Qike, an intelligent business information cloud platform, is committed to using “big data + AI” technologies to empower enterprises in their transformation and upgrade towards data-based intelligent marketing, thus achieving cost reduction and efficiency enhancement.

The company aims to assist enterprises in their transformation and upgrade towards data-based intelligent marketing with Qike products, and to promote data-driven decision making so as to bring their brand assets, customer assets, management and services online and help them stay ahead of the curve in the digital era. Currently, Qike has 14 branches and strong relationships with thousands of small and medium-sized enterprises across many industries.

hireEZ (formerly Hiretual) is the #1 AI-powered outbound recruiting platform with access to 800M+ candidates from 45+ open web platforms and market insights to build strategic recruiting campaigns and candidate engagement capabilities to make outbound recruiting easy. With hireEZ, you can execute a strategically scalable approach to build your workforce of the future.

上海甄一科技有限公司前身是上海汉得信息技术股份有限公司的一步制造云事业部。基于十余年制造业及供应链数字化实践经验,已为超过数百家企业提供了供应链与制造协同数字化服务,包括众多世界五百强、中国五百强企业,在业内具有广泛影响力。一步云专注于供应链与制造协同的行业化。抓住共性痛点,积累了丰富的行业经验,具备丰富可参考案例。云端高效部署,产品轻量灵活,具备极强的快速迭代能力。

上海司顺电子商务有限公司创立于2007年,总部位于中国上海。公司全球雇员超1000人,在美国、加拿大、英国、澳大利亚等国家和地区创建17个分公司和仓库,仓库总面积超30万平方米, 已经完成全球范围内的供应链布局。

公司于2013年创立主体品牌VEVOR,主营MRO工具设备类产品,通过Amazon、eBay、Wish、AliExpress等第三方平台和独立站vevor.com自营平台销往全球,在全球拥有超1000万会员。 2020年公司营业收入超30亿元。

Recently, Suzhou Jufu Polymer Materials Co., Ltd., the owner of Polymaker, the renowned brand of 3D printing materials, completed a new financing round of over CNY100 million. This latest round of financing was participated by Blue Lake Capital, Skytrace Capital, Sharelink Capital, IDG Capital and Changshu Guofa Venture Capital, with 100Summit Partners acting as the financial advisor. The proceeds of this financing round will be primarily used for the layout of global production capacity and supply chain, product R&D, new market development, and application scenario expansion.

Founded in 2012, Polymaker is headquartered in Jiangsu and has subsidiaries in Shanghai, North America, and Europe. The global 3D printing material provider focuses on the development and manufacturing of materials using the extrusion-based 3D printing technology such as FDM/FFF. It offers products that are respectively designed for consumers, professionals, and manufacturers, and can be applied to automotive, aerospace, industrial manufacturing, medicine, architecture, consuming and other scenarios.

Material is a critical restraining factor for downstream applications, because the richness of material varieties will directly impact the application potential of 3D printing devices. Technically, Polymaker’s core technologies lie in the printability, functionality, applicability, and sustainability of its materials. The company boasts multiple exclusive patents in improving the performance of printing materials, which thus enhances the quality of 3D printing products.

The patents include Jam-Free (the technology that prevents jammed nozzles), Layer-Free (the technology that enables Nylon-based filaments to be 3D printed with near-zero warpage), the Nano-reinforcement technology, and the Fiber Adhesion technology. The Jam-Free technology, for example, raises the softening temperatures of Polymaker’s PLA filaments from 60 °C to 140 °C by increasing the degree of crystallinity of materials, addressing the root cause of jammed nozzles. The aforementioned sustainability mainly refers to the efforts of being more adapted to the major trend of sustainable development, the new business model of shortening the supply chain, as well as the recycling and reuse of printing wastes.

In terms of scale, considering that the material industry is highly dependent on the scale effect, Polymaker adopts an omni-channel strategy by positioning itself as a provider for full-coverage solutions to materials using the extrusion-based 3D printing technology. It aims to cover material demands from all sectors and segments globally and continues to enrich and iterate its current materials. Xiaofan Luo disclosed, Polymaker’s existing materials and formulation cover about 80% to 90% of the demands from scenarios using extrusion- based 3D printing technology.

“Blue Lake tracks the additive manufacturing sector in a long time and remains bullish about it. We found Polymaker, an outstanding team, along the industry chain. We are delighted to see that the emerging technique of fused filament fabrication of non-metals is lightening various industries like fire sparks. These industries are not limited to the hand model sector and 3D printing factories for mass production. On the other hand, the production, printing, and manufacturing of end products are driving the further expansion of the future market of upstream materials. We believe the excellent team can be a rare China-based material provider for the global market in the sector of additive manufacturing”, said Haitao Wei, partner of Blue Lake Capital.

In recent years, Blue Lake Capital has kept a close eye on the trend of additive manufacturing and has actively invested in outstanding start-up companies in relevant sectors. Blue Lake Capital’s portfolio companies include unicorns in multiple industries, such as Raise3D and Chaozhuo Aviation Technology (688237.SH). Notably, the latter was listed on the STAR market on July 1, 2022.

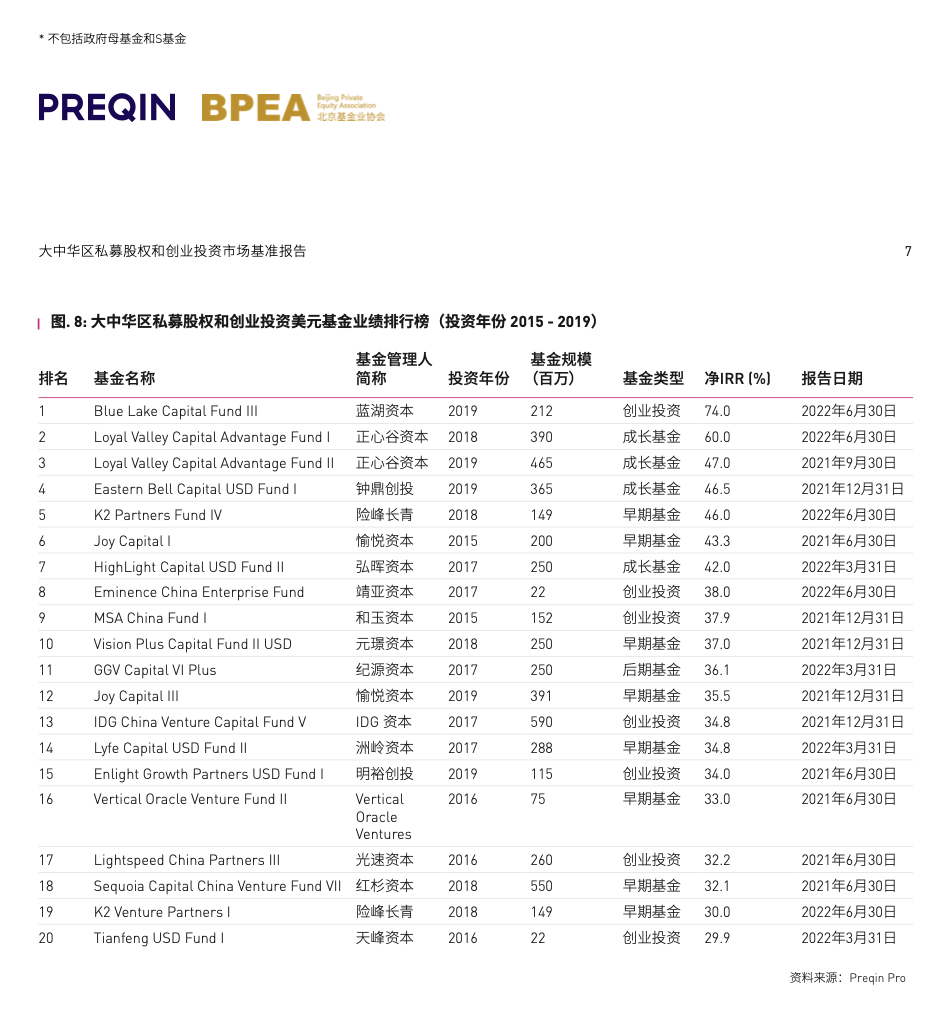

Recently, PREQIN, a renowned data provider and data analysis platform, and Beijing Private Equity Association jointly released the first “Greater China-focused PE & VC Benchmark Report”. Based on the data of 75 fund managers and 210 funds, the report mainly contains performance benchmark data and ranking lists.

The benchmark data aim to provide a range of panoramic metrics showing the overall market performance which is evaluated by net IRR and net multiple. The ranking lists set out best performing fund managers and funds to improve market transparency. The report describes the new landscape and trends of the fund industry in Greater China in an authoritative and systematic way.

According to the report, the strong performance of Blue Lake’s USD-denominated fund III enabled -it to top the list of “Best Performing Greater China-focused USD-denominated PE & VC Funds” for a net IRR of 74%.

As a venture capital fund driven by industry research and industry experience, Blue Lake Capital has been dedicated to smart manufacturing and SaaS with a whole-industry-chain approach. Many Blue Lake’s portfolio companies have become leaders or potential leaders in their industries. The companies include Chaozhuo Aviation Technology (688237.SH), YHDA (301029.SZ), Zhenyun Technology, JST, Moka, Momenta, Raise3D, and Avove Electronic.

Blue Lake Capital will remain optimistic and vibrant and keep on building its soft power. As an investor, entrepreneur, and operator, the firm is committed to making joint efforts with excellent entrepreneurs for the innovation and upgrading of China’s digital industry!

Xizhi Technology, a China-based start-up company engaged in automotive-grade power and battery modules, has recently announced the completion of an Angel round and an Angel+ round of financing of over CNY100 million in total within 6 months. The Angel+ round of financing was participated by Blue Lake Capital, SHANGQI Capital under SAIC (Shanghai Automotive Industry Corporation), Inno-Chip, and Sunic Capital. The proceeds of the investment will mainly be used to build a team of technical talents in automotive-grade power and battery modules, expand production lines for the mass production of automotive-grade power modules, conduct tests for automotive-grade products and establish a failure analysis lab.

Xizhi Technology started its business in October, 2021, two months before it was included in an the list of enterprises attracting programs conducted by Suzhou Industrial Park in December as a valuable tech company. Xizhi Technology has divisions in Shanghai and Suzhou and employs over 80 staff, about 75% of whom are technical personnel. As a start-up company equipped with seasoned senior experts in critical processes such as automotive-grade power and battery modules definition/ design, as well as packaging and development/ manufacturing/quality control, Xizhi Technology is dedicated to meeting diverse demands of clients in the smart EV industry by offering highly customizable automotive-grade power and battery modules.

Propelled by the implementation of policies in carbon peaking and carbon neutrality, market attention on the smart EV industry is rocketing. Smart EVs are expected to contribute to more than 60% of sales in the automotive industry in China by 2030 with an estimated sales of smart EVs exceeding 18 million units while (the figure for the global market is expected to be 40 million units). Meanwhile, benefitted by the continued rapid growth of the smart EVs industry, the smart EV-use global high voltage semiconductor device market is valued at up to USD 50 billion by 2030. In front of Faced with a market of huge potential, Xizhi Technology seizes opportunities to make reforms by planning the expansion of production lines for automotive-grade products on a yearly basis to achieve a gross value of annual output of CNY2 billion for the Suzhou division in the next three years.

To be in line with China’s national strategy of transforming and upgrading the domesticits manufacturing industry, Blue Lake Capital has been deeply involved in the field of smart manufacturing in recent years, and invested in Chaozhuo Aviation Technology in 2020. Its investment portfolio companies in smart manufacturing involves have grown into other industry leaders, including Chaozhuo Aviation Technology (688237.SH), Momenta, Avove Electronic, Cospower, PR Measurement, Raise3D, YHDA (301029.SZ) and EMPOWER.

“Blue Lake Capital pays continuous attention to early investment opportunities in the field of main components of EVs and in the entire industry chain of self-driving. The firm’s investment decisions are in line with the prevailing trend of smartization and localization in automotive. Automotive-grade power modules manufactured domestically enjoy vast market potential and application scenarios, because of the continuous increase in the penetration of EVs and the regular iteration of the EIC system. Xizhi Technology builds a team of top-notch product design talents in China and it is also capable enough to manufacture automotive-grade products. We believe Xizhi Technology will grow into a top-ranking company in automotive-grade power and battery products in a few years,” said Haitao Wei, partner of Blue Lake Capital.

Chinese after-sales service platform Ruiyun Service Cloud completed tens of millions of USD A and A+ rounds of funding. In particular, the Series A round was led by Chuxin Capital and followed by Blue Lake Capital, while the Series A+ round was exclusively invested by Matrix Partners.

The money will be used for technology R&D, marketing promotion and operations.

Ruiyun Service Cloud is a SaaS application for after-sales service and field service management. It is dedicated to helping companies achieve digital transformation of services by connecting customers, businesses and devices, improving service efficiency and enhancing the commercial value of services.

With the advent of the customer experience era, companies are paying more and more attention to after-sales service, which is why after-sales service SaaS has been growing rapidly in recent years.

On the one hand, quality after-sales service is important for customer retention and increasing repurchase. On the other hand, as the traffic bonus disappears, enterprises are gradually changing from focusing on front-end marketing and sales to customer operations. After-sales service is a vital part of connecting with customers and improving customer experience, which also brings new development opportunities for after-sales service SaaS.

Ruiyun Service Cloud has now served more than 1,000 customers, including Bosch, Siemens, Philips, and other companies. Its business covers construction machinery, home appliances, medical equipment, smart manufacturing, new energy, smart hardware and other fields.

In May 2021, Ruiyun Service Cloud’s tens of millions of CNY Pre-A round of funding was led exclusively by Blue Lake Capital. Zhang Yifan, Investment Director of Blue Lake Capital, said that digital industry innovation has been a major development theme in China in recent years and is also the focus of Blue Lake’s investment perspective. Blue Lake also hopes that through the continued empowerment of Ruiyun Service Cloud to help China’s industrial digital upgrading.

The 4th China LP Conference & the 3rd Lujiang Venture Capital Forum hosted by FOFWEEKLY and Local Financial Regulatory Bureau of Xiamen City was held on September 8th in Xiamen. Blue Lake Capital is honored to receive the award of “TOP20 Investment Firm in Soft Power – GP Market Impact” which was unveiled at the forum. Blue Lake Capital was awarded for its deep accumulation in industry perspectives, investment decisions and post-investment empowerment.

It is the second time Blue Lake was recognized by a professional third party within one week after it had been awarded the title of “2022 TOP100 Most Admitted Venture Capital Firms” by Cyzone at the 2022 DEMO CHINA Innovation China Summit on September 7.

Since its establishment in 2017, FOFWEEKLY has been committed to becoming a professional platform for GPs and LPs. It aims to help institutional investors improve efficiency and assist distinguished investment firms with worldwide expansion by leveraging its advantage of being a local platform, its independent and professional philosophy, insightful content, targeted community, and professional services.

In 2022, FOFWEEKLY has profoundly explored how soft power theories impact the GP development in practice once again. It introduces and breaks down soft power into multiple dimensions, such as “value creation, service empowerment, organization & governance, market impact, innovation drive and social responsibility”. It describes and deconstructs the internal momentum contributing to GPs’ long-term development and outstanding performance. Based on quantitative and qualitative evaluation that is open, fair, and just, FOFWEEKLY “re-judged” and “re-evaluated” leading firms in the industry before revealing the “Investment Firm Soft Power Ranking List”.

Blue Lake Capital, a venture capital fund jointly driven by industry research and industry experience, focuses on investing in start-ups in the fields of SaaS and intelligent manufacturing. It deeply empowers entrepreneurs at all stages of business development by providing strategic consultation, introducing core resources, recommending key talents, and advising on financing.

Blue Lake looks forward to cooperating with preeminent entrepreneurs as an investor, entrepreneur, and operator from a unique “research + industry” perspective, while pressing ahead with the innovation and upgrading of China’s digital industry regardless of challenges.

At the 2022 DEMO CHINA held on September 7, Cyzone, a renowned new commercial media as the host of the event, revealed the list of “2022 TOP 100 Venture Capital Firms”. Blue Lake Capital was on the list for its forward-looking and distinctive entrepreneurial perspectives in the fields of intelligent manufacturing and SaaS, its precise and disciplined investment decision-making process, as well as its ecosystem of collaboration and co-prosperity across portfolio companies.

As a media platform conducive to the vertical development of the innovation economy, Cyzone has long focused on investment firms’ reputation. It is dedicated to discovering venture capital firms that are the most respected and admitted with the most “soft power” in the industry, aiming to encourage the industry to think about and pay attention to “the long-term investment value”.

The preliminary screening of the Top 100 list was based on data submitted by candidates and the data from Bestla, a data analysis platform under Cyzone. The shortlists were then voted on by nearly 300 veterans from outstanding VC firms. They selected the most admitted VC firms in terms of the following aspects, such as investment performance, post-investment services, industry position, innovation capability, long-term value, talent attraction capability, ESG practice, and so on. The list of “TOP 100 Venture Capital Firms in China” was finalized with the results of votes being taken into account.

Founded in 2014, Blue Lake Capital is a venture capital fund jointly driven by industry research and industry experience. It invests heavily in the innovation and upgrading of China’s digital industry by focusing on investing in start-ups in the fields of SaaS and intelligent manufacturing.

Since its establishment, more than 20 of Blue Lake’s over 100 portfolios have become unicorns/the best performer in their respective industries, including Yiheda (301029.SZ), Chaozhuo Aviation Technology (688237.SH), Momenta, JST, Moka, Zhenyun Technology, HELIOS and other renowned enterprises. Enterprises invested by Blue Lake Capital secured follow-on financing of over RMB 20 billion.

Blue Lake is committed to enhancing its soft power. It focuses on the innovation process in the noble cause of China’s digitalization and industrialization by providing the most foresighted support for valuable innovative technologies and talents, developing an ecosystem of engagement and collaboration across portfolio companies.

Since its inception in 2014, Blue Lake Capital has been in TOP lists for multiple times revealed by authoritative media as a top investment firm in different categories. Looking forward, Blue Lake Capital will consistently focus on long-term value and soft power with dedication across the whole industry chains of intelligent manufacturing and SaaS. We look forward to partnering with outstanding entrepreneurs to contribute to the innovation and upgrading of China’s digital industry!

Recently, “ezOne.work”, a cloud-native DevOps platform, has completed a Series A round of financing of tens of millions of CNY from Blue Lake Capital. The proceeds from this round of financing will be mainly used for the continuous R&D of products and accelerated commercialization. Previously, “ezOne.work” secured multi-million CNY in the angel round of financing from Kingsoft Cloud, and secured tens of millions of CNY in the Pre-A round of financing from Shunwei Capital.

“ezOne.work” was established in 2019 by a team of business experts from Baidu, Huawei, IBM, Kingsoft Cloud, JD.com and other companies who have long been engaged in the field of enterprise-level R&D effectiveness. The team has long been focus on the improvement of R&D effectiveness as well as the R&D and application of R&D toolsets at top large-scale companies, which allows them to see the power that software engineering and toolsets bring to the world and the huge gap in software engineering and basic toolsets at home and abroad.

Therefore, “ezOne.work” decided to establish a Chinese company specializing in enterprise-level R&D effectiveness to help enterprises achieve business success and show the world the power of software engineering tools developed in China by constantly exploring underlying technologies and continuously using technology and product innovation to promote the improvement of enterprise-level R&D effectiveness.

Since its establishment, “ezOne.work” has been awarded with widespread praise and honors in the industry: In 2020, it was appointed as a CAICT DevOps standard setting company; In 2021, it was appointed as a CAICT trusted cloud standard setting company; In 2022, it was appointed as a specialist company for the Cloud Software Engineering Community; It has successively received the certification of the AAA-level corporate credit rating, the certifications of ISO9001, ISO27001, and ISO20000, and the certificates of Zhongguancun High-tech Enterprise and Beijing Haidian District Germ Enterprise.

According to the latest survey of 1,049 enterprises conducted by the CAICT in the second quarter of 2022, the overall engineering capability of domestic R&D teams is weak, the level of their digitalized R&D synergy is low, and the adoption rate of software R&D tools isn’t high. In most cases, R&D teams are using overseas open source tools for integration, interface modification and packaging, and script concatenation, meaning that they have to invest valuable R&D resources and face high maintenance cost and the low tool-adoption efficiency of engineers. Commercialized DevOps platforms in the domestic market are mainly integrated based on overseas open source software. The current economic climate strongly requires constant efforts in further cost reduction, energy conservation and efficiency improvement as well as in self-developing and obtaining control over basic software. There is a strong demand for a true domestically-developed one-stop R&D synergy platform.

The products of “ezOne.work” are designed in accordance with the current situation, meaning they are all self-developed and can provide users with a true end-to-end one-stop DevOps platform. “ezOne.work” offers products covering project management, knowledge base management, document management, code hosting, code review, code scanning, code metrics, code search, distributed builds and pipeline systems, unified artifact management systems, host deployment systems, Kubernetes cluster management and deployment systems, test management platforms, R&D effectiveness measurement and process approval BPM.

The company’s products boast strong features and have obvious client perception. The features mainly include:

- Having a complete functional matrix: Cover the whole process of R&D in a real sense and enable a highly efficient digitalized synergy involving all R&D process.

- Making R&D data an entire whole: Enable extremely efficient procedures and the visualization, traceability, and auditability of the entire process of R&D management to get rid of fragmented data and complicated management caused by the integration of multiple tools and platforms.

- Strong capability of providing technical support and meeting demands: Based on the company’s strong R&D capability, it can provide its clients with trustworthy technical services so that the clients will no longer be constrained by third party’s components. Meanwhile, it is also able to provide clients with long-term solutions upgraded with the growing functional demands from clients.

- Domestically developed, controllable, and conducive to the domestic innovation in information technology application (referred to as “Xinchuang”) : There’s no need for clients to have concerns that software R&D platforms would be blocked due to potential uncontrollable factors. In addition, last year, the company’s products were delivered to the Xinchuang lab of a state-owned large telecom company and it has become a fundamental platform for Xinchuang testing.

- Products are powerful and professional, suitable for enterprise scenarios: “ezOne.work” has a strong team of experts who have more than a decade of R&D experience and client servicing experience. Its products are designed to be more suitable for enterprises by being safer, more professional and more powerful compared to open source software that is more suitable for scenarios that are free and with no restrictions.

The company’s products are awarded with multiple core technology patents and ten-plus software copyrights. Since they were launched, they have won GOPS 2020 Star Product of the Year Awards, 2021 CAICT Cloud Native Technology Innovation Awards and CAICT Trusted Cloud Devices Tool Advanced Level Certification. Two client cases implemented by “ezOne.work”, the China Life Property & Casualty Insurance case and the TCL case, both won the Outstanding Case Award at the 2022 CAICT Software Engineering Conference.

Up to now, the “ezOne.work” SaaS version has thousands of corporate users while its private deployment version has medium and large sized clients from industries including insurance, banking, energy, Internet, cloud computing, AI, manufacturing, real estate, government, and scientific research institutions. “ezOne.work” also provides a free private deployment version for hundreds of small and micro sized enterprises.

Regarding this round of financing, Qing Liu, the founder of “ezOne.work”, said, “The field of engineering tools for basic software belongs to basic software, with high technical moats which need a long-term accumulation of domain knowledge to form. The company’s product matrix has been improved with years of precipitation and accumulation. The proceeds from this round of financing will be used for constant R&D investment to improve products’ core competitiveness, in turn accelerating their commercialization.”

Yifan Zhang, Blue Lake Capital’s Investment Director remarked, “In recent years, Blue Lake Capital has been seeking outstanding domestic technology enterprises, as investment opportunities in China lie in science and technology. Basic software tools for software engineering in the domestic market is expected to have a promising future, given that the development of these tools at home is weaker than that abroad. Looking forward, as technology evolves in China, enterprises that are more professional in providing basic software tools for software engineering will be desperately needed. As a tech company with strong R&D capability, ‘ezOne.work’ has shown its preliminary strong competitiveness benefited from its painstaking R&D accumulation. This allows the company acquired typical clients in industries by winning biddings in a row and allows it achieved the evident momentum of growth against the adverse environment. Blue Lake Capital is not only bullish on the long-term development of ‘ezOne.work’, it also hopes it can make contributions to China’s technology industry by investing in the company.”

Yixuan Geng, Executive Director of Shunwei Capital said, “As Chinese technology companies expand and technologies like cloud native evolve, the digitalized R&D synergy and management brings increasingly prominent demand for DevOps platforms. For the long term, Shunwei Capital is bullish on ‘ezOne.work’, a Chinese company specialized in this field and a leader in technology, and it is optimistic about the basic software industry in China. Shunwei Capital, the investor in the Chinese tech company’s Pre-A round of financing, believes ‘ezOne.work’ will enter a new development stage with the additional assistance of Blue Lake Capital,”

Kaiyan Tian, Partner and Vice President of Kingsoft Cloud noted, “‘ezOne.work’ has an outstanding team that leads in the domestic DevOps market in terms of technology and professionalism. As the angel investor of ‘ezOne.work’, Kingsoft Cloud believes in the rosy prospect of ‘ezOne.work’ and supports its development. Additionally, it forms a close strategic partnership with the company in many projects. The cooperation between Kingsoft Cloud and ‘ezOne.work’ is more than providing their common clients with more professional service, more complete solutions and higher client value. Kingsoft Cloud’s entire R&D system has been significantly improved in R&D synergy efficiency and R&D management by comprehensively applying the ‘ezOne.work’ platform.”

One Contract Cloud is a professional contract management system developed by Shanghai Zhenling Technology Co., Ltd. By helping enterprises build a contract management ecosystem that covers contract drafting and performance life cycles and integrating the capabilities of third parties, One Contract Cloud helps boost contract performance efficiency and risk management at a lower management cost.

Developed by Suzhou Ruiyun Smart Service Information Technology Co., Ltd, FS Cloud is a SaaS application for after-sales and field services. The FS Cloud omni-channel smart service management platform is an industry-leading solution based on insights from the decade-long practices of over 200 industry leading companies.

Core modules include online customer service, field service, spare part management, billing and settlement, equipment life cycle management, and service marketing. FS Cloud is there for companies that set out to digitalize their services. With smart and predictive services powered by AI, IOT, and AR, FS Cloud is well positioned to drive service efficiency, customer experience and customer value for its customers.

Founded in 2020, Tanma SCRM was one of the first service providers to join the WeCom ecosystem. WeCom-based Tanma SCRM offers customers complete sales solutions. Products from Tanma include Tanma CRM, marketing toolkits, and telemarketing phones, all of which can be utilized for WeCom group chat operations, customer resource management, sales process management, and the consolidation of Wechat data.

On November 15, 2021, ThinkingData announced the completion of its Series C round, raising 376 million yuan primarily from Sequoia, followed by Blue Lake Capital and GSR Capital. Early this year in March, ThinkingData raised 100 million yuan in Series B, led by Blue Lake Capital.

ThinkingData is a leading big data analytics service provider in China. It was founded in July 2015, at a former factory turned incubator at 1058 Kaixuan Road, Shanghai. The core product of ThinkingData, Thinking Analytics, is an integrated solution that has everything covered from data acquisition, to storage and modeling, real time calculation, and analysis and presentation.

Five years on, ThinkingData has signed on over 500 gaming companies, including Funplus, Cheetah Mobile, CMGE, Hero, Habby, Papergames, Leiting, Dianhun, Xmfunny, Hortor Games, 3k.com, Chillyroom, and Boke. Over 3000 games use ThinkingData’s services, including wildly popular games such as Archer Legend, The Marvelous Snail, Rolling Pictures of Jiangnan Landscape, Ulala: Idle Advanture, Shining Nikki, Swords of Legends, Idioms Challenge, Light of Thel, and Figure Story.

Since its inception, ThinkingData has been on a solid growth trajectory and has assumed a leading position in big data analytics in the gaming industry. It is the first company that addresses the specific needs of games that look to expand overseas. The capital raised in this round will fund new product R&D, service upgrades, overseas expansion, team building, and a brand new data infrastructure for games around the world.

Starting from 2022, ThinkingData will officially launch its global initiative. In an effort to help Chinese gaming companies navigate the challenges and complexities that come with going global. ThingkingData’s TA system will offer brand new and refined features just for those games. In addition, ThinkingData will put together its own team outside of China, using our analytics experience in China to serve gaming companies overseas.

The autonomous driving company Momenta recently announced the completion of a Series C+ round, raising over 500 million USD. As of today, Momenta has raised over 1 billion USD in its Series C round, with major investments by SAIC Motor, General Motors, Toyota, Bosch, Temasek, and Yunfeng Capital. Other investors include Mercedes-Benz, IDG Capital, GGV Capital, Shunwei Capital, Tencent, and Cathay Capital.

Momenta CEO Cao Xudong said, “Autonomous driving is something fun and meaningful. We are committed to creating better AI and building a better life. It’s such an honor for Momenta’s products and R&D capabilities to be recognized by customers and investors around the world. I look forward to all of us working together to enable the mass adoption of autonomous driving.”

Momenta CFO Zhang Peng said, “Looking at the Series C round, we are well-capitalized. Many top-notch car makers and tier-one suppliers have become our investors, making our investor mix different from our competitors. We are proud to be recognized by top-notch car makers. This means more to us than the funds we’ve raised. And I believe, with appreciation of our technologies, comes orders and research projects. I’m sure we will also jointly develop autonomous driving products. That will be yet another vote of confidence that sets us apart from our peers.”

As one of the world’s leading autonomous driving companies, Momenta is dedicated to reshaping the future of mobility with best-in-class AI technologies. In an effort to develop solutions with different levels of autonomy, Moment pioneered the data-driven “flywheel insights”, and a two-pronged approach that combines the mass production of both its autonomous driving solution Mpilot and its driverless solution MSD. This approach will enable the mass adoption of autonomous driving and make the future of mobility safe, convenient, and efficient.

Soon after Momenta was founded, Blue Lake Capital became one of the early investors leading the first round of fund-raising. As of today, Momenta has established a partnership with and received strategic investment from world leading carmakers, including SAIC Motor, General Motors and Mercedes-Benz. Going forward, Momenta is going to work closely with its industry partners to accelerate the advent of intelligent mobility, develop and deploy leading autonomous driving technologies that work for driving environments around the world.

Shanghai Zhenling Technology Co., Ltd., a SaaS solution provider for contract management, has officially announced the completion of an angel round raising nearly 30 million yuan. This round was led by Blue Lake Capital and co-invested by Plum Ventures with Yiren Capital acting as sole financial advisor. With the funds raised in this round, the company will boost its product R&D and dive into various new contract performance scenarios to improve its contract management value.

In the new digital economy, big companies are stepping up their digitalization efforts in a bid to reshape their core competitiveness, and contracting is a good starting point for digital transformation since contracts, as a record of business activities, cut across every aspect of a company’s operation.

Collaboration in traditional contracting is weak—contract performance tend to be uncontrollable, and risk management is a frequent challenge. With the introduction of laws and regulations on electronic contracts and constant advances in AI—such as big data and cloud computing technologies—SaaS solutions for smart contract life cycle management have started to gain traction and become an attractive sector for investors.

Zhenling Technology’s core team includes members who previously worked in Hande Information, one of China’s top IT consulting firms. With its strong R&D capabilities and rich experience in enterprise-level digital transformation, Zhenling Technology has become one of the early players in the field of smart contract management. The team started by developing its proprietary solution, now known as “Yinuo Smart Contract Cloud Platform” (One Contract), a smart digital contract management system that allows enterprises to manage business, financial, and legal contracts – all in one place.

Unlike most products that focus on contract drafting and signing, One Contract focuses more on contract performance. In the enterprise operation environment, contract details are recognized by LOBs and Finance as the most accurate operational information and the basis for doing business and financial management. However, the text and content of hard copy contracts have not always been easily accessible. As a result, traditional contract management is inefficient because it is not possible to make timely performance plans, implement effective performance monitoring, or issue warnings when needed.

One Contract automatically extracts milestones from a contract, develops a performance plan accordingly, and notifies relevant personnel across LOBs and legal teams when a task is due. In addition, One Contract can execute scenario-specific compliance oversight to remind, warn, and even discipline the personnel involved.

Xie Weihu, CEO of Zhenling Technology, said,

“Contract signing should be worry-free, and so should contract fulfillment. And that’s where we can make a difference.

Over the years, Chinese companies, especially large ones, have been hard at work trying to digitalize their business. Improvement is being seen across the board, in finance, supply chain, marketing, etc., with contracts containing all relevant key data and information. However, business risks may be buried under those data and information.

We come in and try to help our customers digitalize their data and uncover risks, and by doing so, their legal affairs—even apart from business and finance—will be taken to the next level. We are deeply committed to this endeavor and we look forward to creating greater value for our customers.”

The nearly 30mn yuan funding, largely from Blue Lake Capital, is a testament to the company’s unique insight and competitive edge in contract performance.

Ray Hu, founder, and managing partner of Blue Lake Capital, said,

“We see a future for sophisticated SaaS products in China. Customer demands for contract life cycle management are well defined. That means that as long as a startup focuses on product functionalities, it may significantly differentiate its solutions from OA and e-signature companies and provide distinct value for customers.

Meanwhile, contract management can easily extend to cover various functions, such as legal, finance, and LOBs. There are a great deal of product opportunities if one dives deep. One Contract Cloud has been developed and refined over the years by a team with shrewd business sense. We are excited about its future developments.”

Zhenling Technology serves nearly a hundred industry-leading companies including Tencent, Hello Inc., Tal Education, and Siemens Healthineers, providing them tremendous value by boosting drafting efficiency and controlling performance risks. Zhenling has also gained extensive domain experience as it offers vertical-specific solutions for sectors such as healthcare, the internet, and manufacturing.

Going forward, product innovation and upgrade remain to be the focus of Zhenling Technology. The company will keep improving contract drafting efficiency with an emphasis on performance compliance. It is committed to providing better contract management services to help companies with their innovative efforts, supplier and customer management, branding, and reputation.

Moka, a leading Chinese provider of software-as-a-service (SaaS) human resources services, announced the completion of a US$100 million Series C financing. The round was led by Tiger Global Management, LLC. Existing shareholders, including Blue Lake Capital, GL Ventures, GSR Ventures and GGV Capital, also participated, with Taihecap acting as the sole financial advisor.

After completion of the financing, Moka plans to continue expanding into the HR sector by furthering the development of comprehensive SaaS-based HR solutions and continuing its commitment to product innovation and enhancement while stepping up efforts in recruiting and training talented professionals.

“We are seeing a subtle change in the relationship between employers and their employees as an increasing number of employees are working to realize their own value while focusing more on the work experience as well as on how to derive a sense of achievement from their work. In the HR software sector, a field that is seen as being closest to ‘people’, traditional HR software products that were exclusively designed for decision makers to manage employees are not what companies really need,” said Moka CEO and co-founder Li Guoxing.

“As a result, we decided to design products not only for HR professionals or decision makers, but also for other roles across the organization, including employees, interviewers, candidates and executives, by shifting our focus to each individual involved in the process. We plan to create the next generation of complete SaaS-based HR solutions for all employees across the organization by using our innovative technologies and expertise to deliver a better work experience to each employee and allow them achieve more as a member of the organization. This is also our mission at Moka,” Li added.

At the same time, in order to recruit quality talent and deepen efforts in research and development of new technologies and offerings, Moka have established a second headquarters in the Tianfu New Area, Sichuan province. Moka has also entered into a strategic collaboration with the area’s government agencies to build product, service and marketing facilities there, with the goal of promoting the development of the SaaS-based HR sector by facilitating industrial transformation through our professional services,” added Mr. Li, the CEO. “Moka looks forward to working in concert with more industry partners to develop the next-generation of complete SaaS-based HR solutions that are smarter and easier to use, with the aim of empowering recruitment strategies among employers and helping improve the overall social efficiency.”

The Chinese market for SaaS-based HR services has experienced rapid growth over the past few years, and foresees a bright future by leveraging the growing number of opportunities brought about by the changes in industry policies, market conditions and the management model adopted by key industry players. In particular, the awareness of the importance of using information systems has been raised among Chinese firms while their ability to pay for it has also been strengthened.

Over the past six years, the average purchase price of products has increased fivefold, a testament to their willingness to pay for premium solutions; at the same time, rather than choose on-premise products, organizations are increasingly looking for more agile SaaS-based solutions that can deliver a better user experience. This has opened up new opportunities for the SaaS-based HR services market.

As the lead investor of the previous round, Ray Hu, the founder and managing partner of Blue Lake Capital, said he was pleased to make a large percentage of additional investment in this round. We are very proud that Moka has grown to be one of the top HR SaaS brands in China after our investment. This validates our initial view that the next generation of enterprise management software will be a comprehensive product-focused competition, and that Moka has been designed and developed with customer satisfaction in mind from the very beginning. The best practices of talent acquisition management exported by Moka are spreading from the Internet industry to other industries, and are driving a new paradigm of “people-centric” management in Chinese enterprises.

Currently, Moka, one of the fastest-growing Chinese suppliers of SaaS-based HR solutions, provides customers with the Moka Intelligent Applicant Tracking System and Moka People (Human Capital Management System):

- The Moka Intelligent Applicant Tracking System, launched at the end of 2016, provides organizations with more efficient and accurate recruitment management services in tandem with an improved user experience. The system enables unified management of the recruitment process as well as the establishment of and access to a talent pool while ensuring the supply of complete data. In addition, the product has become the industry’s first recruitment solution to be designed for multiple scenarios, including recruitments that take place both before and after the prospective hiree has graduated, by way of introductions through social networks and in-company recommendations, as well as to fill the manpower need in retail chain stores, helping employers find just the right employee at the right time.

- Moka People was launched at the end of 2020 based on three identified needs: creating the ultimate user experience, building a close connection among recruitment staff and looking at expectations of what the product should deliver from the perspective of top management. The solution has been widely applied in several of the most common business scenarios across multiple organizations, including personnel, time off, salary and performance management as well as analysis of staff data. With wide application across business scenarios, the solution provides management with data insights and science-based assistance. Most notably, a synergistic connection has been built between Moka Intelligent Applicant Tracking System and Moka People, creating a complete SaaS-based HR solution that has been delivered to nearly 100 corporate customers.

Thanks to its cutting-edge innovation alongside an ultimate product and service experience, Moka has led the industry in terms of Net Promoter Score (NPS) while maintaining a customer renewal rate that far exceeds the industry average. Built on these advantages, Moka has become the largest provider of recruitment management systems in China in terms of market share, with a growth rate surpassing 100 per cent.

To date, Moka has expanded its business into over 25 sectors, among them, online, chain retail, biomedicine, intelligent manufacturing, finance and real estate, providing over 1,500 corporate customers with paid subscription services. The firm’s most well-known customers include Tencent, Xiaomi, Qihoo 360, McDonald’s, ANTA Group, Genki Forest, Intco Medical Technology, Dian Diagnostics Group, Contemporary Amperex Technology, Arm China, Panasonic, China Pacific Insurance and Vanke.

Follow us on Wechat