second, even a tech giant will have to stay in the game for years to see any result. The best and brightest always go where they can deliver the best performance. Third, customers don’t always opt for big brands.

Tencent News: With so many SaaS companies in your portfolio, have you created a profile for successful SaaS founders?

Ray Hu: CEOs always care more about customer satisfaction than anything else. This is a business built on repeated purchases, which is an enabler of long-term profitability and a positive growth cycle. A kick-ass SaaS company keeps their customers happy, and the rest of the problems take care of themselves.

Tencent News: I don’t think you’re betting on the founder. As one of your partners Wei Haitao said, “you can’t bet on the founder based on your own preferences.”

Ray Hu: No, we definitely bet on the founder. Regardless of how much we know about a business, 70% of its success depends on the founder. But there are uncertainties. Will a kid make it to an Ivy League school? You never know.

“Not based on one’s preferences” means acknowledging what the founder manages to achieve in a given industry environment. Try putting the entrepreneur and the deeds in perspective instead of being way too biased.

Tencent News: Any profile that you think is no good?

Ray Hu: Those that dither won’t make the cut. A good founder has just the right amount of salesmanship. Smooth talk is important, but he can’t get carried away. He should be aware that he is smooth talking, in a way that the investor picks up without calling him bluff.

Tencent News: As a fund with a focus on SaaS, how do you feel if you fail to invest in the top players?

Ray Hu: How I feel doesn’t matter. It’d be a failure.

Tencent News: How do you just keep winning, and make sure that you always get to invest in top SaaS companies?

Ray Hu: first of all, we have a bit more common sense and a feel about the business than most people. Second, we continue to create value for entrepreneurs, for example, by offering sales enablement module, etc. Blue Lake is like an SaaS for our founders.

We can’t be sure, of course. We can only work harder each day. As we say in Blue Lake, keep showing up at your customers’ doors – that’s how you get business. And we also say that there are only two seasons in a year – a busy season if you work hard, and a slow season if you don’t.

Grab a drink, keep these words in mind, and keep at it. Go home, get some sleep, and go to work again the next day. (chuckle)

05 “VCs are for lazy folks. At least they can get home for dinner.”

Tencent News: You had worked in BCG for 4 years, and GGV for 7 years. Why did you decide to quit and become an investor?

Ray Hu: A consulting project lasts for about 8-10 weeks. 3-4 weeks down the road you know what you are about to write. The rest of the time is spent on writing it up, double checking the format, footnotes, numbers and punctuation, tweaking the wording to get rid of the edge, and fiddling with the color palette. If you look to spend 20 years in consulting, 15 of those years will be all about tweaking formats and wording. That’s kind of boring.

So I was thinking, can I do it the other way around? As a consultant, I put together slides to share my insights with clients. I charged them on a per person per day basis. I couldn’t make more than my hourly rate, which can’t get beyond a certain range. Investing, however, is about using a financial leverage to magnify the return on my insights.

Tencent News: What was your focus area for investment in GGV?

Ray Hu: GGV didn’t assign specific sectors. There were 10 of us and we invested mostly in internet companies and enterprise service companies. We didn’t invest in gaming, though.

I was new to investing. I couldn’t read the three financial statements, and I didn’t know how internet traffic worked. GGV was nice for a rookie like me. I didn’t know anyone there when I joined, and I didn’t make any meaningful contribution in the first 18 months but I didn’t have to stress over it. Those days are gone. Now you can’t possibly show up at GGV clueless about investing. There are more than enough smart and capable people in this business.

Tencent News: Among the companies you invested in GGV, Qunar, 21Vianet and Grab, which is the most interesting?

Ray Hu: Every deal has interesting stories to tell. Qunar opened a door for me. When I heard Zhuang Chenchao’s thinking behind the founding of Qunar, I got inspiration about how to spot investment opportunities in an ocean of companies. He co-founded Shawei.com, a sports website after graduating from college. I asked him why. He said Sina was the hottest portal in 2000 it was impossible to beat. So he picked the hottest channel.

He thought about doing news, and if he did, whatever he created would probably be as big as Toutiao (news site Jinri Toutiao). But he decided that doing news was risky and entertainment news was no fun. Sports is not bad and sports advertisers were rich. So he decided to do a sports portal.

Before he founded Qunar, Baidu and Google were the hottest companies, and finance contributed the lion’s share of revenue for Google. So he founded rong360, a financial search platform. The second biggest advertisers were travel agencies so he switched to OTA and founded Qunar.

Tencent News: Why did you leave GGV in 2014 and founded Blue Lake Capital?

Ray Hu: I was tired of working for others. I could run a financial model and calculate how much I would make in the next 10-15 years. It was a depressing exercise. Not that the numbers weren’t great, just predictable.

Tencent News: Have you seen a seismic shift in the VC industry since 2014?

Ray Hu: The total amount of capital it the hands of top VCs is 2 orders of magnitude (100 times) larger than that of the second-tier VCs. Sequoia, Hillhouse and Tencent each have a pocket so deep it’s bottomless. This was unimaginable back then.

Tencent News: How did you manage to slowly switch Blue Lake’s investment focus to the SaaS vertical?

Ray Hu: In 2016, we saw a shift in the macro environment and sectoral landscape. Money was increasingly concentrating in the hands of top VCs. So they grew bigger in size. When capital is no longer scarce, brand recognition becomes more important. That rules out the possibility of staying as a competitive and comprehensive boutique fund. If you run a small fund and you want to be competitive, you must specialize.

Tencent News: Why didn’t you run a big fund?

Ray Hu: Even big funds start small.

The VC cultures in China and the US are different. Many LPs told me that LPs in the US would usually ask a GP: what is your specialty? And your ROI? But the first question for a Chinese GP is: how big is your fund?

Tencent News: How do small and medium funds like yours survive in an increasingly concentrating VC market?

Ray Hu: We live by diving deeper into a vertical to achieve a network effect. I heard investors quote a famous Chinese saying “the water may be boundless, but I’d take the one ladle I need”. I thought they meant to caution against investing in too many companies. Later I realized it wasn’t a matter of quantity. As long as you’re investing in companies of the same type, same vertical, or of similar nature, you’ve got it all under control.

Tencent News: Large VCs and PEs are putting heavier bets on B2B businesses. How do you get ahead and get deals? Your parnter Chen Haohui said, there was a time where he spent 6 months trying to get a deal, but he still lost it even with 5kg of Chinese liquor down the throat.

Ray Hu: Branding has indeed given them great momentum. Let’s say if you are not the first to meet the founder, you have to be at least the 10th, or you have to set up a meeting in the same week, or do your dd three days ahead of top VCs. And salesmanship is important. We need to lay out what we can offer – our understanding of the business, how the company can snowball and how we can keep learning and providing input. This isn’t just inputting resources. I just disdain the practice of putting together a Wechat group and providing post-deal services from there.

Tencent News: Any advice you have for B2B investors?

Ray Hu: Most investors like me have a pretty steep learning curve. So I’d say spend more time with businesspeople. Old birds like us are not likely to grow wiser hanging around pure investors like we did in the past decade.

Tencent News: Do investors born in the 60s, 70s, 80s, and 90s have different investment styles?

Ray Hu: Generally speaking, the older the investor, the more conservative he is. If you’re born in the 60s and still in the game, you must really love investing. Most post-90s investors are in it for the money. Post-70s is a mixture of both. They haven’t made big bucks, but the love is still there.

Tencent News: Any difference between Beijing VCs and Shanghai VCs?

Ray Hu: People in Beijing VCs tend to hang out more with those of the same work level. Young folks tend to hang out, have a meal, get some kebabs, and gossip. Those in Shanghai keep to themselves instead of having big gatherings.

Tencent News: How will China’s VC landscape change in the next few years?

Ray Hu: It’s hard to tell. The handful of VC firms at the top will get bigger, so does the tail, because money is abundant.

Tencent News: How would you describe the standing of Hillhouse, Sequoia and Tencent in the investment community today?

Ray Hu: They are the Wudang Mountain and Shaolin Monastery (two establishments that churned out Kungfu masters), while we are honing our “Dugu Nine Sword Moves” (the invincible killer sword moves in a well-known Kungfu fiction).

魏海涛

蓝湖资本合伙人

跟大家介绍蓝湖资本在5G主题下的重要投资布局——昆宇新能源。很高兴在去年蓝湖投资之后,作为储能锂电池领军企业,昆宇新能源于近期完成了数亿元的C轮融资,投资方包括多家政府产业基金和市场化投资机构。

蓝湖团队认为,国内5G通讯储能刚刚开始起量,市场需求确定性高。随着5G通讯基站建设进入高峰期,整个市场在未来5年有1200亿的锂电需求,头部企业有望占到15-20%的市场份额。昆宇新能源团队作为这一领域的行业老兵,有着非常丰富的经验,未来空间可观。不仅如此,昆宇新能源作为中国通讯储能海外市场的先行者,有望在海外的锂电储能市场爆发后吃到最大的一波红利。除5G通讯储能外,电力储能、超级电容电池等市场也有很大空间。我们对昆宇团队充满信心和期待。

昆宇新能源是国内领先的储能锂电池高新技术企业,专业从事锂离子电池研发、生产和销售,掌握储能锂电池的核心技术,并拥有自主知识产权,具有强大的研发、制造、质量保证和售后服务能力。

在过去疫情肆虐的2020年,昆宇新能源在国内通讯储能领域不仅服务了中国移动、中国铁塔、中兴通讯等头部通信客户,在国内电力储能领域也取得了规模化突破。2020年12月,昆宇新能源参与的西藏日喀则市50MW“光伏+储能”综合能源示范项目并网发电。2021年1月,由昆宇新能源承接的东营垦利宏泰光伏电站配套储能项目成功并网。

昆宇新能源是中国通讯储能海外市场的先行者。目前,昆宇新能源已经具备完整的自有海外营销网络,共在17个国家和地区建立分公司或办事处,销售覆盖60多个国家和地区。在印度、韩国、俄罗斯等新兴国家市场,昆宇新能源的市场份额遥遥领先,在全球通信锂电市场保持着领先的行业地位。

公司目前已经在国内布局6个研发制造中心。公司核心研发团队平均拥有20年以上行业经验,是国内最早的锂电研发团队之一。公司研发一直以技术极致化为导向,团队曾多次参与国家新能源863项目、电池重大研发项目、参与超过50项国家和行业标准制定,团队累计获得各项专利超过200项。

随着本轮融资的迅速完成,昆宇新能源将进一步加大研发投入,加快产线建设,加强市场拓展能力的建设,力争向下游客户提供更好的产品和服务。

Editor’s Note: This article is edited based on the two-hour keynote presentation of Ray Hu in the opening seminar of Dark Horse Enterprise Services Training Camp. Ray Hu is the Founder and Managing Partner of Blue Lake Capital and served as an acceleration mentor for the Camp. Over 50 start-up founders attended the event.

Ray Hu was awarded Forbes’ 2019 Best Venture Capitalist in China. He has fifteen years of investment experience in enterprise services, including Investments in Meicai, Momenta, Yiheda, Going-Link, Helios, and Moka. Under Ray Hu, Blue Lake Capital has been an early-stage investor in at least one-third of the top-notch SaaS companies in China with an ARR of over 100 million RMB.

As an investor, it is very important to look at sector-specific opportunities and start-ups from an industrial perspective. One increasingly important industry is information technology, which has become the crucial infrastructure for even traditional sectors.

So, how should aspiring entrepreneurs go about starting their own software business? According to Blue Lake Capital’s investment playbook for the software industry, there are two options: developing business solutions for SMEs (small and medium enterprises), a process that involves zooming in on particular verticals, identifying common pain points, addressing these pain points, and eventually developing vertical-specific products; Or, developing modules for big companies by examining the needs of various LOBs (lines of business) and producing industry-agnostic software such as HR, finance, accounting, and procurement solutions.

Two Common Misconceptions about SaaS Startups

Misconceptions toward SaaS start-ups and the industry as a whole are not uncommon even now in China. Many investors believe that the software market is small and those software companies grow only slowly, while in fact, SaaS software is driving a digital transformation in many companies. According to Blue Lake’s industry analysis, China’s software industry shows just as much potential as the software industry in the US.

To begin with, 20%-70% of software for various sectors worldwide are cloud-based. This number will climb to 60%-90% in the next 10 years. China’s cloud migration progress is where the world was in 2016. That means China’s software market scale only lags behind the global market by 5 years—not as far behind as we thought.

The software market in China is riding an unprecedented wave of mobility based on AI and cloud migration. All this is transforming the industry from inside out. A plethora of products with these core competences has mushroomed, making China a heaven for investors. US investors were not as fortunate the US software market didn’t grow in the same way.

Second, over the past few years, the market cap of US SaaS companies has expanded eight-fold, while the NASDAQ Index only saw three-fold returns. During 2008 to 2020, the market cap of the top 5 US SaaS companies combined surged over 40 fold. All this shows how quickly the SaaS industry is expanding.

Non-US SaaS companies are equally impressive. We selected about two dozen SSE/HKSE-listed software companies that are leading the cloud transformation, weighted the share prices and compiled the Blue Lake China SaaS Index. A comparison of the SaaS Index with the A Share Index showed that the market cap of these companies grew five-fold over the past 5 years. Kingsoft Cloud (one of the leading cloud computing companies in China) and Ming Yuan Cloud (a China-based ERP and SaaS company primarily serving real estate companies), in particular, have had an impressive run since they went public.

Looking at the numbers, we can conclude that the software industry is a high margin, high growth, and big volume sector, with SaaS companies being the front runner, and that makes SaaS software a compelling racetrack for start-ups.

Four Changes in Customer Demand

Why is there an increasing number of companies purchasing SaaS software in China? It is because the demand side is shifting.

First, customers are more demanding. In the past, traditional software companies would pour hundreds of millions of RMB into developing a new product, sometimes to no avail. Companies were often disappointed and got impatient with R&D. As a result, customers were generally unhappy with the products. But these days software companies have been working on improving their cost structure and efficiency. Products are constantly iterated so customers are happier with the products and more willing to renew their subscriptions.

Second, customers have a growing demand for cost optimization. Traditional software companies used to be project-based before the advent of SaaS software. They would identify customer needs, provide a cost estimate and develop the product accordingly. These were typically multi-million RMB contracts and the money would have to be paid upfront. These days, the process is completely reversed—an SaaS company develops a product first and looks for customers later. A customer only pays hundreds of thousands of RMB for a single order. Of course, they are happier.

Third, B2B end-users expect the optimized, fool-proof user experience they’ve grown accustomed to with B2C software. When procuring enterprise software, customers care a lot about whether the product is user-friendly and efficient. We call this “consumerization of enterprise software”. Take booking a flight as an example. Doing T&E reimbursement on Helios (a Blue Lake Capital holding which has become the top expense management and business travel service provider in China)is just as hassle-free as on B2C platforms like Ctrip. This was simply unimaginable in the past when users would have to grapple with complicated OA software.

Finally, SaaS software does not need deployment or maintenance, resulting in enhanced security and a shorter deployment process. All these fuels the long-term development of SaaS software. For any enterprise software to be adopted in the past, the CIO would have to look at the entire IT architecture, budget, compatibility, interface, and available resources before he made the final decision. It used to be a complicated process. These days, all it takes is for the marketing and HR departments to pick the right product and launch it across the company. This explains why SaaS software is gaining traction among companies.

The Growth Path and Opportunities for the SaaS Sector

1. On Sectoral and Start-up Opportunities

Over the years, Blue Lake Capital has accumulated a wealth of experience and knowledge about investing in SaaS start-ups.

The first thing we learned is that neither entrepreneurs nor investors should underestimate the growth potential of the market. Right now, several leading software developers have been growing a lot faster than people thought they would. In fact, explosive growth is possible with increasing customer stickiness. But this kind of growth should not be taken as a given in the early stages of any company. So don’t jump to conclusions about when and where a software company might hit the ceiling.

Next, the demand side for general purpose software has changed, which presents challenges to traditional software developers, but also creates opportunities for start-ups. In the past, SAP and Oracle dominated the general-purpose software market. But today, as customers are more segmented, traditional software companies will not be able to meet changing needs with their existing product mix. Digital transformation is no longer a corporate-wide project, but broad-based adjustment that extends to the entire supply chain. Customers expect the software to interface with companies all along the supply chain. This is a challenge to traditional software companies, but it’s an opportunity for SaaS companies.

Meanwhile, the development of the software industry has constantly stretched the limits of our knowledge as investors. In the past, we thought that management software migrating to the cloud would be a tall order. Now it is made easy with technological leaps. There are over 200 software companies being traded in the Shanghai Stock Exchange with a total market cap of over 3 trillion RMB. But most of these companies are still traditional, project-based companies. All their previous projects can get a do-over in the future. On the supply-side, it is increasingly important to be product-centric. Product depth and expertise are key.

Chinese entrepreneurs who wish to explore opportunities in SaaS should look at how their US counterparts did it, and then decide what products they should or should not do in China’s market. But they cannot simply copy to China whatever products work in the US because Chinese companies are not quite the same as US companies. For example, SFA (Sales Force Automation, software that works like CRM for sales) products developed by SaaS companies in the US might not work seamlessly here given the different sales management styles and philosophies of Chinese companies. In fact, so far, SFA products from the US do not work so well for Chinese companies. Marketing these products in China hasn’t been easy, and so US developers operating in China usually face two possibilities—either rebuilding a product with a ton of customization or bracing themselves for roadblocks in sales.

So it is very important for a Chinese SaaS start-up to take a deep dive into the local market and identify real customer demands. This step can be a turning point for a company helping to realize robust growth within the next 3-5 years. It is something that SaaS entrepreneurs need to figure out from the get-go.

Today, a company would have to pay 200 USD per year for every employee that uses American or Japanese T&E reimbursement software, but the cost would go down to 200RMB per year per employee using systems developed by Chinese SaaS companies. My confidence in Chinese software companies only grows over time as I witness how they have flourished with technical expertise, great product quality and fast iteration. No doubt they stand a chance in overseas markets and they can be a force to be reckoned with.

2. On Customer Recognition

There are two things SaaS companies need to keep in mind in order to gain customer recognition.

One, lower cost and boost efficiency for key accounts. These are the pressing needs in light of their complicated organizational structures. Forget about helping your key accounts increase revenue as they have multiple product lines and even more factors that affect revenue.

That brings me to my second point: do help SMEs boost revenue. SMEs have fewer employees and relatively simple organizational structures, and boosting revenue is their pressing need.

3. Advice for Starting a SaaS Business.

Blue Lake Capital offers the following pieces of advice on starting a SaaS company.

First, be patient when just starting out. Note that SaaS companies in the US that went public in 2020 have been around for 10 years on average. So, do not expect a SaaS start-up to grow several folds in a year and go public within three years. When choosing investors for your start-up, you have to manage investor expectations by giving them a realistic and reasonable ROI.

Second, you need a disproportionally large sales force. Pay them generously and keep them motivated.

Third, keep iterating your products, even if it brings only a 1-2% improvement with each iteration. Think of the edge you are going to have with 50 iterations.

Fourth, find like-minded investors. SaaS entrepreneurs should look for investors with domain knowledge, as start-ups benefit from the industrial perspective and domain-specific advice that experienced investors can offer.

Three characteristics of a Startup Mastermind

Excellent start-up entrepreneurs have three things in common.

One, they know how to do the math. How much does it cost to acquire a customer? How much commission do I pay to my sales people? How much inventory do I have? Numbers are what keep you grounded when delivering your products.

Two, they are persistent and patient. The first 30 customers of a SaaS start-up are important because these customers help you shape the product and get it right. Keep them happy. Think about it, how can you possibly serve 300 customers if you can’t even serve 30? Don’t overstretch the company within the first two years.

Three, always put customer satisfaction first. Given the nature of 2B business, 1/3 of a software company’s success can be attributed to its relationship with customers, old and new, and 2/3 to the quality of its products and services. SaaS companies that always keep customer satisfaction in mind will not fare badly in the long run.

蓝湖资本合伙人陈昊辉:针对中小企业客户的SaaS销售是个数学题。从开发、跟进、成交、收款、履约、服务到续签,创业者如何建立起自己的销售漏斗,需要创业者扮演一位精明的“算计者”。但真正要把针对中小企业客户的销售搭建起来,则是一个体系化的工程,除了会做数学题,也考验管理的智慧。

过去几年,我们非常关注蓝湖SaaS生态圈企业发展中的销售问题,并依靠蓝湖团队的经验和诸多支持蓝湖的行业大佬们一起分析、诊断和调优,协助多家公司招募了CMO和完成了销售体系的搭建。

在本篇文章中,我们邀请了蓝湖的好朋友严校长分享他对销售体系搭建的实践心得。

我们时常面临来自面向全国中小企业的SaaS创业者的提问,应该如何搭建销售体系?首先需要对自己业务的基本面做个梳理,初步判断该业务是否适合全国做直销。然后,我们才会进一步探讨,销售体系搭建的假设、验证、规模化三步曲。

所谓销售体系搭建三步曲,首先是对业务做出假设,基于市场、行业、客户、竞争的分析,制定业务的目标、策略、计划。其次,基于业务假设,选择一、二个市场做验证,沉淀打法、形成模式、迭代产品。最后,基于验证的结果,分析差异性,完善业务,开展业务的规模化复制、全国性拓展。

今天对于2B SaaS赛道的企业CEO们,假设我们的业务适合直销,客户容量足够支撑在全国布局直销团队,那么我对于搭建销售体系,重点想和大家探讨的是两个话题,一是如何让销售新人快速成长,二是如何建立业务可复制能力。后面有机会,我再和大家分享市场如何有效裂变和深化、业务如何健康可持续。

命题一:如何让销售快速成长

2001年,阿里巴巴建立直销铁军,核心管理层摸着石头过河,当年马云思考的问题首先是“如何让销售快速成长“?而这个问题,阿里巴巴历经三年曲折探索才做出了完整的回答。这是建全国直销团队必须思考的核心命题。

我们把销售人员比喻做种子,把公司体系比喻成土壤。如何让种子能够在土壤里快速成长,这里面有四个要素,一是种子的人才画像,二是形成良好土壤的培训体系、分享精神、传帮带机制。

阿里直销工作非常辛苦,产品高客单价、价值难量化,业务的挑战非常大。前期用血肉长城来形容毫不为过。冲上去一批,牺牲一批,再冲上去一批,又牺牲一批;一批批的,最终剩下来的就是战场上的勇士。分析一下活下来的人,发现有个共性,虽然来自五湖四海,但大都苦大仇深,有一颗想要改变命运的心。这样特点的人,在面对困难和挫折时,更懂得隐忍和坚持。在挑战性目标面前,有更强的要性和狼性,愿意持之以恒的付出自己的努力。

在新人生根发芽的土壤上,当时阿里也走了些弯路,最后发现培训体系、分享文化、传帮带机制环环相扣缺一不可。

培训体系,为期一个月的新人培训,在公司、产品、销售心态、技能以外,贯穿其中的是文化价值观的植入,在每个人的内心都深深烙下“客户第一”的价值观,把向客户的推销,转变成布道电子商务、帮助客户成功。在当时,我们用真诚和热情,打动了很大一批客户。

分享精神,在新人进入市场后,与一般公司销售间相互竞争信息阻隔相反,在阿里大家倡导分享精神,你有一个想法,我有一个主意,当我们相互分享后,我们都可以更有解决问题的思路。正因为这样的分享精神,团队教学相长,最终形成了开放、简单、成长的氛围。